Stocks are oversold and attempting to consolidate. Whether that consolidation leads to higher prices, or whether it simply works off oversold conditions and heads lower, remains to be seen.

BUT, we can say with confidence that several markets are trading at critical support levels (whether re-tests of lows or tests of key long-term support areas).

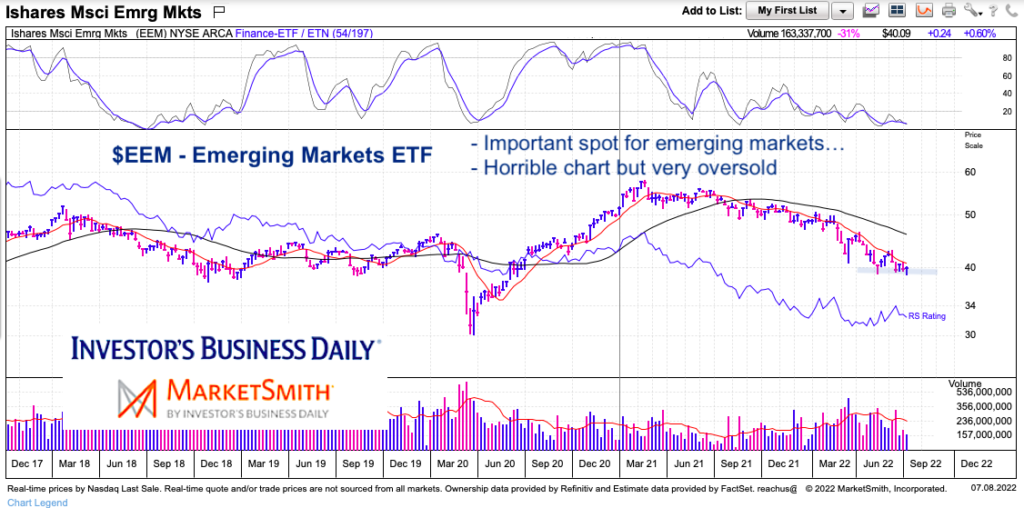

Today, we look at the Emerging Markets ETF (EEM) on a long-term basis and highlight why it’s trading into an important support zone.

Don’t get me wrong, it’s a horrible chart. But for those interested inter-market analysis (or trading radar ideas), this is one to watch. Especially with the run-up in the US Dollar (an EM headwind).

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$EEM Emerging Markets ETF “weekly” Chart

As usual, we present a chart that reads by itself. The $36 to $42 served as support/resistance over the past 5 years. The chart is oversold and entering into this support area. This is also occurring as the US Dollar Index nears 110 and is overheating. Should the dollar take a break (ie pullback), it may benefit emerging markets.

As stated above, the chart is in terrible technical condition and needs to begin a constructive repair before any bullish thoughts can emerge. That said, what happens here will hint at the markets next move (strength or weakness). Stay tuned.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.