The financial markets started the year off on a positive note. Although the US Dollar (CURRENCY:USD) has pulled back a bit in 2017, it is still holding near 100 on hopes of improved economic growth. During this recent pause in the dollar, the bond markets have stabilized. But major stock market indexes like the S&P 500 (INDEXSP:.INX) are still at or near all-time highs.

But right now it seems that the political conversation is louder than the financial one. But we’ll try to focus not he market here.

Below is a global financial markets review of January (into February) along with some thoughts on The Federal Reserve (interest rates and their stash of crisis era bonds).

Stocks & Bonds

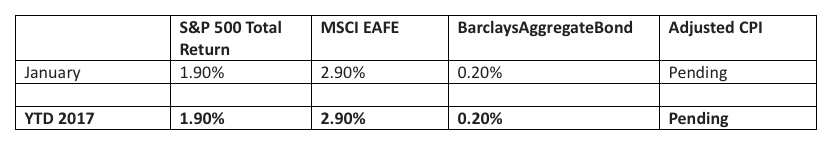

The U.S. stock market continues to move higher on hopes of tax cuts and other fiscal stimulus. Foreign markets have performed even better, although the relative strength of one month (January) does not make up for the overall dismal 2016 that many American investors experienced with their international funds. After 6 months or so of red ink, bonds (NASDAQ:TLT) stabilized a bit in January. Here are the numbers:

Commodities & Currencies

When OPEC announces production cuts, eyes then start to look at implementation. Historically, OPEC members have not cut production as much as promised – the short-term revenue sacrifice is usually too large. Market participants believe that OPEC is on track to deliver about 75% of its promised cuts – a historically solid number. At the same time, drilling activity in the U.S. as measured by the number of active oil rigs is jumping. So oil bulls and oil bears continue to fight it out. In January, oil declined slightly to $52.81 per barrel. Continued political uncertainty proved to be a positive for gold, which gained just over 5% in January to close at over $1,200 per ounce.

The U.S. dollar, after a strong December, declined 2.6% in January.

Economy

The ISM Manufacturing PMI in January came in at 56%, showing accelerating growth from the previous month. The non-manufacturing, or services, index came in at 56.5%, down slightly from December. The Commerce Department released its first, ‘advance,’ estimate of fourth quarter GDP growth, calculating an annual rate of 1.9%. The National Association of Realtors reports that existing-home sales in December 2016 were 0.7% higher than in December 2015. In addition, the median price increased 4.0% to $232,200. We are now approaching almost 5 years of rising median home prices. Distressed sales (foreclosures and short-sales) rose to 7% in December, higher than previous months but lower than the 8% number from a year ago.

Commentary

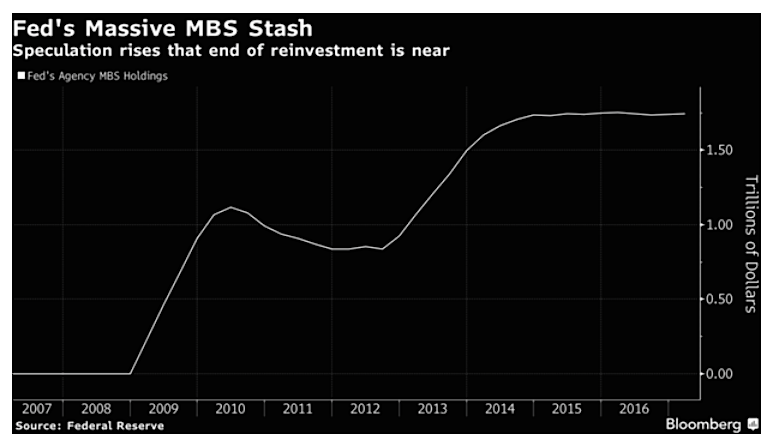

As the Fed is starting to raise rates, market watchers are also wondering when the Fed might start to sell some of its crisis-era bonds. Before the crisis began, the Fed held less than $1 trillion of assets. Over the following 6 years and multiple QE programs that amount ballooned to $4.5 Trillion. Besides buying U.S. government debt, the Fed stretched its mandate and also directly purchased Mortgage Backed Securities – MBS. In other words, starting in 2008, the Fed bought about $1.5 trillion of MBS to drive mortgage interest rates lower and help rescue the housing market.

Buying MBS makes mortgage rates go down, which is nice. But selling MBS, and especially selling $1.5 trillion of MBS, makes mortgage rates go higher. In fact, Moody’s Analytics estimates that if the Fed unwinds its MBS holdings over a 3 year period, mortgage rates could climb to 6%.

The average rate on a 30-year mortgage had already jumped to an almost 3-year high in December, hitting 4.32%, as markets anticipate tax stimulus and improved economic growth prospects.

So we run into the problem of our ultra-low interest rate environment – basically, the Fed already has the pedal to the metal in terms of stimulating the economy. We cannot go any faster, i.e. interest rates can’t practically go below 0%, even if various groups and factions want to go faster. And the moment the Fed takes their foot of the gas a little bit, there could be outsize consequences for our credit-driven economy. Interest rates drive the housing market (mortgages), and the automotive market (car loans), and the retail market (credit cards). These 3 markets are about half of U.S. GDP.

I do believe the Fed wants to tighten monetary policy, and I believe that some tax stimulus is coming our way. I also believe a consumer with a $750 tax credit and a rejected mortgage application is not going to believe that they are better off, and that the economy will continue to bump along for the next 4-8 years much as it has for the last 4-8 years.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- standardandpoors.com – S&P 500 information

- msci.com – MSCI EAFE information

- barcap.com – Barclays Aggregate Bond information

- bloomberg.com – U.S. Dollar & commodities performance

- realtor.org – Housing market data

- bea.gov – GDP numbers

- bls.gov – CPI and unemployment numbers

- commerce.gov – Consumer spending data

- napm.org – PMI numbers

- bigcharts.com – NYMEX crude prices, gold and other commodities

- https://www.bloomberg.com/news/articles/2017-02-06/the-mortgage-bond-whale-that-everyone-is-suddenly-worried-about – MBS chart and associated mortgage rate analysis and information

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.