Gold Market Takeaways:

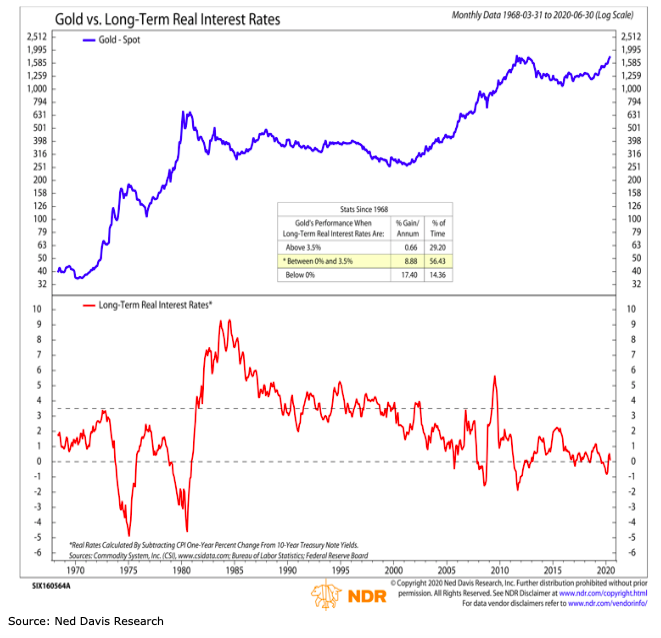

Gold is more sensitive to real interest rates than currency swings.

Gold sentiment is frothy, but strong trends will provide support.

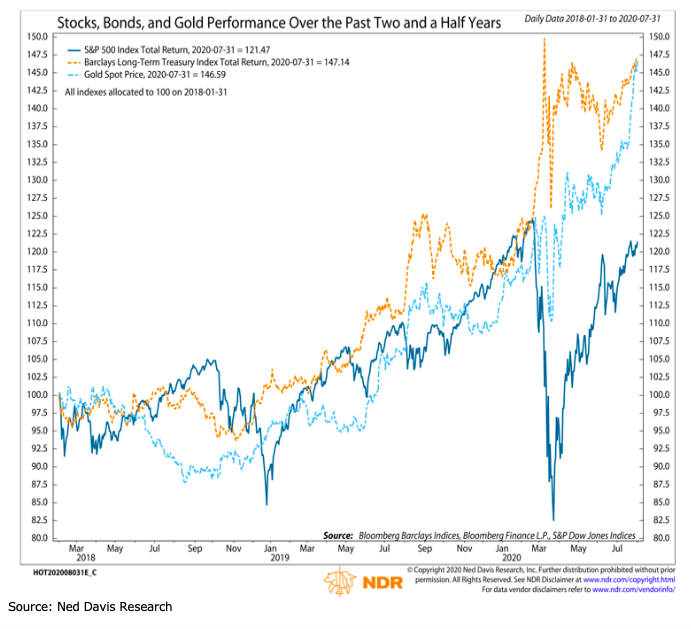

Gold has outperformed stocks over the past two years and past two decades.

When asked about the role of gold in an investor’s portfolio, I usually think about two types of investors:

– For those who insist on always having some gold, I usually suggest having as little as is necessary to allow the investor to sleep at night.

– For more dynamically minded investors who are looking to lean into opportunities as they emerge, I tend to suggest having enough exposure to actually make a difference in a portfolio.

We see no reason that exposure to gold, or any other asset class for that matter, needs to be static over time. If conditions improve for one asset class or another, we can increase exposure – when they deteriorate we can decrease exposure. We follow the wisdom of John Maynard Keynes, “When the facts change, I change my mind – what do you do, sir?”

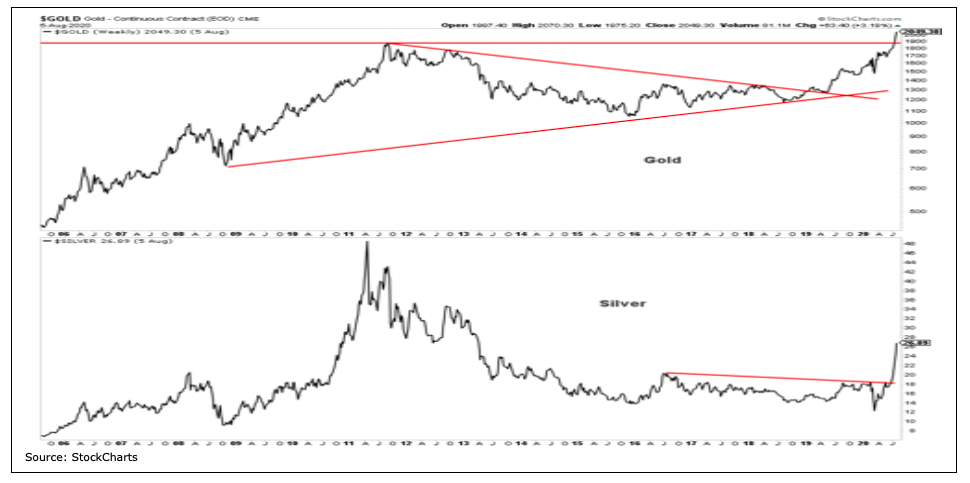

Right now gold (and silver) are in strong up-trends, supported more by low and falling real interest rates than currency volatility. Gold has broken to a new high, trading above $2000/oz for the first time ever. After initially lagging, silver has heated up in recent weeks, breaking through a multi-year downtrend and moving to its highest level since 2013. In our go-anywhere Tactical Opportunity portfolio, our exposure to Gold and Silver has risen to more than 20%.

Many see gold as a hedge against dollar weakness. Gold is typically priced in dollars, so there is some logic in this approach. However, while gold is at its new highs, the dollar is just off the new highs it made earlier this year and remains in trading range that has persisted for more than five years. The correlation between gold and the dollar has actually been rising in recent months.

Gold is typically more sensitive to the direction and level of real interest rates than currency swings. Historically, gold does best when real rates are low and falling. While there has been downward pressure on some measures of inflation in recent months, bond yields have also been falling. The yield on the 10-year T-Note has dropped to 0.5% and there is some evidence that the inflation environment may not be as benign as some suggest. Rising food prices are straining household budgets and median home prices are pushing higher. Even with the rally to new highs for gold, the fundamental backdrop remains relatively bullish.

Long-term trends are strong and the low real interest rates provide a tailwind, but sentiment in gold may have gotten ahead of itself. The NDR gold sentiment composite shows a swing from excessive pessimism in late 2019 to current widespread optimism. Flow data reveal a similar surge in interest. Excessive optimism has historically cooled price gains, but it is worth noting the speed with which gold sentiment moves around. While sentiment would argue against chasing rallies at this point, strong underlying trends suggest pullbacks should be seen as opportunities to add exposure.

Gold and bonds have been outperforming stocks (S&P 500) over the past couple of years and over the past two decades. From a traditional perspective, bonds provide the portfolio ballast while stocks power the gains. Since early 2018, the S&P 500 has underperformed and been more volatile than either gold or bonds. While the facts on the ground will change at some point, right now they seem to support continuing to tilt tactical exposure toward gold (and silver).

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.