We have seen some nice recoveries in the cryptocurrency markets over the past few trading days. Some intraday structures are looking very impulsive, so it appears that there will be more upside to come, especially for cryptos like Ethereum and Bitcoin.

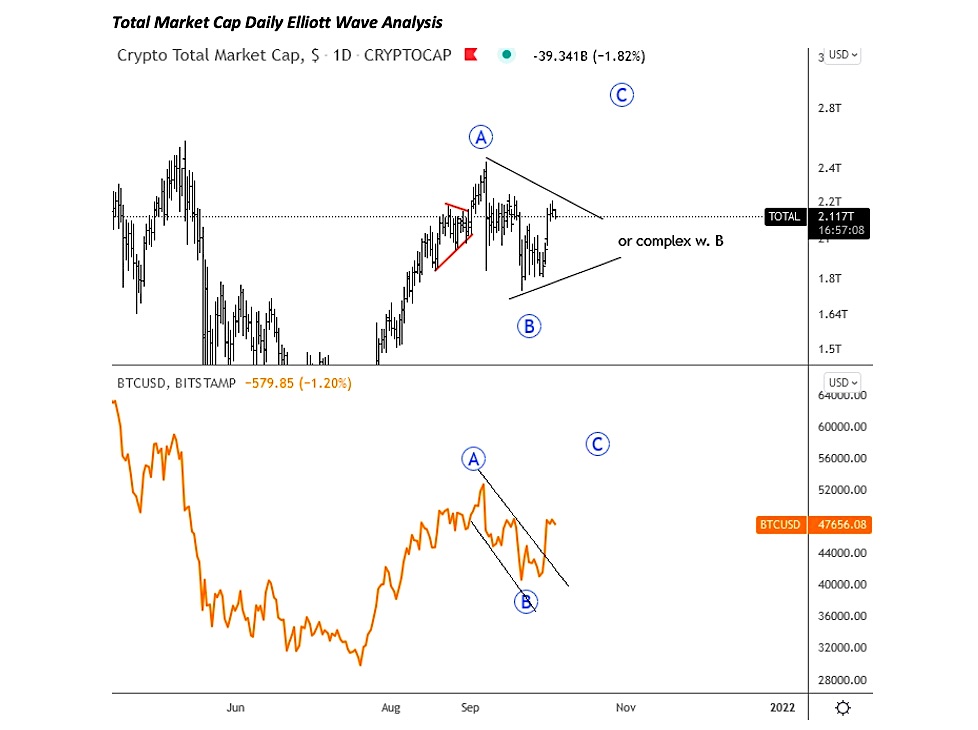

In fact, on a higher degree scale I see only three wave setbacks from the September highs, meaning that cryptocurrencies may stay supported or trapped in a sideways consolidation.

As per basic technical analysis we can also see price breaking out of a bullish flag formation.

Cryptocurrencies are moving higher, and it may have something to do with the standoff between President Joe Biden and Republicans over raising the U.S. borrowing limit; the US debt ceiling deadline is Oct 18.

Technically, I see some nice intraday impulses which can take prices higher after any pullbacks. Bitcoin is already at the highs so maybe ETHUSD is ready to do the same as recent drop to 3300 support area can be corrective, ideally wave four, so be aware of a fifth leg to around 3600.

Ethereum, ETHUSD came down in the 4-hour chart, but it’s now reversing from key price support, from 2700 area where the market might have completed a three-wave decline. The most important thing bulls need to see is for a rally in the next few days out of this basing channel. This typically represents acceleration for wave 3, which can be the case on the 4-hour time frame chart while the market is above 3000. A drop below that level will likely make a drop from 4000 much more tricky, complex and deeper.

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.