Despite a challenging start to the year and recent turmoil in some European bond markets, U.S. fixed income markets perked up in May with five of the seven primary fixed income sectors posting positive monthly returns.

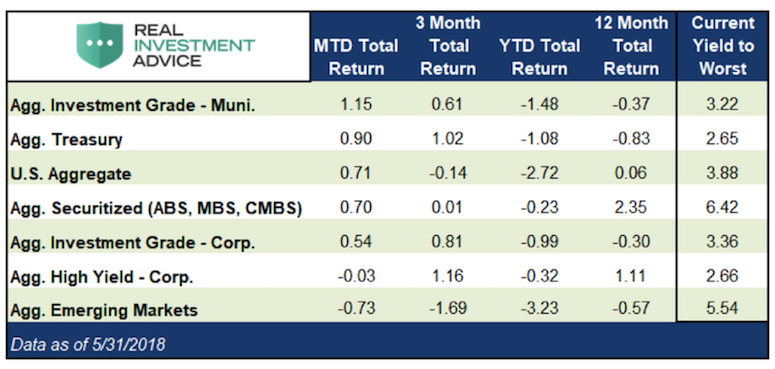

Investment grade municipals were the best performing sector returning 1.15% for the month followed by U.S. Treasuries, the aggregate index and securitized bonds.

Monthly Fixed Income Report – Data Through May 31, 2018

The table below, sorted by May’s performance, highlights returns over varying time frames as well as their current yields.

Mid-way through May, 10-year U.S. Treasuries rose sharply by 16 basis points from 2.95% to 3.11% and importantly surpassed the heavily followed 2014 taper tantrum highs of 3.05%.

But those levels would not hold and a month-end rally, initially inspired by rather dovish FOMC minutes, helped the 10-year close the month at a yield of 2.85%. All the while U.S. credit spreads were relatively well-behaved mostly ignoring problems in other parts of the world. In particular and worth following going forward, political turmoil in Italy resulted in a stunning increase in Italian yields (Ten-year BTP 1.70% to 3.10%). This likely produced some anxiety in riskier sectors which seems to be the primary reason for the small monthly loss in high-yield credit.

The emerging markets (EM) were down 73 basis points for the month and are posting a 3.23% loss year-to-date. New sanctions imposed by the U.S. on the Venezuelan government aimed at choking off funding for the Maduro regime coupled with an emergency 300 basis point rate hike in Turkey raises the risk of EM mutual fund outflows, broad-based weakness and further losses.

Despite the small loss for the month, U.S. High Yield remains the best performing sector year-to-date as the domestic focus of the high yield market remains supported by sound U.S. economic conditions and a favorable corporate fundamental backdrop. The chase for yield is certainly helping as well. Nevertheless, the high yield sector is the most leveraged segment of the fixed-income market. Therefore, sensitivities to economic conditions and interest rates have the potential to spur volatility for junk bonds.

It may be somewhat surprising to see high yield debt outperform investment grade corporate bonds in a period of tightening liquidity but so far, financial conditions have not deteriorated very much. Additionally, as the chart below illustrates, high yield spreads historically do not show a consistent pattern of widening relative to investment grade during rate hike cycles. Based on the last 25 years, junk spreads more often underperform after the terminal Fed Funds rate has been achieved for the cycle.

Data Courtesy Barclays and St. Louis Federal Reserve

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.