Aside from the high likelihood of keeping that premium you sold, another benefit of the ultra-low depths that the CBOE Volatility Index (VIX) keeps plumbing is the solid analysis cultivated as the wary and complacent alike struggle to figure out what’s next. The eerie calm that sets in during unusual regimes of low volatility (evocative of a similar feeling in late 2006) easily gives rise to bouts of both complacency and paranoia (sometimes both: talk about cognitive dissonance) from which few traders are entirely immune. Thankfully, there’s no shortage of great material floating around that helps with recalibration of easily skewed expectations and empirical debunking some of the spurious (but persistent) claims in the VIX mythos — Andy Nyquist’s and Adam Warner’s among others.

On the margins of this ongoing dialog about the vacuum of equity volatility underwa and the slow, inexorable quelling of expectations about any and all directional violence (including here where I review why the market is about to change gears), though, there’s a broader theme playing out: volatility has been completely crushed across asset classes. Like FX and Rates across the curve, stocks are merely symptomatic of a grand implosion of implied volatility. Risk premia in many instruments – EZ peripheral spreads, anyone? – are compressed to multi-year or all-time low levels as what Ross Heart terms the “Emerging Bubble in Certainty” continues it’s expansion.

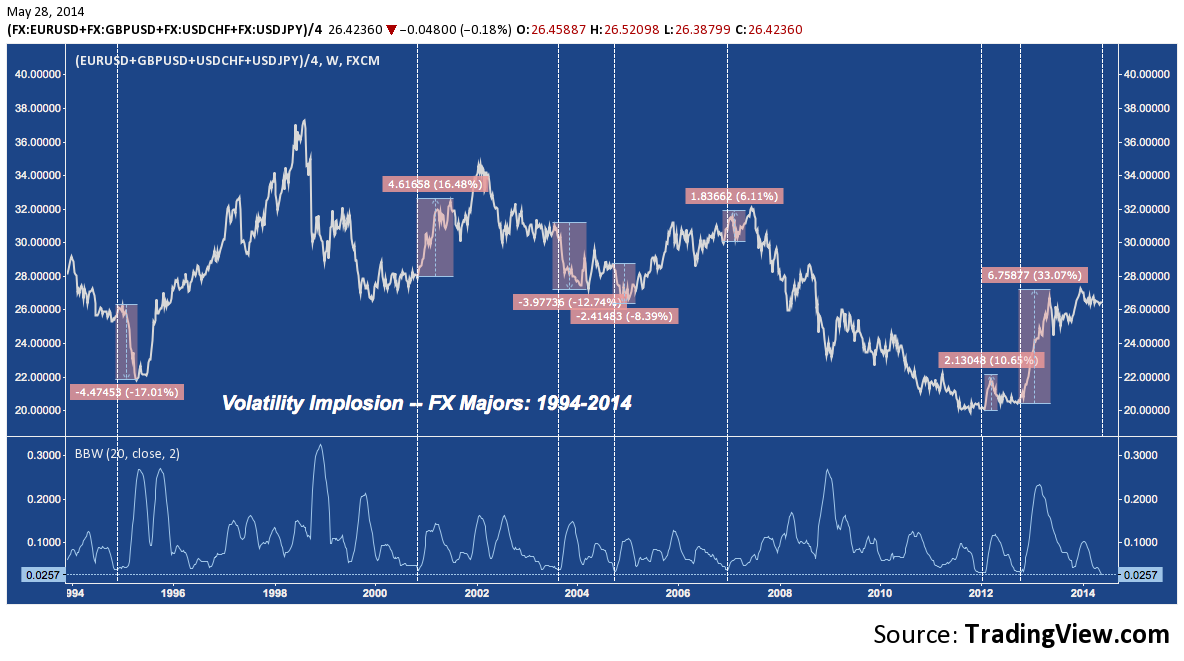

Nowhere is the global reach of the crash in implied volatility better summed up than in its all-surpassing ebb across the so-called “Major” currency pairs in the Foreign Exchange market. In case you’re unfamiliar with the term, four currency pairs – the Euro/US Dollar (EUR/USD), British Pound/US Dollar (GBP/USD) US Dollar/Swiss Franc (USD/CHF) and US Dollar/Japanese Yen (USD/JPY) – are classically (post-Bretton Woods era) regarded as “the Majors” because they account for the preponderance of trade in the Forex. The weekly chart below plots their average, along with their Bollinger Bandwidth in the lower panel (a running measure of the spread between +2 and -2 standard deviations of the average). The lower right corner says it all: in the past 2o years, the Majors have come close, but never been less volatile. And on these occasions where major troughs have occurred, resumption of volatility has been abrupt, without respite and often involving a trade-in of an initial spike for a longer steady-state regime of increased ranges (with the mid-’90s and late-’00s the best examples here):

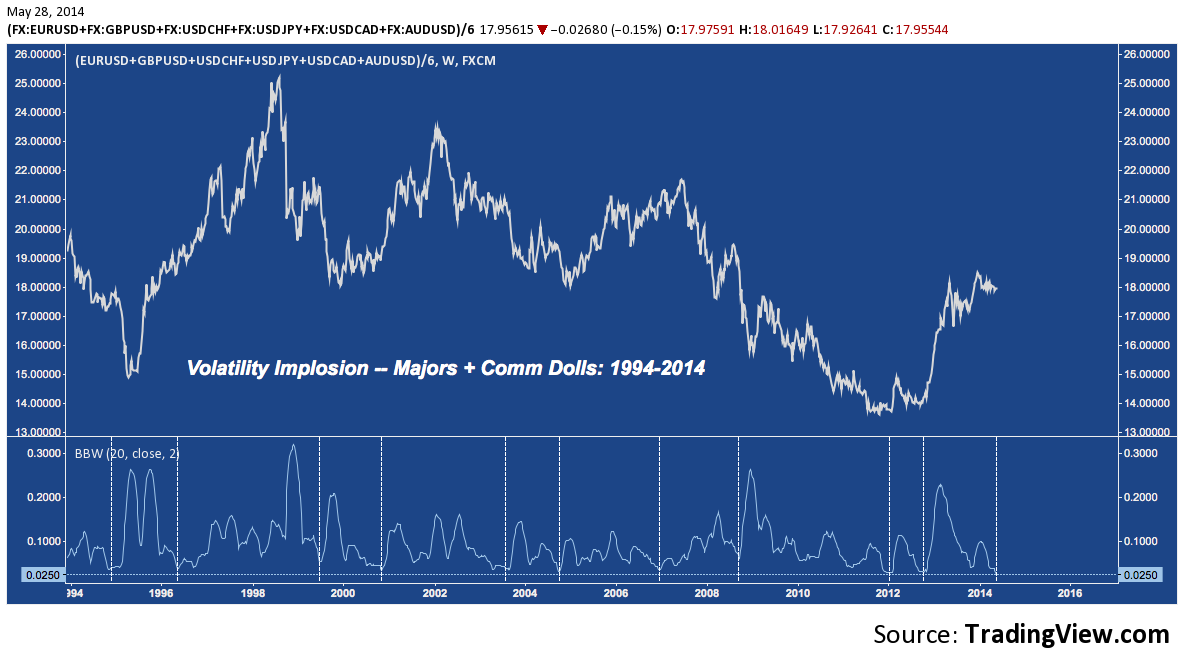

A broader (and fairer, given the global energy and metals trades) measure is to look at the above currencies along with the US Dollar/Canadian Dollar (USD/CAD) and Australian Dollar/US Dollar (AUD/USD), collectively referred to (along with NZD/USD) as the “Comm Dolls” for their reflexive sensitivity to oil, natural gas and precious/industrial metals. Once again, the same picture results:

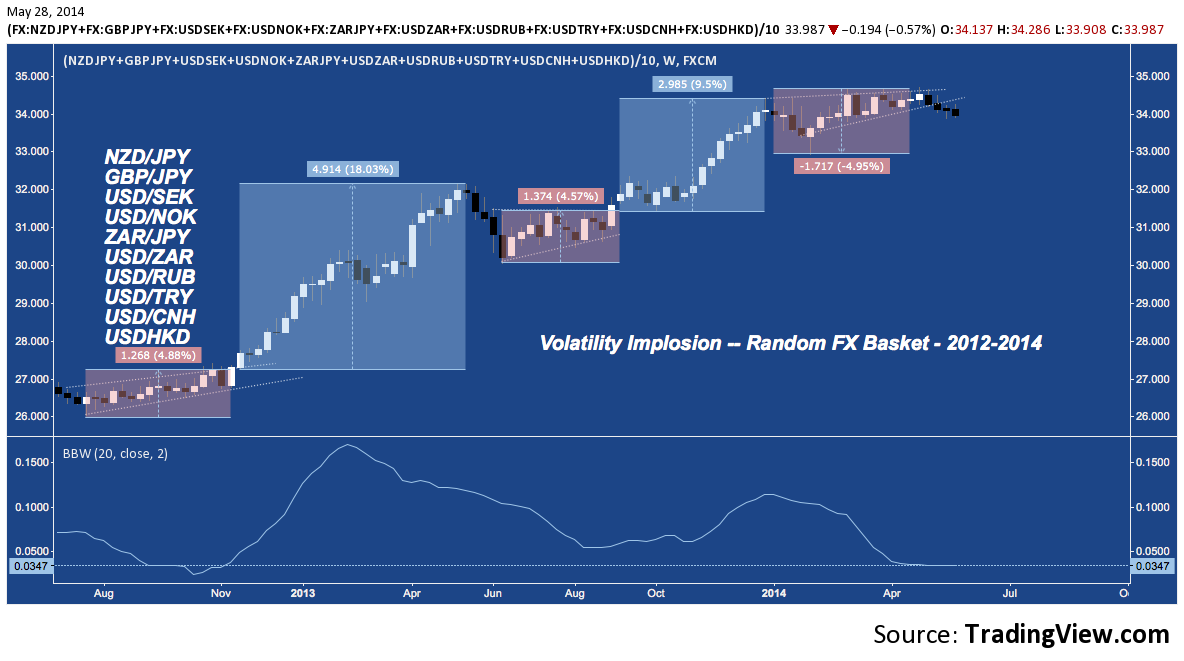

These six pairs and their various permutations accounts the majority of daily notional foreign exchange volume; but just to drive the point home, consider some other lesser-known and exotic pairs from around the world over a more recent time horizon:

From the Euro (EUR) to the South African Rand (ZAR) exchange rate volatility, like equities, is at multi-year (and in some cases, decade) lows. It’s no exaggeration to say composite, intermarket volatility has rarely ever been more subdued. The world has never been less excited on so broad a scale about where money will go and and what it will do.

The assurances (epitomized by ECB President Mario Draghi’s “whatever it takes” regarding the ensured viability of the Euro project) that have gotten us to this place of intense and escalating indifference to risk are many. Certainty in the omnipotence and infallibility of unconventional monetary policy is at an all-time high as the former lenders of last resort continue to permanently adapt their crisis measures into an entrenched market activist presence. Despite Ben Bernanke’s protestations to the contrary, the present and heavy hand of central banks has come to be regarded as a de facto “panacea”.

The inevitable increase in volatility in FX, rates and equities doesn’t have to equal a breakdown of this trend or even a pause in its progression; to wit, more volatility is exactly what incited this wave of encroachment by central banks into financial markets and any renewed stress on “the system” will only be met with further consolidation. But whatever that stress ultimately looks like, it will have to return in some form to incite the uptick in volatility that – working from the safe assumption this time still isn’t different – is soon in coming.

Twitter: @andrewunknown and @seeitmarket

Author holds no exposure to securities mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.