As many of you are aware, we’ve been covering GoPro stock (GPRO) pretty closely since its IPO. And in my last GPRO stock update, I showed why 36 dollars lines up as a key GPRO technical support level since tagging its 98 dollar high (another target I wrote about post-IPO).

Well, the stock is almost there folks.

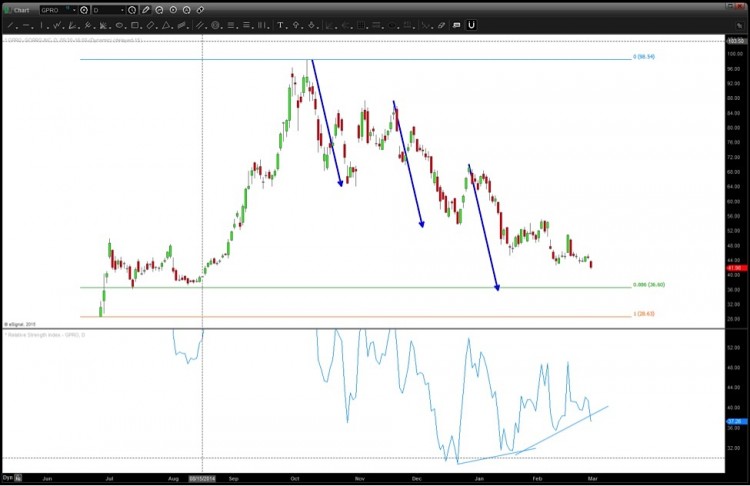

The main indication that the 36 dollar area might be a tradable support level (or even a bottom) is the measured moves shown in blue in the chart below (same chart as last update – sorry, I’m on the road). Measured moves show the harmony in a move and, as we can see, each and every down move has been equal. Since this stock is very oversold, probability favors using this 36 level as an opportunity to play a bounce OR take profit if short OR look to scale into a longer term investment. Either way, it’s definitely on my radar as a critical GPRO support level.

GoPro Stock Chart

The other key is the measured move lands right on the .886 retracement. We have discussed square roots and their inverses and how they tie into musical theory before. So how is .886 important?

- 1.618

- Square Root (1.618) = 1.27

- 1/1.27 = .786

- Square Root (.786) = .886

So, the key to understanding Pattern Recognition is that its all in the probability. As active investors we can’t be sure of anything. And with that in mind, we always want to identify trading setups that are well defined (where we can use a nearby stop loss) and offer good risk-reward. I personally think GPRO has a well defined line in the sand that helps to define risk tolerance. Whether it bounces or not is something traders cannot control. Again, this is the reason we always use stop losses to take our emotion out of trading. If the 36 level doesn’t hold, then the stock could head down towards 30 pretty fast.

Thanks for reading and happy hunting!

Follow Bart on Twitter: @BartsCharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.