Over the last two weeks the US Equity markets have rallied to new all-time highs. At the same time we have seen the yield on 10-year US Treasury bonds increase from a low of 1.6% to 2.15% yesterday. That is a meaningful loss in the bond positions that have been working for the last 3-4 months.

What has caused the recent change in market direction and where do we go from here?

The impetus for bond yields suddenly reversing was the stronger-than-expected jobs report on February 6th when the economy added of 257,000 jobs. Around that same time, the US Dollar started to decline relative to other major currencies. The declining US Dollar corresponded with Crude Oil prices reversing and heading up. Let’s elaborate on this.

Notice the trend in lower oil prices that started in June of 2014 suddenly reversing in early February in this chart from finviz.com:

Crude Oil Price Chart

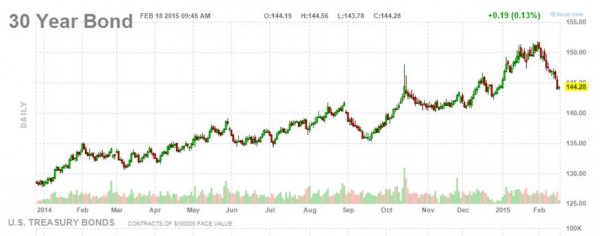

Compare that to the chart of the 30-year US Treasury bond:

30 YR Treasury Bond Chart

I am not implying causality, just showing correlation. The consensus narrative on the financial news channels is that the strong jobs report may cause the Federal Reserve to begin to raise interest rates in 2015 (presumably because the economy is doing so well); that oil prices have bottomed and that is seen as positive for stocks. So the stock markets have moved back to at or near all-time-highs.

Bob Doll of Nuveen Investments articulates the consensus view in a recent Business Insider article when he says that “stabilizing oil prices are helping markets move past the recent weakness.” He also says that “deflationary fears are receding” and that we’ll see “further gains in global equity markets…as the world economy improves”. In other words, now is a good time to sell bonds and buy stocks.

I disagree and want to briefly explain why.

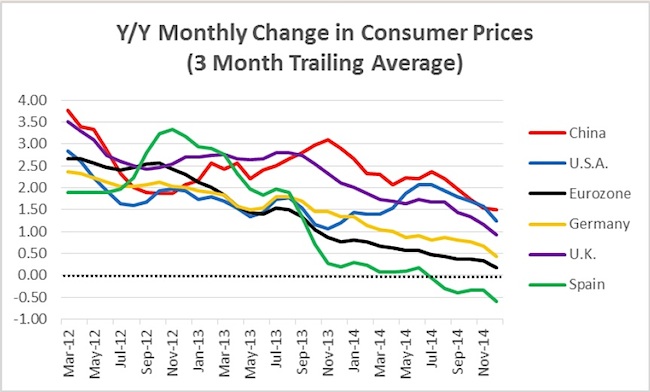

First, disinflationary pressures continue to increase around the globe. Look at this chart by Daniel Alpert of Westwood Capital. It shows that the year-over-year change in consumer prices around the world continue to decline in China, Germany, Spain, UK, Eurozone and the US. Remember that declining prices reduce inflation. That is good for consumers but bad for indebted governments. That’s why we see countries around the world starting to take more aggressive action to debase their currency in an attempt to import inflation.

Global Consumer Prices Monthly Change Chart

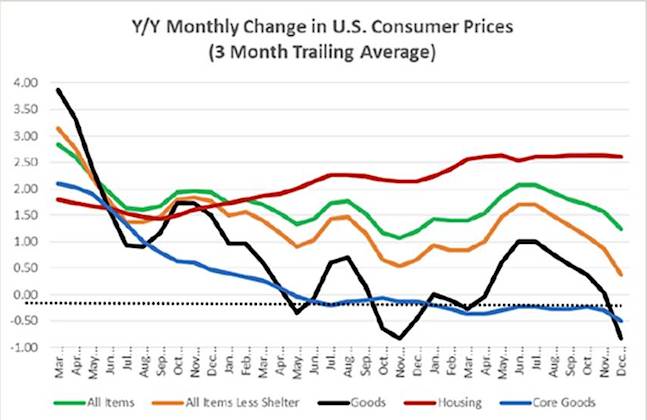

Secondly, many Wall Street System economists have been saying that the U.S. is like an island and that we are able to remain strong in the midst of a global slowdown. I believe the data shows that the U.S. is also being impacted by the global slowdown. U.S. Consumer Prices have been and continue to decline as shown in another chart from Daniel Alpert:

US Consumer Prices Monthly Change Chart

We are seeing global deflation. As other countries continue to ‘ease’ to make themselves more competitive it will cause the U.S. Dollar to strengthen relative to their currencies. That is bad for the U.S. economy and positive for US Treasury Bonds because US Treasuries become a store of value for foreign investors. It is good for the U.S. consumer because everything we buy that is imported is going down in price. That is bad for U.S. companies because it causes their profits to go down unless they can sell more at the lower prices. For instance, if a retailer has a 10% markup on a $100 item, they make $10. If the price of that item declines to $90, the retailer still makes 10% but that is now only $9. That means to top line growth will decline and so will their profits in dollar terms. Lower prices puts more pressure on businesses to lower their costs by paying their employees less, hiring fewer employees or laying off non-essential personnel.

The strong dollar also makes it harder for U.S. companies that export products abroad because it makes their products more expensive. So they, too, have to find ways to cut costs to remain competitive. Producer prices were reported today and they support this thesis that disinflation continues.

The Impact On Treasury Bonds

Thirdly, the more that the economic indicators reveal the ongoing deflation concern, the more I expect bond yields to decline. Already, the 10 year U.S. Treasury bond is paying significantly more than the corresponding bonds in other countries.

Corresponding 10-Year Government Bond Yields:

United States 2.16%

Germany 0.38%

Japan 0.39%

UK 1.82%

Today’s news that US producer prices post record drop on tumbling energy costs is positive for bonds and I expect that we will see the bond positions we hold begin to recover. I don’t expect them to recover overnight, but I will not be surprised if we see the 10 year UST yield go lower than the 1.6% level it recently hit over the next weeks and months. As bond yields and the price of oil decline, I would expect that major stock market indexes to retreat from their highs. I will be expanding on this thesis with a more in-depth discussion on the price of oil in the coming days and weeks.

So, although we have seen the U.S. stock markets push back up to their highs and US Treasury bond yields go higher, I strongly believe that it is a counter trend that will not last. Until then, I will remain vigilant and continue to closely monitor risk through disciplined systems.

My Market Trending Indicators:

US Stock Market Trending Up

Canadian Stock Market Trending Up

US Bond Yields Trending Down

Follow Jeff on Twitter: @JeffVoudrie

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.