The S&P 500 (SPX) rose last week, up 11 points to 2804, a 0.4% increase.

Our projection this week is for more choppy price action with continued rally attempts, as the market continues to digest a sharp 10-week rally.

Stocks were quiet last week with narrow trading ranges. While marginally higher, it is no longer clear that the bulls are winning the battle, as I pointed out in the latest Market Week show.

There was little follow through on the rallies and continued low volume.

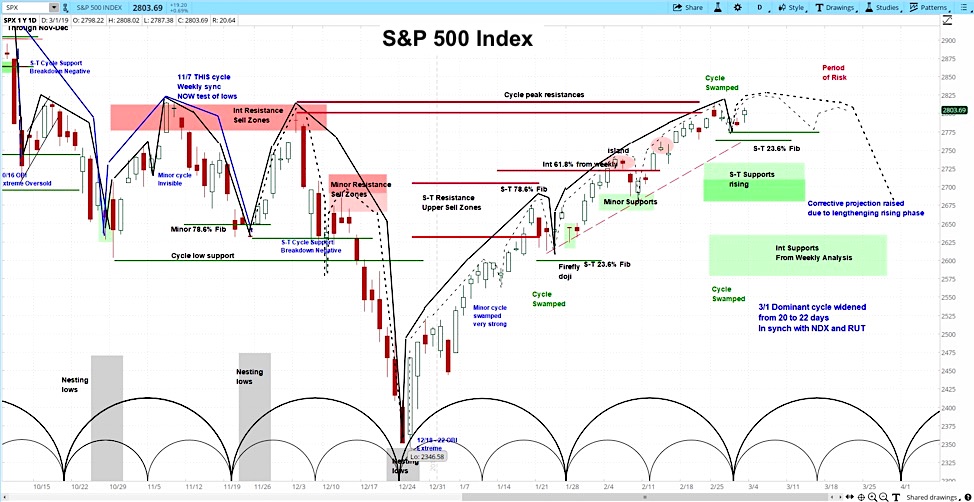

S&P 500 (SPX) Daily Chart

Our analysis of the S&P 500 is for choppy price action with similar rally attempts to what we saw last week. We are currently in the rising phase of the first minor cycle and expect resistance at 2822 will continue to hold.

The week began with the Trump administration delaying the increase in tariffs on $200 million of Chinese goods from 10% to 25%. While trade chief Robert Lighthizer highlighted the progress that had been made, he also recognized that it was too early to predict a final outcome.

The increase in tariffs was originally scheduled to take effect on January 1 and was delayed until March 1. While the administration extended the increase, it did not identify a new date.

This signals confidence but also removes some of its leverage in the trade negotiations.

Market Week Video – March 3, 2019

Elsewhere in Asia, tensions flared in the historic conflict along the Kashmir border between India and Pakistan, after the latter shot down an Indian fighter jet and captured its pilot. While Pakistan return the pilot to India, the violence before and after the incident represents the most significant conflict between the countries in nearly 20 years.

Turning to the macro picture, the US manufacturing PMI fell short of expectations at 54.2, which was also a decrease from the previous month. However, China’s two PMI readings came out mixed versus expectations, and the German and British figures were in line.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.