Google (Alphabet) announced their 4Q 2021 earnings on Tuesday, February 1. And they were even stronger than expected. Investors sent the stock ticker (GOOGL) flying in after hours.

Google continues to grow at a rapid clip despite the strong growth last year during the same period.

Growth was abundant in Google 4Q earnings, as sales grew 32% to $75 billion with all segments contributing significantly.

Google’s “Cloud” division remains a real challenger to Amazon Web Services (AWS) and Azure due to its analytics and AI capabilities. This was the original thesis for our investment during mid-2020 as our conversations with partners suggested tangible traction.

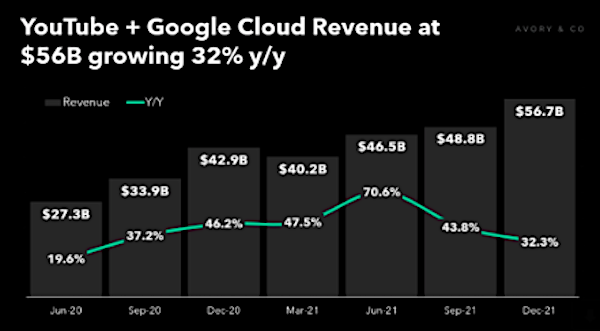

YouTube + Cloud sales are now 19.1% of total sales, with annualized sales standing at $56.7B and growing 32.3% year over year.

Here’s a quote from CEO, Sundar Pichai:

“Our deep investment in AI technologies continues to drive extraordinary and helpful experiences for people and businesses, across our most important products. Q4 saw ongoing strong growth in our advertising business, which helped millions of businesses thrive and find new customers, a quarterly sales record for our Pixel phones despite supply constraints, and our Cloud business continuing to grow strongly.”

Here’s a look at some numbers:

Growth:

- $75B in sales, +32.4% year over year.

- Google Cloud $22.2B annualized business.

- YouTube $34.5B annualized business now.

- YouTube + Cloud is a $56B annual run-rate business.

- Evolving hardware product portfolio with strong reviews.

Margins:

- 29.1% operating margins. (strong)

- Core Google ex other bets is +46% margins. (wow)

- After 5 quarters of op margin expansion, there is some leveling.

- $92B in operating cash flow over the last 12 months.

Longer Term View

Google has multiple layers of growth with valuation remaining attractive relative to the durability of the franchise. They remain well-positioned for structural growth and innovation, including future mobility, computing, digital work, and interactive entertainment.

Twitter: @_SeanDavid

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.