The Emerging Markets (NYSEARCA:EEM) have long benefited from a weaker US Dollar (CURRENCY:USD). This makes sense as a majority of the world’s debt is issued in US Dollars and commodities, a key export of Emerging Markets, tend to receive a tailwind when the buck is headed lower.

The heyday of the Emerging Markets came in the early 2000’s as the US Dollar Index slid from well above 100 to well below 100. But those days would be short-lived…

When the Dollar bottomed in 2008 (and headed higher), it ushered in a period of pain and underperformance for the Emerging Markets ETF (EEM). This pain culminated in 2015-2016 with the US Dollar’s move back above 100 – and EEM’s move back to the bottom of a multi-year trading range.

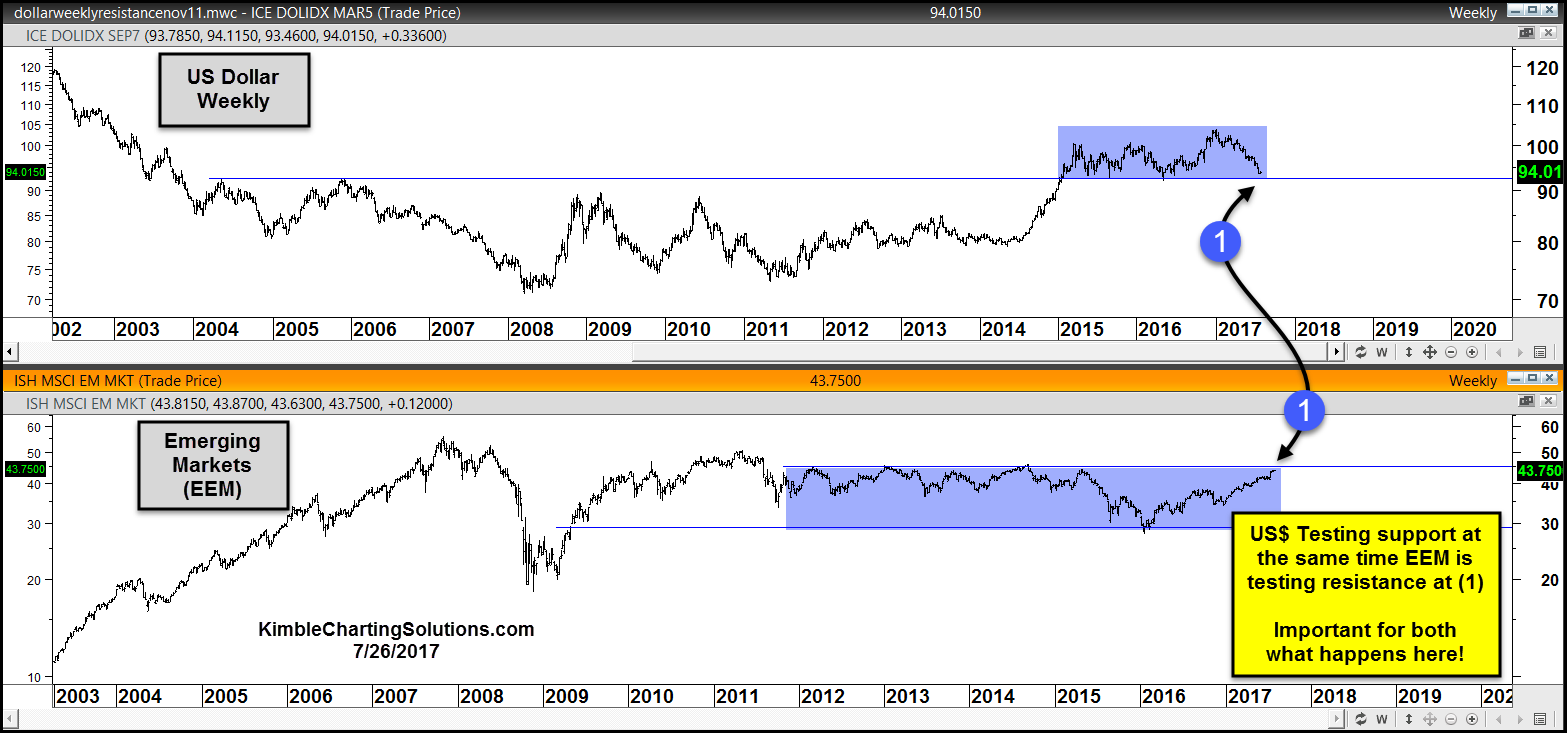

Fast-forward to today… and the Emerging Markets are feeling much less pain. In fact, EEM has been an outperformer in 2017. Why? You guessed it – The US Dollar. As you can see in the chart below (point 1), the US Dollar Index has declined 9 percent in the past 30 weeks!

But the US Dollar is at a trading crossroads… it is testing the lower end of a 30 month trading range (point 2). As you might suspect, what happens next will likely bear importance for investors… and Emerging Markets.

The next chart shows the relationship of the US Dollar and the Emerging Market (EEM). The recent rally higher for EEM has brought it back to the top of its multi-year trading range (resistance) at the same time that the US Dollar is testing 30 month support (point 1). It’s clearly important for both what happens here! Stay tuned!

Thanks for reading and have a great week!

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.