In the midst of the biggest week of corporate earnings for the quarter, it’s easy for traders to fixate their attention on stocks with price extremes.

Case in point, Alphabet (GOOGL) exploded higher by 47 points and Whirlpool (WHR) plunged by nearly 22 points after traders digested their quarterly reports on Tuesday. Without a doubt, those movements are exciting and there’s certainly opportunities if you’re on the right side of the trade.

But as a Dividend Growth Investor who focuses on the long term, I get excited about a different number that oftentimes gets announced during the earnings season with much less fanfare than the earnings numbers themselves. Many companies choose to announce dividend increases at the same time they are announcing earnings.

So What About Hershey’s?

For dividend-raising stocks in the United States, the standard practice is to announce an increase once per year. Which quarter that is announced is entirely up to the board of directors of each company. Many companies have already announced their dividend increases this year, but one high quality stock that is likely to announce a dividend increase this week is Hershey’s (NYSE: HSY).

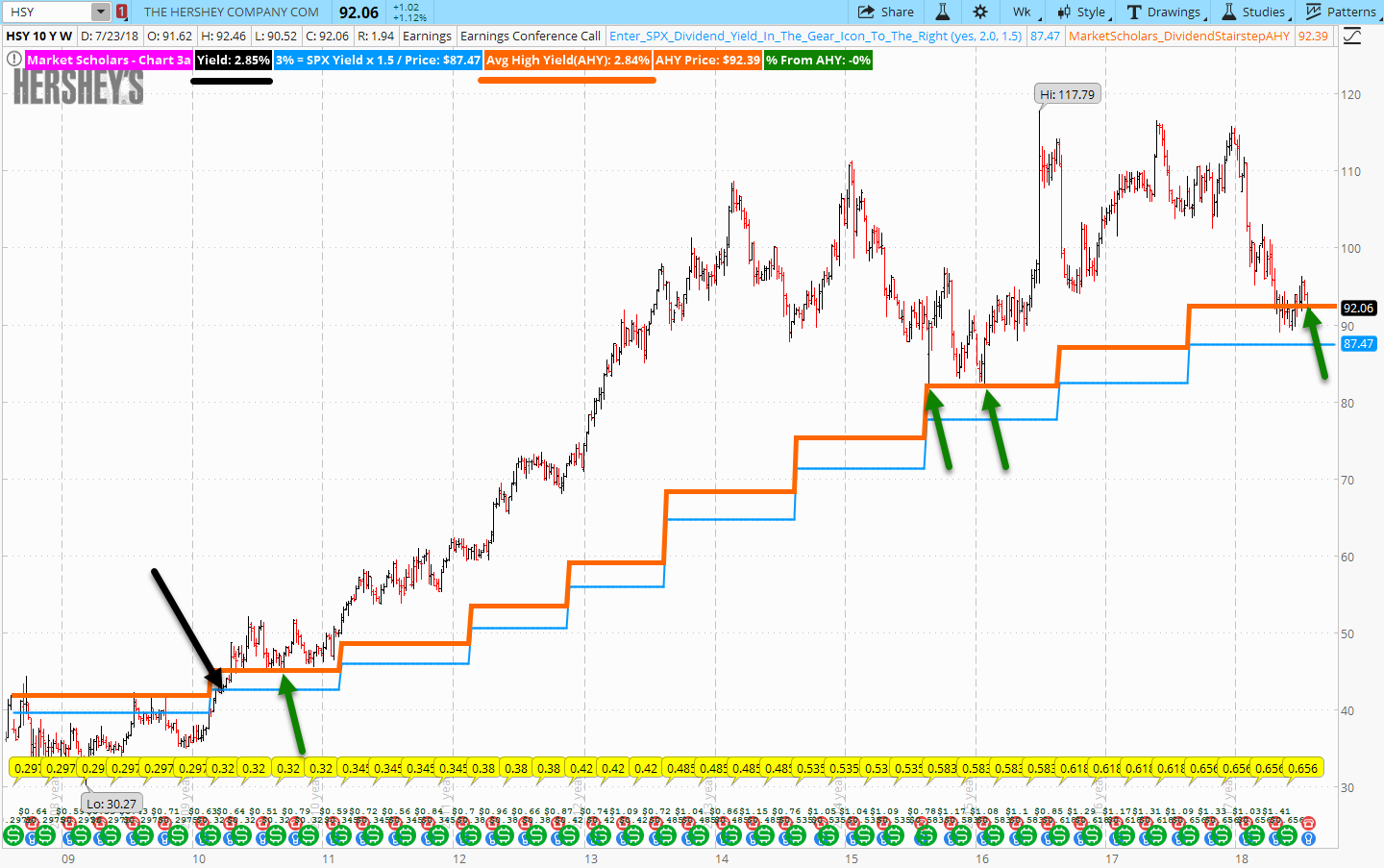

Notice in the image below that HSY typically declares their annual dividend increase at the same time they report their earnings in late July or early August. This year, they are slated to report earnings on Thursday morning, July 26.

Hershey’s needs no introduction in the United States, where it controls just under half of the chocolate candy market. It is lesser known across the rest of the world, but if there is one market you want to dominate, it’s the United States where more chocolate is sold than any other country. Beyond chocolate, they also own key brands such as Twizzlers, Jolly Rancher, Ice Breakers, and Good ‘n’ Plenty.

As a long-time admirer of Warren Buffett, I’ve often heard him reference See’s Candies as an example of an asset-light business that allows for robust profit margins. Cocoa and sugar are relatively cheap compared to the end product that you see priced at a steep premium in the grocery store. Buffett also jokingly mentions that you won’t win many accolades if you gifted someone special in your life with a no-name chocolate brand. Interestingly, the chocolate candy aisle offers very few private label alternatives compared to many other food categories that are currently struggling with that type of competition.

Naturally, investors may be interested in locating other public companies similar to See’s Candies considering Buffett’s glowing remarks about the industry. For such a basic product category, it’s more difficult than you might expect. Mars is a huge competitor in the United States, but it’s privately-held. Many of the other players in the U.S. chocolate market are smaller, niche companies like Rocky Mountain Chocolate Factory (RMCF) that wouldn’t move the needle much in terms of scale.

A handful of chocolate brands are controlled by foreign companies such as Nestle (NSRGY) which would potentially subject U.S. based investors to foreign withholding taxes on dividends. Oddly, in a world where I hear the term “scarcity value” applied to social media platforms like Twitter (TWTR), it could just as easily be applied to publicly-traded chocolate companies in the United States.

TRICK?

The stock price of HSY has fallen on hard times this year for a variety of reasons. Input costs are moving higher with labor, freight, and occasionally cocoa prices rising due to the currently-strong economy. Believe it or not, even the cost of the aluminum foil that Hershey’s Kisses are wrapped in was called into question as the United States implemented tariffs earlier this year on that commodity.

Additionally, the company’s recent purchase of Amplify Snack Brands (maker of Skinny Pop popcorn) outside of the high-profit candy aisle has drawn critics. Lastly, HSY’s Consumer Staples sector has been the worst performing sector in the S&P 500 year-to-date as well-known brands struggle to keep up with the changing consumer preferences being reshaped daily in our Amazon-obsessed digital age. When Hershey’s reports on Thursday morning, these negative storylines could very well haunt the company’s stock price in the short-term.

TREAT?

On the other hand, long-term investors willing to ride through a potential short-term storm may find something to like here.

With the stock price down and the dividend amount likely to be raised, its dividend yield is starting to look attractive for a long-term entry. While high yield alone is not a reason to buy a low-quality stock, it becomes interesting when applied to a company that’s been paying dividends consistently for over eight decades like HSY.

One concept that I work with my clients on is the idea of buying a high-quality dividend stock when its current yield is attractive compared to that specific company’s own historical average high yields. Using a high yield number averaged out over the last ten years, HSY is viewed as an attractive entry by income investors when it is yielding 2.84%.

The following chart features what I refer to as a “Dividend Stairstep” in orange, which plots the level that the stock’s price would need to be trading at in order to obtain that yield over the previous decade calculated from HSY’s various dividend rates. Notice the green arrows, which identify times when HSY’s price was touching the orange Dividend Stairstep line and offering investors a 2.84% yield. Most would agree those would have been viewed as attractive times to build a position in this stock. Note that HSY’s yield, even before considering the likely dividend increase later this week, is 2.85% and would be considered attractive on this metric currently.

Now notice that there’s a second Dividend Stairstep line in blue that is also plotted. That level is where HSY’s stock price would need to trade in order to achieve a 3% yield for investors. With risk-free 10-year U.S. Treasuries trading around a 3% yield level currently, it becomes an important hurdle rate for many income-oriented investors who need to justify the additional risk they are taking by investing in common stocks. For many stocks, a 3% yield is commonplace. But for HSY, it has been elusive. The black arrow on the chart points to the last time HSY had a 3% yield, which was back in early 2010.

I believe there’s a good chance that HSY’s stock yields 3% for the first time in eight years right now for investors willing to think creatively. HSY has shown a tendency to raise their dividend between 6 and 10% in recent years. Their current dividend rate is $0.656 per quarter. If we take the bottom end of their recent dividend-increasing range and apply a 6% increase to the current rate, that means their new rate would be $0.69536 per quarter. That gets annualized to approximately $2.78 per year. If you divide that number by .03 to see where the stock’s price would need to be trading for a 3% yield, it comes out to $92.66, which is higher than where HSY closed Tuesday.

BOTTOM LINE

A 3% yield doesn’t guarantee success because investor sentiment towards income-producing assets can change over time. But for those patiently waiting for HSY to achieve that yield hurdle, it has probably felt like a long 8 years. I expect Hershey’s to announce their dividend hike later this week and I expect them to raise it within the 5-10% range which means that investors now likely have that elusive 3% yield opportunity.

If you’re a long-term investor who is interested in becoming a partial business owner in a high-profit margin business at a unique price, HSY could very well satiate your hunger at current levels.

Twitter: @BrandonVanZee and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.