A lot of Gold bugs were excited for the Federal Reserve meeting this past week, seeing that decision as a potential catalyst for a breakout of the recent price consolidation.

The response was muted, at best.

Just two weeks ago, I wrote about that precious metals was a breakout… in the making. I added the “in the making” because there wasn’t confirmation. Silver had a nice breakout above it’s downtrend line and gold was right on it, trying to break out. Typically, silver leads and provides momentum. But, in this case precious metals stalled out… and the consolidation continues.

So here we are today with a multi-week consolidation and both bulls and bears waiting for a catalyst. Considering the trend, one has to give the bulls the advantage. Let’s look at the chart and discuss some key indicators and price levels to watch.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

Okay, let’s look at Gold’s price chart.

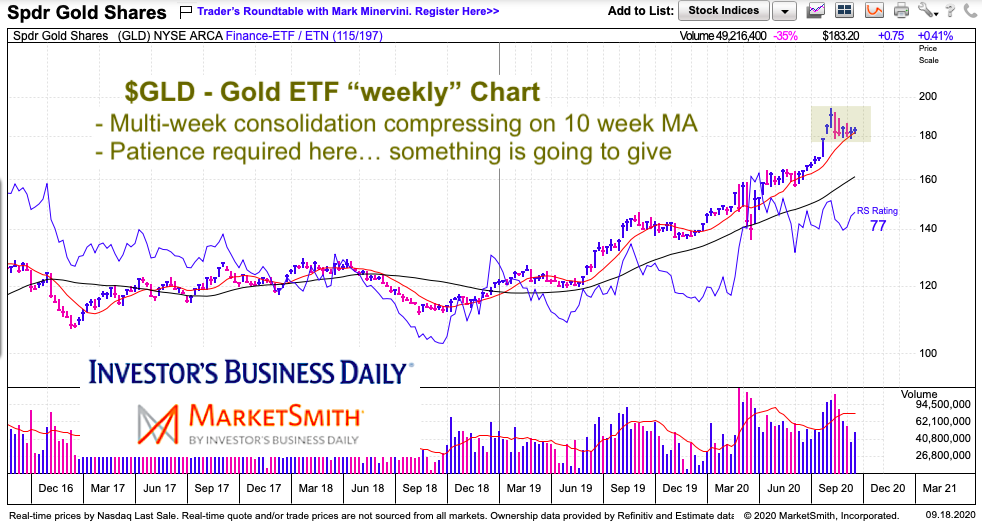

Gold ETF (GLD) “weekly” Chart

As you can see, the yellow metal has been consolidating for weeks. And since the trend is up, we have no reason to be outright bearish here. However, one thing to note is that price is compressing into the 10-week moving average. And just below this key moving average is the bottom of the consolidation at $178.

A move above $185 (that holds) should see a retest of the highs and likely new highs. Two other indicators to watch are the US Dollar and Silver. We watch the Dollar for obvious reasons (weakness is bullish, strength is bearish). And watch Silver to see if it starts to lead (bullish) or lag Gold (bearish). Silver brings the beta.

Twitter: @andrewnyquist

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Editor’s note 10:05 pm CST 9/20/20: Edit to clarify that author does not have a position in mentioned securities.