While we are positive on the markets in the near term, given the age of the current market cycle we certainly have an eye on adding defense. Enter Gold (GLD).

For many investors, one issue is that with bond yields so low and many defensive sectors trading at a big premium, becoming defensive has become more challenging.

Our firm believes gold exposure continues to offer decent value and a good defensive vehicle in conjunction with traditional bonds and other defensive holdings.

Gold possesses a unique set of defensive characteristics, which shine when uncertainty rises in the market. It has had a fantastic run this year, with bullion up 17% and the Gold Miners (GDX) up 34%.

The recent pull-back has provided perhaps another opportunity to get in on what may very well be a multi-year run. After a short rest, the gold bull appears poised to take its next step higher.

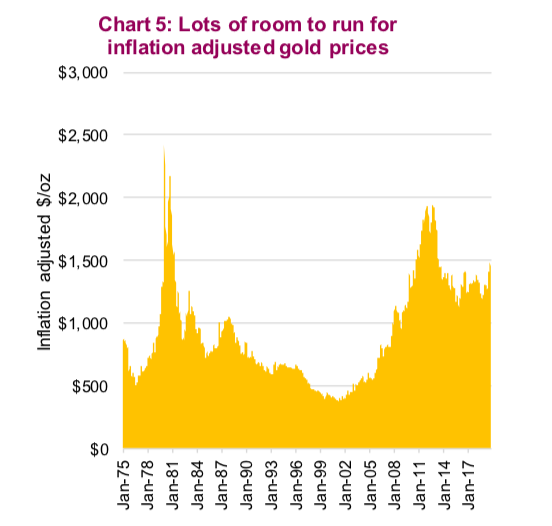

Technically, both physical gold and stocks appear ready to break out of its narrowing range, if history is a guide. From an inflation-adjusted perspective, gold prices still have some way to run before they reach 2011 levels (Chart 5).

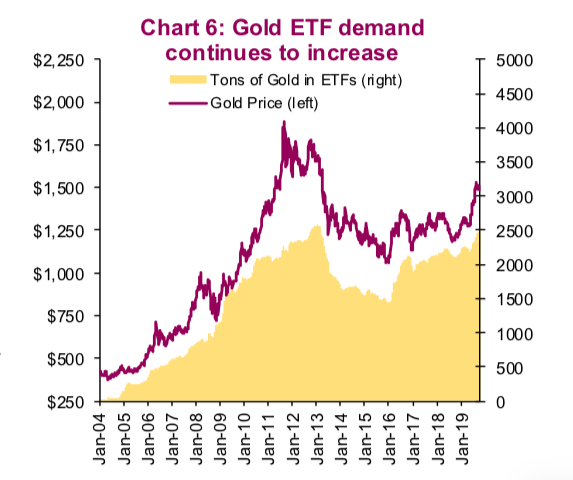

There are a number of reasons why we believe gold’s recent positive performance is not an aberration, including our cooling on the U.S. dollar. Weakness in the U.S. dollar, which is historically expensive versus most major currencies, would be a positive for gold prices. Gold is a real asset quoted in U.S. dollars, so a weaker dollar equals a higher gold price. Secondly, total known exchange-traded holdings of the metal have steadily risen (Chart 6).

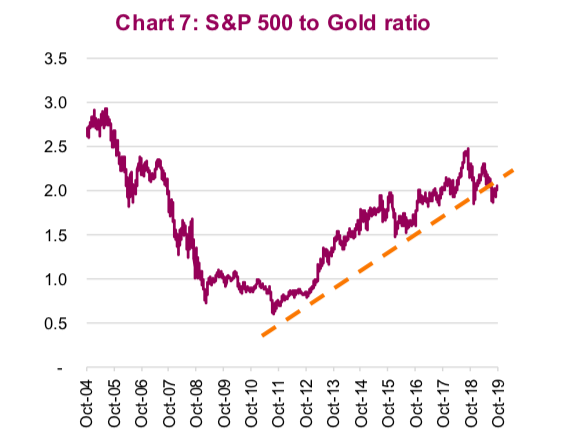

We believe the rise in popularity of crypto currencies in the past few years siphoned off some of the gold bugs. Now that cryptos have crashed back down, we think many are coming back to the yellow metal. Thirdly, central bank demand – particularly on an international basis – remains robust. Since bottoming in 2011, stocks have outperformed gold. You can see this trend in Chart 7, which is a simple ratio of the S&P 500 versus the price of gold. The rising trendline has broken after topping last year, which would suggest a new lower trend is now in place. (Chart 7).

The supply side of the equation is equally important. The gold industry already had their boom in the 1970s and 1980s. Abundant capital poured into the industry, new mines were discovered, and global production ramped up; but now production growth is slowing as these older mines are gradually depleting. The business of exploring for gold has also become much more difficult compared to the 80s amid stiffer environmental regulations, and safety and labour concerns.

Above-ground supply of gold has changed little over time, and new discoveries have been lacking as have miners’ reserves. Presently, it’s a very profitable period for gold miners with gold prices trading above $1500/oz – this is well above the all-in sustaining costs for most miners.

Central banks have also been increasing the amount of gold in their portfolios. The motivations vary but one trend appears to be the desire to better diversify their reserves.

In our opinion, gold exposure is a solid defensive diversifier, especially given such a low-yield environment.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.