European stocks have been hit hard in 2015. And there’s no better stock market index to follow for Europe than the German DAX. Back in July, we noted that the German DAX had begun what might be the start of a downward reversal after having reached and fallen away from important resistance.

Since that time, the longer-term outlook for the German DAX has deteriorated. And a few weeks back we provided a note on the status of the DAX and why the bear market may continue into 2015.

The DAX has accelerated downward relatively faster than its U.S. counterparts, and it has shown a breakdown of channel geometry similar to what we described recently here for the Russell 2000 ETF.

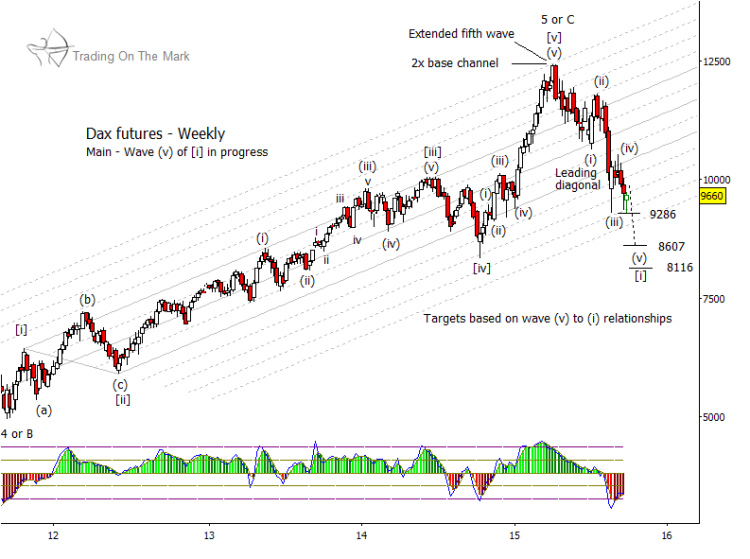

Throughout the climb from 2011 to 2015, the German DAX recognized the geometry of the channel shown on the weekly chart below. Most of the intermittent highs and lows lined up with the major channel lines or their harmonics. The low we have labeled as wave [iv] touched the outside 50% harmonic before price rose back into the channel, which is consistent with normal expectations for a fourth wave.

Early in 2015, the index formed a nearly double top at the channel’s outside 100% harmonic line, which is more than a technical analyst could ask for. It then produced an accelerating decline which took price out of the main channel in the other direction.

German DAX Futures Weekly Chart

Like the move in the Russell 2000 ETF IWM, the decline in the DAX has met the minimum criteria for a downward impulsive wave from the 2015 high. However, we believe the index may push to lower price targets before wave [i] reaches exhaustion. If lower, support near 8,607 or possibly 8,116 may produce a wave [ii] bounce, which may offer bearish traders another opportunity during the early part of 2016.

Also as with the Russell 2000 ETF, the safest opportunities for short trades probably will come when the stock market index retests broken areas of support from below. For the DAX, that might mean a test of the main channel boundary, which could put price at approximately the same level as what we have labeled sub-wave (iv) of [i].

Stay tuned for our timely market updates on our website and Twitter. Have a great weekend.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.