This week the Gold Miners (NYSEARCA:GDX) have been hit hard, and Gold (NYSEARCA:GLD) itself has seen some downside follow through.

So what’s next for the yellow metal?

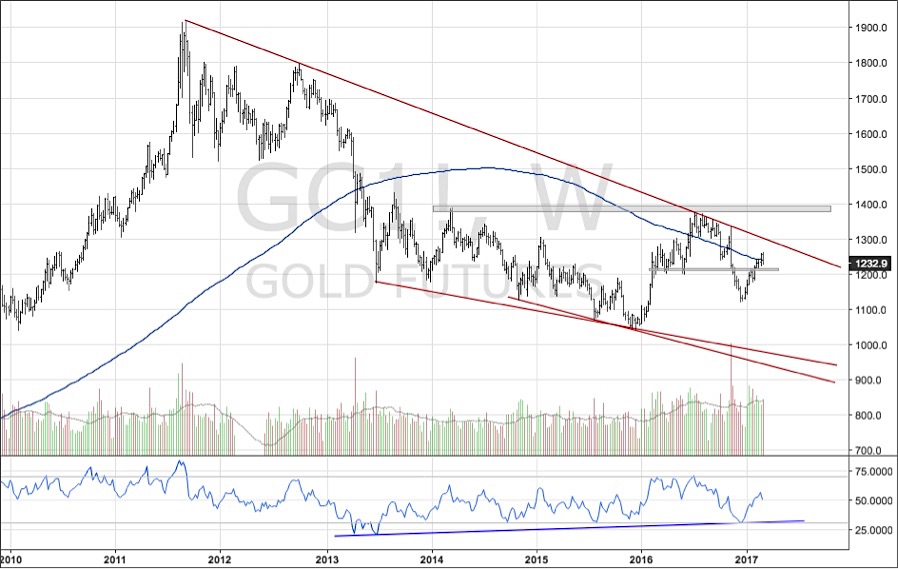

Gold is in an interesting position. I see two possible scenarios: 1) The strength can continue upon a breakout above ~1,300 and ultimately toward a retest of the prior resistance from last summer at ~1,390 or 2) Gold is ahead of itself and we sell-off down towards 1,000.

Do I know which will happen? No, but I have been cautious for the past few weeks with price chopping around a downward slopping 200 week moving average. See the chart of Gold futures below.

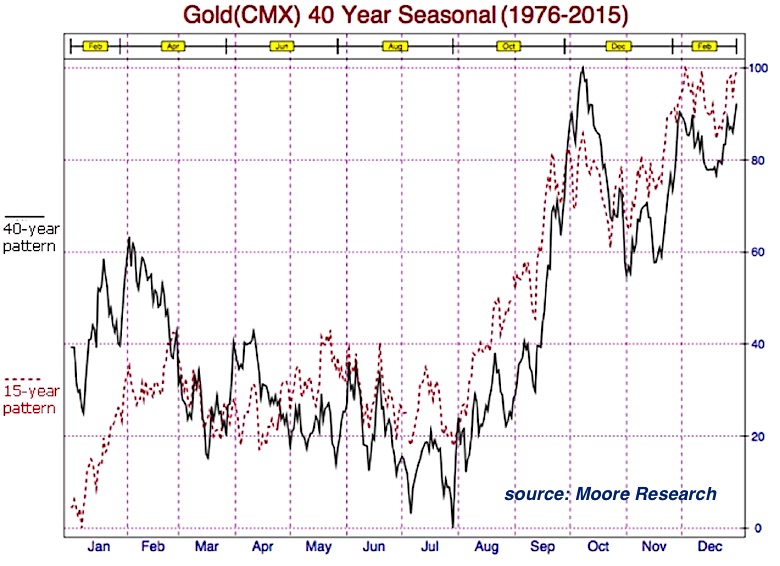

I feel Gold has been the recipient of positive seasonality to start the year, but also of fear purchasing. With the overall market ripping higher, Gold has continued to catch a bid. I don’t believe in justifying moves on negative correlations, but it is interesting to see the Dollar move higher as well and it not affect Gold. To me, as long as the Dollar Index is above 99 and USD/JPY holds above 111.50, I don’t think it will bode well for Gold over the intermediate term.

Now as we begin March, it is not a seasonally strong period until the end of the summer. We will have to wait and see if seasonality continues to hold true.

An interesting situation that may give us more insight into the future move is the intermarket relationship between Gold and Gold Miners.

There has been a recent under performance of Miners relative to Gold. Gold bulls want to see the Miners outperforming Gold, along with the Junior Miners outperforming the Senior Miners. This lack of strength internally is the reason I believe we got hit hard this week. Going forward, to see a continued bullish environment we want these ratios break out. If they cannot, I do not want anything to do with Gold.

Let price dictate your actions! Thanks for reading.

StockTwits: @Alpha_Eye

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.