Many talking heads have been chatting about the coming Fed taper effects on the market. But what if the Fed taper is already being priced in? The financial media often overlooks this concept and I believe it could use some further context. The two areas that I tend to focus on in this regard are bonds and gold. And both appear to be feeling Fed taper effects, and thus pricing in (or attempting to price in) the Fed taper. But, there’s more to it.

Many talking heads have been chatting about the coming Fed taper effects on the market. But what if the Fed taper is already being priced in? The financial media often overlooks this concept and I believe it could use some further context. The two areas that I tend to focus on in this regard are bonds and gold. And both appear to be feeling Fed taper effects, and thus pricing in (or attempting to price in) the Fed taper. But, there’s more to it.

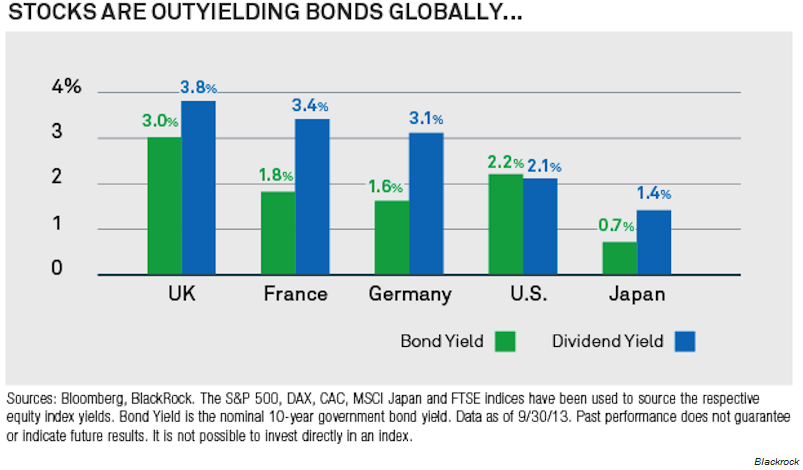

Bonds and gold have been out of favor for most investors in 2013, as equity markets continue to attract attention (and capital flows). However, there may be another reason so many investors are selling their bonds and jumping into stocks: Stocks on a global basis have a much more attractive yield than their nominal 10-year government bond yield counterpart.

So what does this mean for 2014? If trends remain steadfast, it may mean a continued selling of safe haven assets as investors continue to chase risk assets (this likely hinges on yields remaining low). On the contrary, the stock market could run into trouble next year if there is a larger cut in the bond-buying program and the bond markets become unstable; this would likely send shockwaves through the credit markets and usher in another round of global uncertainty. I believe the gold market ultimately depends on the performance of the bond market. If rates go up, gold should continue to struggle and vice versa. So, although many markets are feeling Fed taper effects, the situation remains fluid, as speculators gauge the amount of the taper.

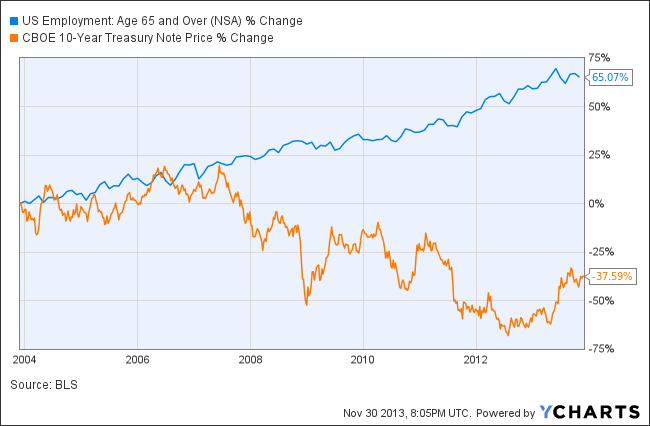

Another Interesting Correlation to Note: Rates & +65 Employment

From now until 2030, pew research estimates that 10,000 baby boomers will turn the age of 65 each day and start collecting benefits. Many boomers will be looking to supplement their income with dividends and interest payments from their bond portfolios. But, there’s one potential problem: their bond portfolios have been underperforming. And consider this: the fixed income part of the boomers’ portfolios may continue to be under pressure for the duration of their lifetime should rates continue to climb. The chart below depicts the percent increase in the amount of workers over the age of 65 since November 2003. This is set against the 10 year Treasury note which has fallen -37.6% over the same period.

Trade safe.

The material provided is for informational and educational purposes only and should not be construed as investment advice. All opinions expressed by the author on this site are subject to change without notice and do not constitute legal, tax or investment advice. At Castle Financial, securities are offered through Cadaret, Grant & Co., Inc. and TD Ameritrade, Inc. Members FINRA/SIPC.

Twitter: @stockpickexpert

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.