At the half-way point of 2018, there are a multitude of interesting stories to cover in the fixed income markets.

Let’s dig in…

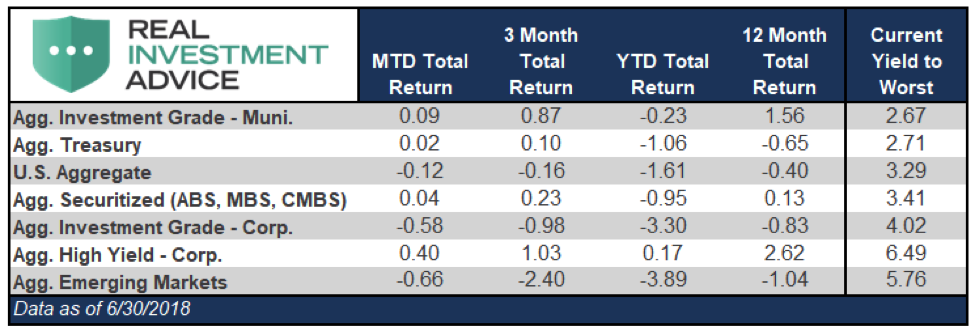

Beginning with June’s performance, the headline remains the divergence in performance between investment grade (IG) and high yield (HY) credit. From a total return standpoint, junk bonds (HY) were the best performing sector for the first six months while IG was only kept out of the fixed income cellar by the poor performance of emerging markets (EM).

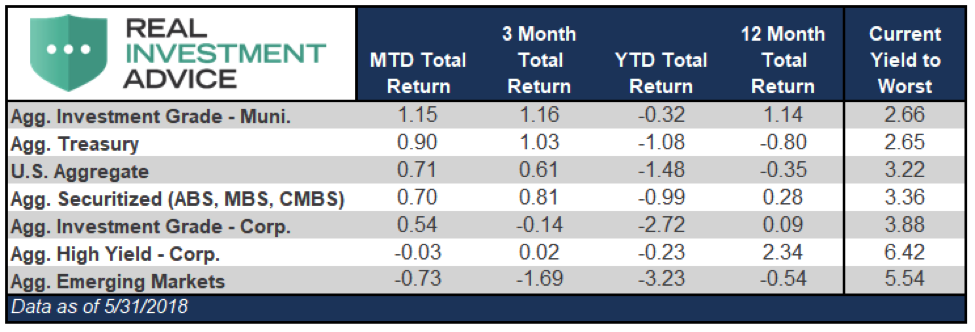

**Please note there was an error which has since been corrected in the May performance table. For reference May’s corrected table is shown below June’s.

June’s Performance:

May’s Corrected Performance:

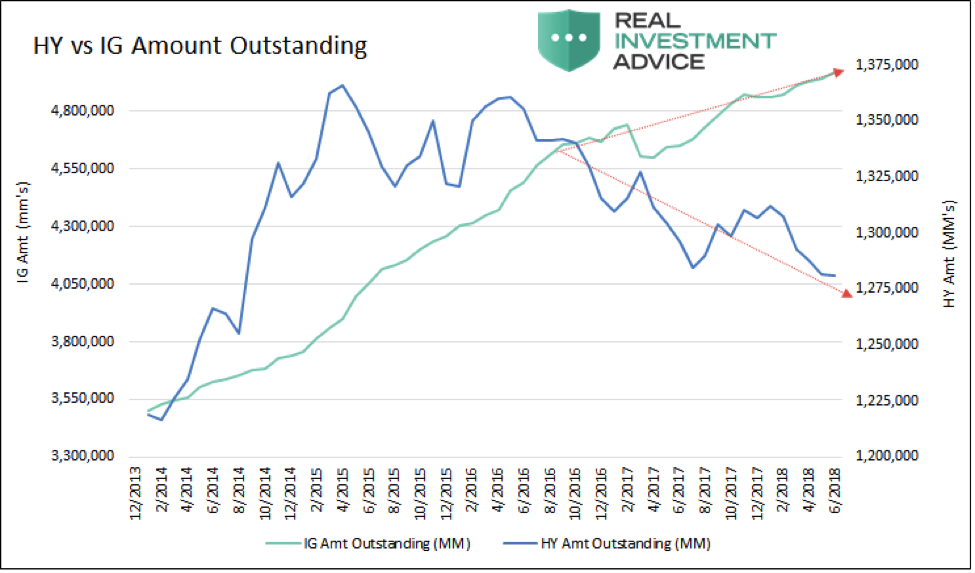

The primary culprit for IG underperformance versus HY is heavy supply from merger and acquisition-related issuers in the healthcare, food & beverage and retail sectors so far this year. At the same time, HY supply has been on the decline.

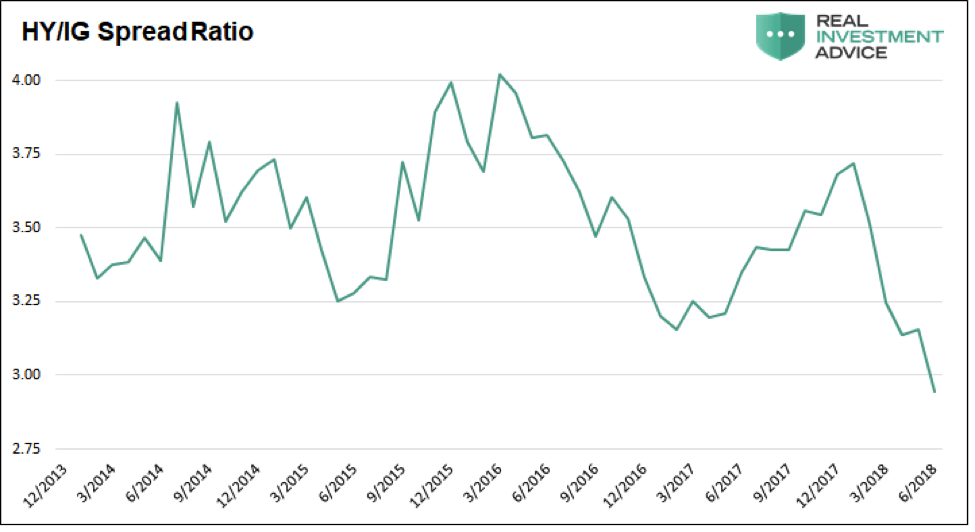

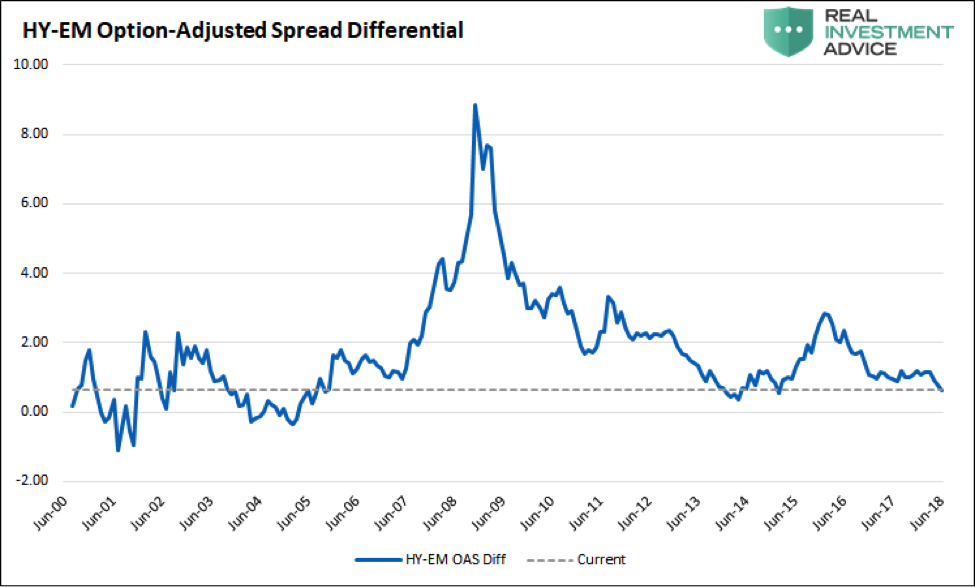

The performance of the high yield sector also stands out against the poor performance of EM bonds as the comparative spread between the two are back near multi-year lows.

The emerging market index total return has been negative in 5 of the first 6 months of 2018. Turbulence in EM is more troubling than the supply-related problems seen in IG. Federal Reserve (Fed) rate hikes and the slowing/reversal of easy monetary policies in the developed world has led to meaningful investment outflows from emerging markets.

In conjunction with the Fed policy shift, elections in Mexico, Brazil and Turkey as well as the continued escalation of global trade tensions, have been disruptive. As long as central banks, politics and trade remain concerns, it seems reasonable to continue to expect EM assets to struggle.

The Aggregate Index declined for the month of June due to the poor performance of investment grade corporates. Like IG, it has been negative in 4 of the first 6 months of the year. Apart from the fluctuations in high yield and emerging markets, other sectors rose only slightly for the month.

Credit markets in general remain rich on an absolute and relative basis as yields are low, spreads are tight and thus offering a low ratio of return per unit of risk. Despite the outlook for three to four more Federal Reserve rate hikes, tighter financial conditions and the macro uncertainties associated with global trade, investors seem content sticking with a horse that has been a proven winner for so long. That said, the underlying quality of credit is poor and the risk-reward fulcrum seems clearly skewed toward the “risk” side of the equation.

It is worth mentioning that over the last thirty years IG and U.S. Treasuries have provided investors a reasonable hedge in times when equity markets declined. The S&P 500 remains nearly 5% below the record highs of January and does not appear nearly as strong as in 2017 despite improving corporate earnings.

History tells us that we should expect flows into the more durable fixed income sectors to increase if the equity market shows continued weakness.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.