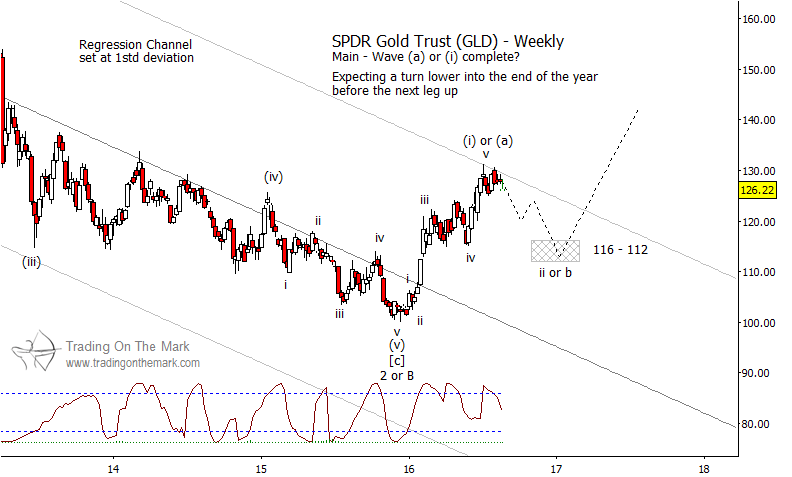

Since we last wrote about the SPDR Gold ETF (NYSEARCA:GLD) in March, the Elliott wave pattern has come into focus for the Gold ETF (you can find our prior article here). Gold price targets for the wave higher have been met and a move lower (or price correction) may be in process.

In terms of time and price, the move up from late 2015 appears to have completed a five-wave impulsive move. As well, there are additional factors suggesting that gold prices should begin to consolidate or make a downward retracement soon. Below are some potential gold price targets into year end (or perhaps early 2017).

While we can count a possibly completed five wave structure up from the low, price also is testing potential resistance in the form of the first standard deviation of a regression channel on a weekly chart. Beyond that, late August is also near the peak of a 52-week cycle (not shown).

Meanwhile, recent COT reports have large speculators heavily long in gold futures just as commercial interests are heavily short. We expect the imbalance to resolve with a correction in gold prices.

Gold ETF (GLD) Chart – Potential Elliott Wave Pattern

Keep in mind that it is too early to discern the larger pattern. In the big picture, price might try to form a three-wave pattern that goes generally upward into 2018, or it could form a more lengthy five-wave impulsive pattern. Thus we have labeled the recent move and the forecast retracement as either (a)-(b) or (i)-(ii). However, in both cases it makes sense to watch for a downward leg before trying to ride gold higher. The 52-week cycle suggests that the next low could occur in the later months of 2016, and we expect it to be a higher low versus the one formed in 2015.

Our next email bulletin will focus on grains. Request your copy via this link. Thanks for reading.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.