So far, we’ve had quite the rollercoaster of emotions for investors this year, with many markets on the verge or even dipping their toe into correction territory. The recent large intra-day swings may make it seem like we’re nearer to the elusive capitulation day that often marks a bottom, but history would suggest such days are basically impossible to know until well after they are over.

With volatility elevated, the risk of being wrong seems more punishing than at any point over the past 20 months. Conviction is important when investing, but conviction in and of itself means nothing if it’s not founded on rational decision making. Investors have short memories and are most captive to recent experiences. Buy the dip — wash, rinse and repeat. The habit has been simple, reinforcing and rewarding, most notably for a swath of new investors.

Bursting bubbles

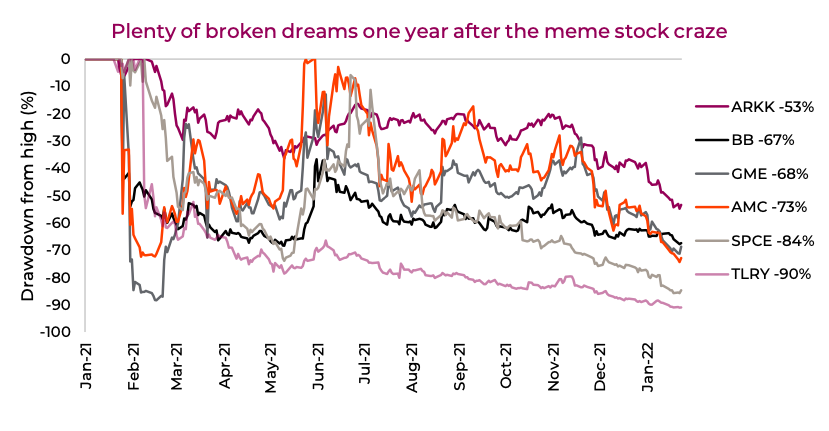

Looking back, it’s now clear that most high growth/non-profitable tech stocks were in a bubble. Well, the bubble has most definitely popped, and many individual names are down 50%, 60% even 70%. This isn’t just a routine correction for this segment of the market. Oddly enough, we’re approaching the one-year anniversary of peak meme stock mania. Last January GameStop (GME), AMC Entertainment (AMC), Blackberry (BB), and other names rose on the back of hype on Reddit and other platforms, cementing the term ‘meme stock.’

Companies rose based on how they would thrive in the new world or stick it to the establishment, not based on revenues and cash flows. Since then, the road has been anything but paved with gold and filled with Lambos. Sure, some fortunes were made, but the drawdowns for the highest flyers have been horrendous. For some time, investors clamored to be part of a movement, owning some of the worst companies. That idea appears to be dead.

Over the past decade, there have been several localized bubbles, but none carried with them a broad market risk of contagion. If mega-cap growth goes out of favour, however, that could change. Easy money, cash on the sidelines and low interest rates have always been there for the taking, making the dips buyable. However, with rates rising and financial conditions becoming less accommodative, is the path of least resistance shifting to going lower?

We’re not saying investors shouldn’t stay largely invested, because the risk of being out of the market if this is a normal correction can be just as painful. But we do argue for balance. Investors should once again pay attention to valuations, scale back exposure to companies with overly optimistic growth assumptions and refocus on portfolio allocation with diversification in mind. The predicament many investors are finding themselves in is that they are still overpaying for growth and are overexposed to those sectors. This is rooted in a couple of behavioural biases.

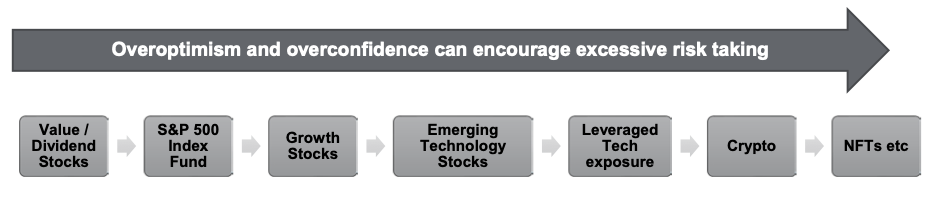

Overconfidence – Sometimes called the ‘superiority illusion’, this is a tendency for most people to believe that they are above average — whether that’s their intelligence, sense of humour, driving ability or investment skill. In investing, overconfidence induces investors to take riskier bets. When markets have long rewarded this type of risk-seeking behaviour, it only magnifies the optimism.

Overoptimism – Over-optimistic people will have an unrealistic expectation of how often they’ll get a good result versus a bad result. Strong recent performance makes it easier to feel optimistic about the future. Unsatisfied with just average market returns, these behavioural biases entice investors to increase exposure to riskier investments. Recency bias also plays into this over-optimism.

These biases also cause increased trading activity. The gamification of many of today’s online trading apps/sites is meant to further increase transaction volumes. Lowering transaction costs usually is presumed to be good for investors; however, reducing commissions to zero may have had the perverse and counterintuitive effect of decreasing investor welfare and feeding into this bubble.

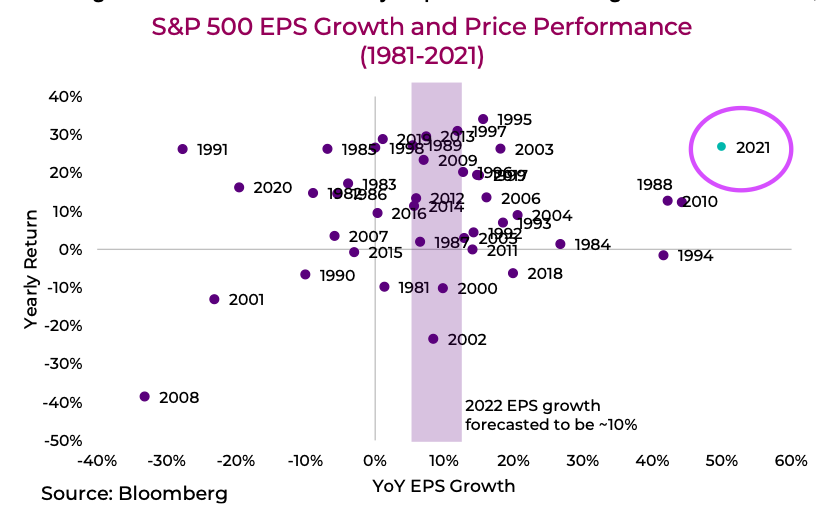

High earnings multiples are often a manifestation of high confidence, not necessarily strong earnings prospects. 2021 was a year with exceptionally high earnings growth and stock returns. This growth will be hard to follow up, and the market is realizing that many companies won’t be able to live up to the earnings growth expectations their share prices have set. This is hitting growth investors, reminding them that high growth is the exception, not the rule.

When returns are easy to come by, it’s all too easy to be convinced of your own abilities. These hardwired biases are hard to eradicate especially when good performance reinforces them. Often the best course of action is to follow simple advice: diversify and rebalance when necessary.

Prices matter, but a cheap price is not the same as value

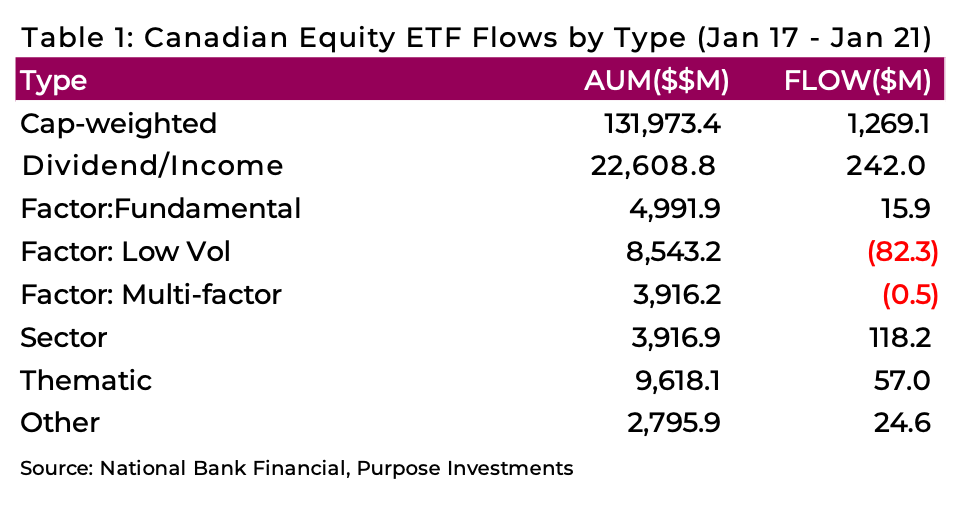

The battle between value and growth will likely be drawn out for some time. Growth’s outperformance has left a lot of room for value to make up and we would not be surprised to see higher market volatility as the two factors battle it out. Obviously, we have no idea if the bottom is in, but the excesses seen over the past couple of years are being let out and it’s a process that can take plenty of time. Interestingly, Canadian inflows into dividend-focused equity ETFs, which heavily tilt towards value, continue to be strong with the category adding over $240 million last week and $110 million the week prior. That said, last week’s earnings out of the growth mega-caps like Apple, Alphabet and Microsoft continue to impress. Again – it is hard to say if the trend has reversed.

There is no question that valuations have begun to matter again, but there is a big difference between what truly has value and what is just down. Rather than just looking at what stocks have fallen the most, focus on areas of the market that have enduring and sustainable growth, but also can be bought at reasonable prices in the changing conditions of tightening monetary policy. It’s good practice to have price targets that if hit, prompt action. Targets and stop losses are simple ways to help take the emotion out of investment decisions and help mitigate behavioural mistakes.

Sources: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.