Investors are getting excited about the Federal Reserve’s interest rate pause and a soft landing for the economy.

Time will tell, but I do want to share with you a correlation that may be telling for the future of interest rates… and perhaps precious metals.

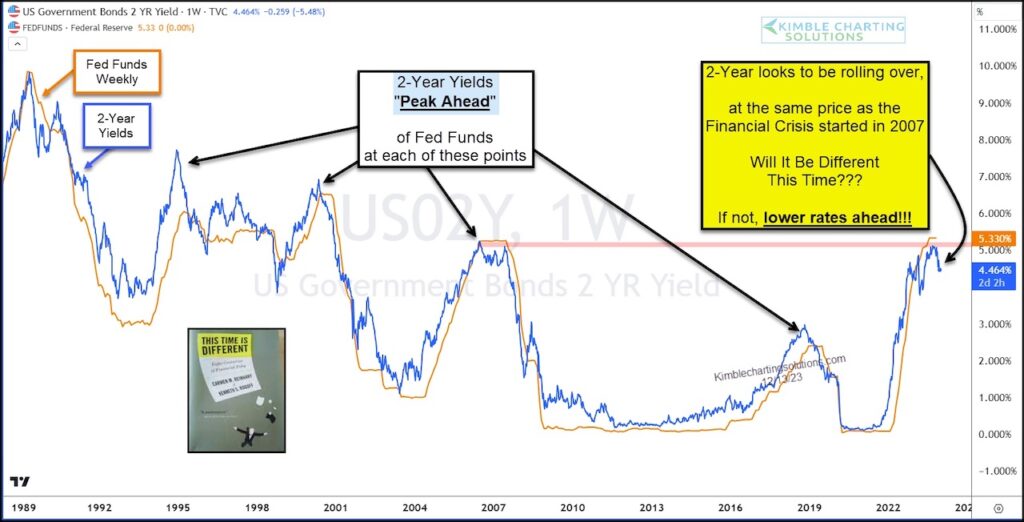

Today we look at a chart highlighting the correlation of Fed Funds and 2-Year treasury bond yields.

As you can see, at critical turning points, the 2-year yield turned down ahead of Fed Funds. That appears to be happening again now. And right at prior highs (resistance).

Will the Fed follow interest rates like they have again and again and again and again?

If they do, we should see a falling interest rates environment develop and this is historically bullish for precious metals! Stay tuned!

2-Year Yields versus Fed Funds Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.