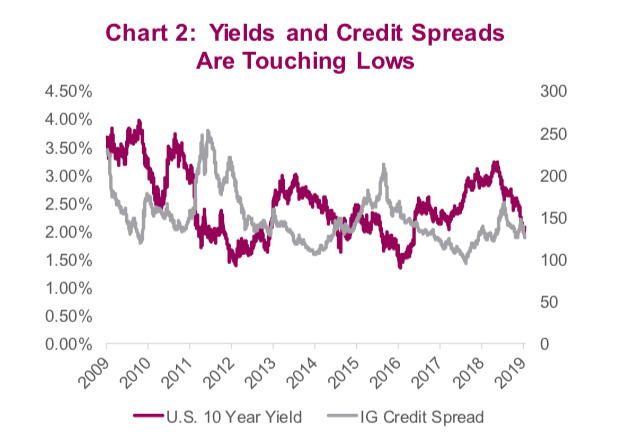

Sports betters and casino gamblers alike are always looking for that sure thing to move all in. With treasury bond yields at the lowest level since 2017 and credit spreads the narrowest they’ve been since before the market melt-up in the fourth quarter last year (Chart 2 below), fixed income investors may be wondering if they should begin taking their chips from the table.

Investing, however, isn’t gambling; the only free lunch is diversification.

That “fix” or “free lunch” comes from combining uncorrelated assets into a diversified portfolio. This enhances risk-adjusted returns over the long term because as some investments rise, others fall (and vice versa). Through an inverse relation tried and tested through the years, equities and bonds have come to form the foundation of your standard balanced portfolio.

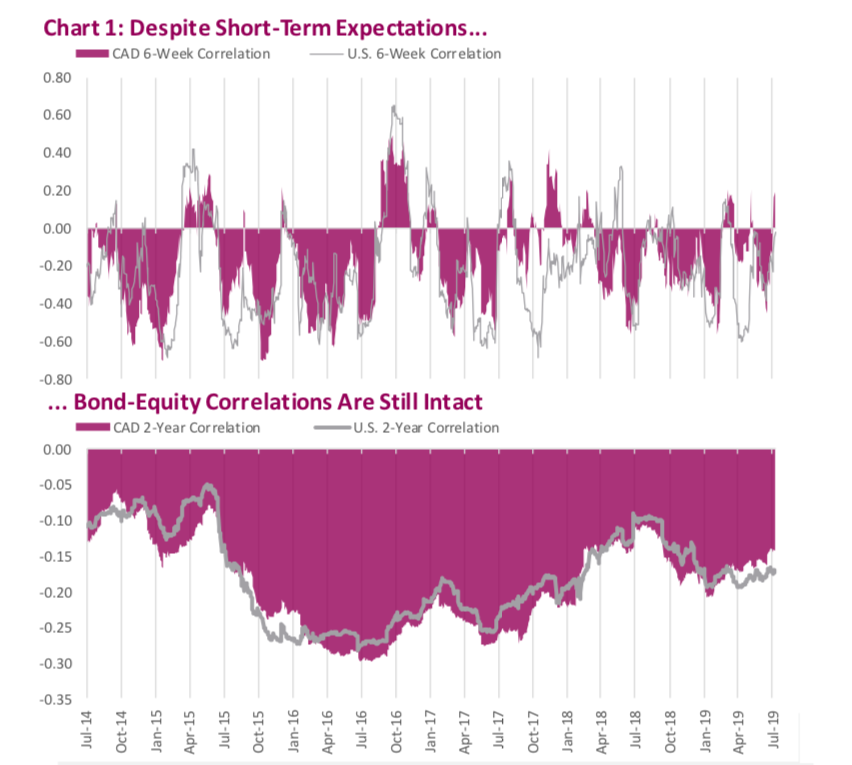

As both bonds and stocks continue to advance higher this year, recency bias has investors thinking that perhaps the inverse correlation is broken, thereby stoking fears that fixed income might not act as the sought-out safety net for investor portfolios during the next correction.

The reality is that the correlation hasn’t broken.

The weekly correlation between the S&P TSX and the Canadian Bond Universe is -0.34 year to date.

The story is similar south of the border: the U.S. has a YTD -0.46 weekly correlation between a similar broad market of domestic stocks and bonds. The relationship is not perfectly predictive in the short term, but over the long run it has held steadfast. Furthermore, the inverse relationship tends to be strongest during bouts of high volatility.

Chart 1 (above) illustrates the rolling correlation between equities and bonds in both Canada and the U.S. over a six-week and two-year horizon. This shows that over some brief periods, equities and bonds can move in tandem but over a longer period they tend to move in opposite directions.

Consider the equities drawdown we experienced in May, when the S&P 500 fell 6.4% and the U.S. aggregate bond market edged higher by 1.7%. We saw the same thing in December when the same U.S. index fell 9.3% and bonds rose 1.5%. Despite yields at recent lows, traditional bonds still offer diversification benefits.

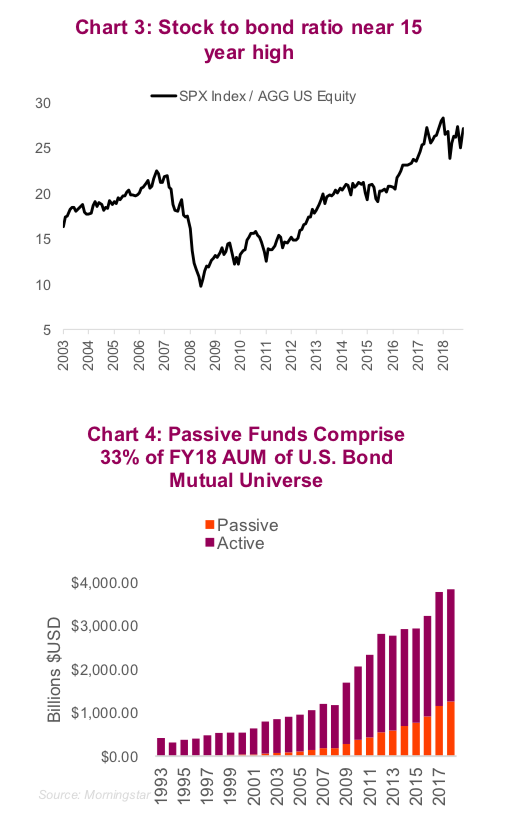

Naysayers may continue to disagree and continue betting on what’s working now. The stock-to-bond ratio remains near 15-year highs, though it has been a slight tug of war between bond and stocks over the past couple of years (Chart 3 below).

Moreover, even those who believe in the math and employ diversification in an investment management strategy, tend to wrestle with the thought of buying boring bonds. Many of those who have held a meaningful fixed income weight tend to be leaning towards bonds with more credit exposure to chase higher yields or move into fixed income alternatives, which tend to have higher correlations to equities, particularly during bouts of volatility.

Perhaps what has most intrigued us, is the momentous shift into passive fixed income ETFs (Chart 4 above). Increasingly ETFs are grabbing the lion’s share of fixed income fund flows. The main advantages of these instruments range from their ease of use, more accessible liquidity, less onerous capital requirements and, most importantly, lower costs.

Passive fixed income certainly has a place in a portfolio, as it provides the investor with the ability to make swift tactical asset-allocation changes while reducing fee drags. But this financial innovation comes with some drawbacks not discussed in most sales literature.

continue reading on the next page…