We did an earlier chart reflecting that home builders are diverging similar to 2007.

Housing is a critical component to the economy and stock market, as we found out a decade ago. And unfortunately, current housing market concerns don’t end there.

There are several housing and real estate related indexes and ETFs that are flashing caution here.

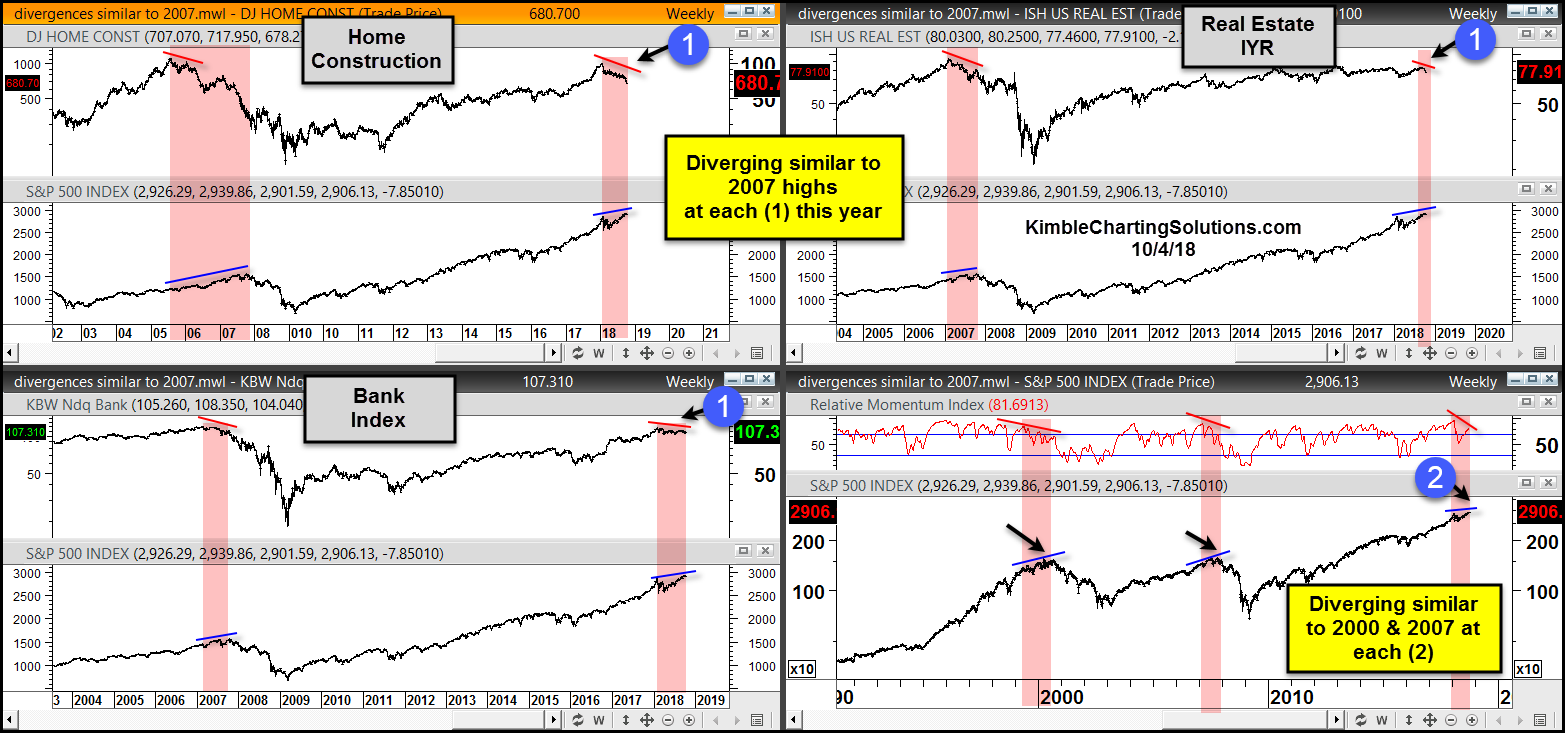

In today’s 4-pack of charts, we can see four different divergences similar to 2007 that are taking place.

These are but a mere warning, as divergences can go on for some time before they take effect. As well, they can work themselves out over time with consolidation.

That said, they are concerning. The top two charts illustrate how the housing construction and real estate sectors are diverging from the broader market (at point 1). Then there’s the bank index doing the same in the lower left.

Lastly, the broad market S&P 500 is showing its own internal momentum divergence as well (point 2) – bottom right. Keep an eye on these in the weeks ahead!

4-Pack of Housing / Real Estate Charts

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.