Nothing lasts forever – thankfully this includes pandemics. And while the path out likely remains a hilly road with ups and downs, people’s behaviour appears to be inching back towards normal. This is clearly good news.

With each jab in the arm, we move a small step closer towards the new normal. This pandemic has obviously triggered a great number of advancements across medicine, logistics, manufacturing, etc.

One of the advancements in the world of economics has been the rising use and availability of higher frequency data. Economic data, generally, takes time to tabulate, report and then is often revised. GDP, for example, is reported about 3-4 weeks after the quarter ends, and revised multiple times over the coming months. In the end you have a clear picture of what happened a year ago. Not very useful for investing given how fast markets move.

High frequency data attempts to capture some measure of economic activity closer to real time. The most obvious benefit is that it can provide a glimpse of what is happening today: are things improving, deteriorating or remaining stable. The downside is because it is relatively new, its efficacy remains a bit of a wildcard. In this edition we will look at some of these high frequency data points to show that the economic re-opening is gaining momentum.

In fact, this momentum is starting to show up in retail sales which is a more traditional economic data point, providing increased proof that the high frequency data can be a leading precursor to the more traditional data.

Re-opening

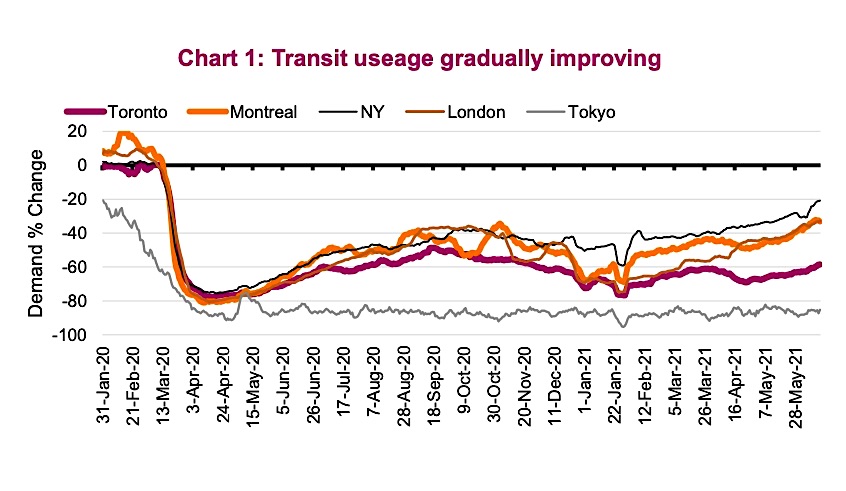

Much of the higher frequency data involves movement of people or things. Given social distancing was used to help combat the pandemic, this limited mobility and signs of improvement can be equated to the pace of economic re-opening. Chart 1 is the transit usage across various cities and while things are not back to

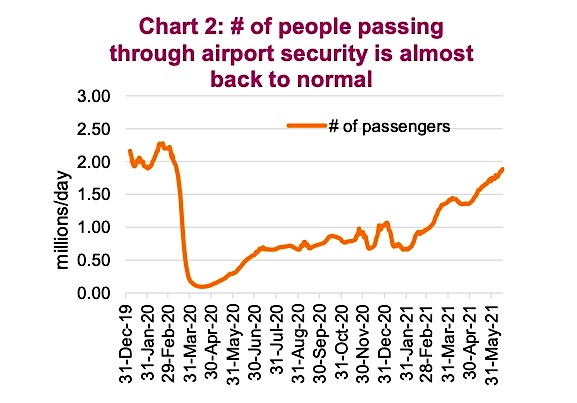

normal, the gap is closing pretty quickly. Sticking with the movement of people, air travel has been improving dramatically in the U.S. (chart 2). The number of passengers passing through security checkpoints in the U.S. is almost 2m a day, just a hair under pre-pandemic paces. This figure is tilted to domestic travel, but encouraging nonetheless.

These trends are similar across a number of measures. Box office tickets sold for movie goes, restaurant reservations (we just made one for this week) and back to work trends. This is all good news.

The sweet spot

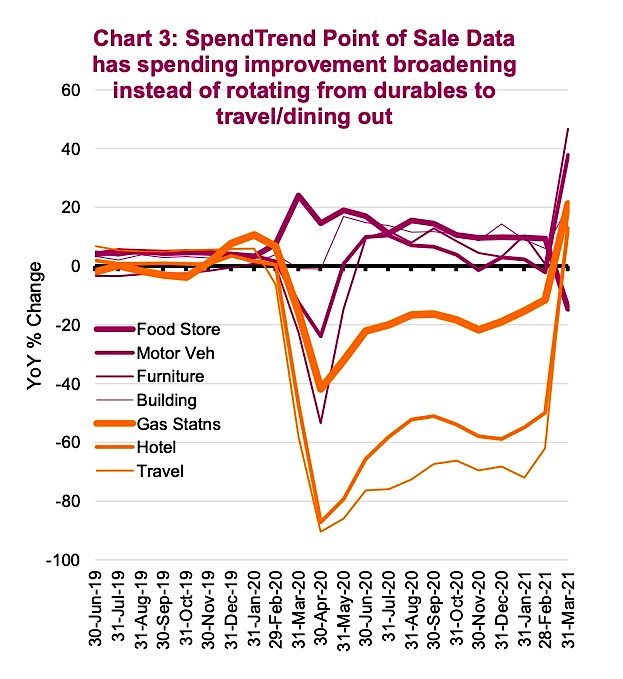

As we highlighted in “A dollar is not just a dollar” report on May 10, consumption spent on durable goods such as cars or home improvements have a bigger economic and equity earnings impact compared to most leisure spending Concern remains that as spending reverts to a more balanced mix, this could become a drag. So far that is not the case. Spending on durables has remained elevated while spending on services such as travel and leisure has started to improve. Evidence of this trend can bee seen in the retail sales data and Chart 3. This would support the view that there is excess savings out there and a strong demand to spend.

Our view

Time will tell if spending on travel / dining out and other activities we have not been allowed to do for the past year starts to crimp into spending on durables. Or spending on durables could normalize (aka contract from elevated levels) simply because if you bought a new sea doo or RV in 2020, you probably don’t need another new one in 2021. But so far people are simply spending freely on just about everything, and 2021 could still really surprise to the upside economically if this pace continues.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.