After the big reflation reset in positioning, global bond markets are showing more signs of breaking down.

We previously talked in detail about the idea of the reflation reset in the context of a decent global growth and inflation outlook which would likely set the scene for growth assets to outperform defensive/income assets. Now we are beginning to see signs that this is about to get underway in earnest with a number of global bond market indicators breaking down.

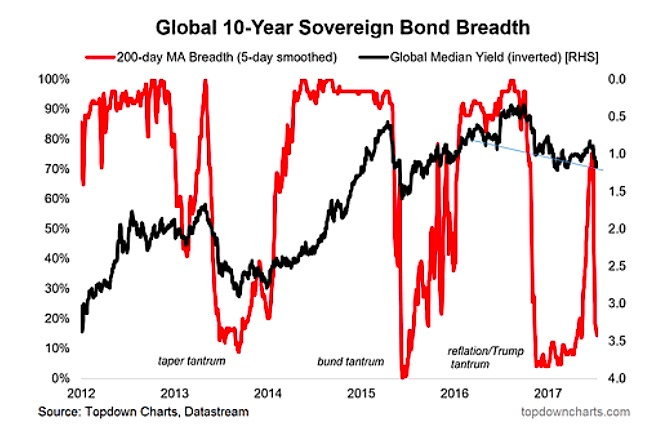

The first is global sovereign bond market breadth which has “re-crashed” after the reflation reset.

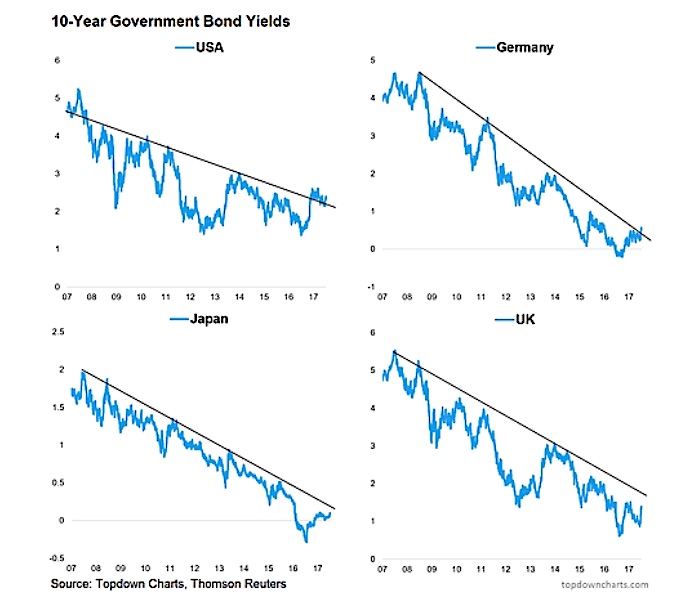

On the same chart you can see a fairly clear trend in the median global government bond yield, and if that looks like it’s breaking down then you’ll want to check out the next set of charts. US 10 year government bond yields had already broken up but then consolidated, but now German bond yields are breaking out and Japan and the UK are hot on the heels. The key fundamental catalysts are improving growth and inflation dynamics, particularly in the Eurozone, and this is allowing central banks to pull back on easing e.g. the ECB will be tapering, the BoJ has conducted a kind of stealth taper, and the Fed is already hiking and about to kick off balance sheet normalization, and the Bank of Canada has also joined on the rate hiking front. So with technicals lighting up and fundamental catalysts the conclusion holds.

Global sovereign bond market breadth has broken down again into “tantrum” territory.

The US broke first, and now Germany, while Japan and the UK look close to seeing their 10-year government bond yields break through the downtrend lines too.

For more of my macro analysis, visit Top Down Charts. Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.