Materialise (NASDAQ:MTLS) is a $510M maker of additive manufacturing software and 3D printing services trading 3.4X FY17 EV/Sales and 8.4X Cash. MTLS grew revenues 12.7% and 7.3% Y/Y the last two years and forecasting 19.5% and 16% for 2017 and 2018, while set to reach profitability in 2017 at $0.04/share EPS. 3D printing has seen its share of ups and downs, but General Electric (GE) commentary on the space indicates it is a technology that can continue to evolve. MTLS started delivering its first products in Spring and set to ramp up in Europe during the year. MTLS divides up segment revenues into 41% Industrial, 33% medical and 26% Software. MTLS is cementing itself as the backbone technology provider across the industry and has collaborations with Siemens and GE. MTLS may not post great Q1 numbers, but expect to ramp up in the second half this year. MTLS has been able to post EBITDA margin expansion and upside drivers remain the many partnership opportunities. Shares have closed higher each of its last three reports. MTLS shares hit a high in 2014 when it came public near $15 and worked down as low at $5.25, shares recently showing strong momentum and accumulation.

Nova Measuring (NASDAQ:NVMI) is a $520M provider of control systems used in the manufacturing of semiconductors. NVMI shares trade quite cheap at 12.25X Earnings, 3.17X Sales and 5.7X Cash. NVMI has posted impressive revenue growth of 23% and 10% the last two years and expects nearly 20% growth this year and EPS growth of 23%, a small cap that is very profitable. NVMI posted record quarterly bookings last quarter with strength from its Memory & Foundry customers, and all indications are for that trend to continue based on reports we have seen this quarter. NVMI’s top customers are Taiwan Semi (39%), Samsung (20%), and UMC (17%). The ramp in 3D NAND is a major trend which calls for an increased need for process control, and NVMI is positioned for this demand. NVMI shares have closed higher 7 of its last 9 reports. On the chart shares are hitting 15 year highs with a powerful move over the past year.

Quantenna Comm (NASDAQ:QTNA) is a $662M maker of wireless chips trading 24.7X Earnings, 5.1X Sales and 5.66X Cash. QTNA grew revenues 54% in 2016 and hit profitability, and expecting 35% annual revenue growth 2017 and 2018 with EPS set to jump to $0.79/share in 2018 from $0.04/share in 2016. QTNA is a leader in high performance Wi-Fi with a 48% CAGR since 2013. The demand for better Wi-Fi is being driven by streaming, increased OTT and cloud content, and high bandwidth applications. QTNA has long been penetrating the Telco market and more recently Retail and Enterprise with future opportunities sin Automotive, Consumer, Industrial and Aerospace. QTNA also posted record gross margins in Q4 at 51.5%. QTNA shares jumped more than 6% in its only public earnings report. On the chart shares have seen lows around $14 and highs near $25, currently settling in with a higher base. As a best of breed play in a strong growth niche industry with growing available markets, QTNA fits the bill for a long term own.

Commerce-Hub (NASDAQ:CHUBA) is a $700M provider of cloud-based services assisting retailer and brands for advertisement, logistics and other solutions. CHUBA shares trade 29.9X Earnings and 5.5X FY18 EV/Sales and growing revenues at a stable 12-15% annual rate with EPS growth expected at 8.7% this year and 24.8% next year. CHUBA software helps customers expand product assortments, reach new sales channels and speed up customer delivery, tied to the e-commerce growth theme. Increased adoption of virtual inventory and growth in recurring subscriptions are positive drivers for CHUBA’s business. E-Commerce is growing at a 15% CAGR since 2010 and still only 12.6% penetration of total retail sales. CHUBA sees a $1B revenue opportunity in 2016 for its markets and $2B by 2020. CHUBA is also a high margin name at 76% gross margins and low sales & marketing expenses at 13% of sales. CHUBA shares closed higher last report, and lower in November on its initial earnings report. It’s a combination of impressive growth in a major market trend with high operating leverage. On the chart CHUBA recently pulled back to trend support and based nicely near $15, setting up for new highs to $20.

Cogint (NASDAQ:COGT) is a $285M provider of cloud-based information and performance marketing solutions to enterprises. COGT trades just 1.4X EV/Sales and has seen revenue growth of 1,225% in 2016 with 25% growth expected this year, though still not profitable. On the chart COGT shares have wedged back to support near $3.25 and recently broke out of that wedge, and above $5.75 would open up shares for a strong move upwards. COGT delivers real time solutions based on all available data that can allow customers to target for advertising, manage for risk, and make informed decisions. Growth drivers for its services include online retail, omni-channel, mobile device usage, cloud migration and AI. In March the CEO, COO and Executive Chairman bought 46,000 shares of stock near $3.60. COGT should be able to see margin improvement in coming years as more revenue mix comes from its information services business, and the company anticipates margins running up to 50% from current 30% levels. COGT’s idiCore product now is entering a phase where it should start to become a more meaningful contributor.

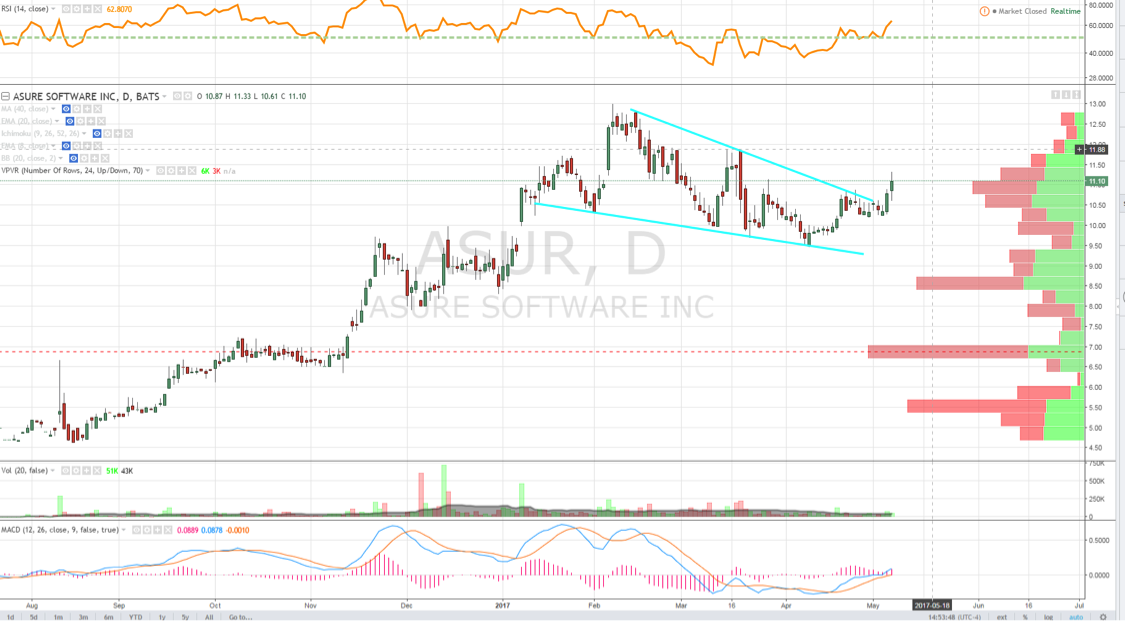

Asure Software (NASDAQ:ASUR) is a $91.8M provider of software for time and labor management and other workforce solutions. ASUR shares trade 14.65X Earnings, 2.6X Sales, and revenues grew 32% last year with 29% growth expected this year and a 176% increase to EPS. ASUR was founded in 1985 but really just started to reinvent itself in 2016. It is a smaller player in the very strong growth Human Capital Mgmt. (HCM) market. ASUR’s acquisition of Mangrove Software helped start its conversion to SaaS, now representing 58% of sales with cross-selling growing 46% Q/Q and bookings +13% Y/Y. The HCM market is fragmented with SAP (SAP) the largest player having an 11% share and WDAY at 9% followed by ULTI at 9%. The CEO bought 10,000 shares in December at $8/share. On the chart shares have trended higher since November and recently put in a nice base near $9.50/$10 zone, setting up for a move to $15. ASUR shares have closed higher on earnings 2 of its last 3 reports after being lower 5 of the previous 6.

Radiant Logistics (NASDAQ:RLGT) is a $295M provider of multi-modal transportation and logistics services trading 26.8X Earnings, 0.39X Sales, and 19.7X FCF. RLGT grew revenues 44% in 2015 and 55.7% in 2016, but expects a 3.2% decline in 2017 before returning to growth in 2018. The Company’s primary business operations involve arranging the shipment, on behalf of its customers, of materials, products, equipment and other goods that are generally larger than shipments handled by integrated carriers of primarily small parcels, such as FedEx, DHL and UPS, including arranging and monitoring all aspects of material flow activity utilizing advanced information technology systems. The Company also provides other value-added logistics services, including customs brokerage, order fulfillment, inventory management and warehousing services to complement its core transportation service offering. RLGT shares have closed higher the last two reports after being lower 5 of the previous 6. On the chart RLGT shares hit a peak in 2015 near $7.80/share before selling off all the way down to $2.50/share, but have seen strong accumulation in 2017. RLGT has been expanding margins nicely and continues to look for acquisitions.

MCBC Holdings (NASDAQ:MCFT) is a $315M maker of sport boats trading 11.77X Earnings, 1.42X Sales and 11X FCF. MCFF grew revenues 3.4% last year and projects 3% growth this year and accelerating to 6% and 8% growth the next two years forward, while EPS growth also forecasted to accelerate. MCFT has a 14.2% CAGR in sales since 2013 and EBITDA at +51.7%. MCFT has the leading US market share in performance sports boats and is seeing expanding margins. Industry data shows strength continues in boating, while MCFT has lost some market share to Malibu (MBUU). On the chart shares are nearing record highs, and with new product launched set to reinvigorate growth, shares trade way too cheap on valuation.

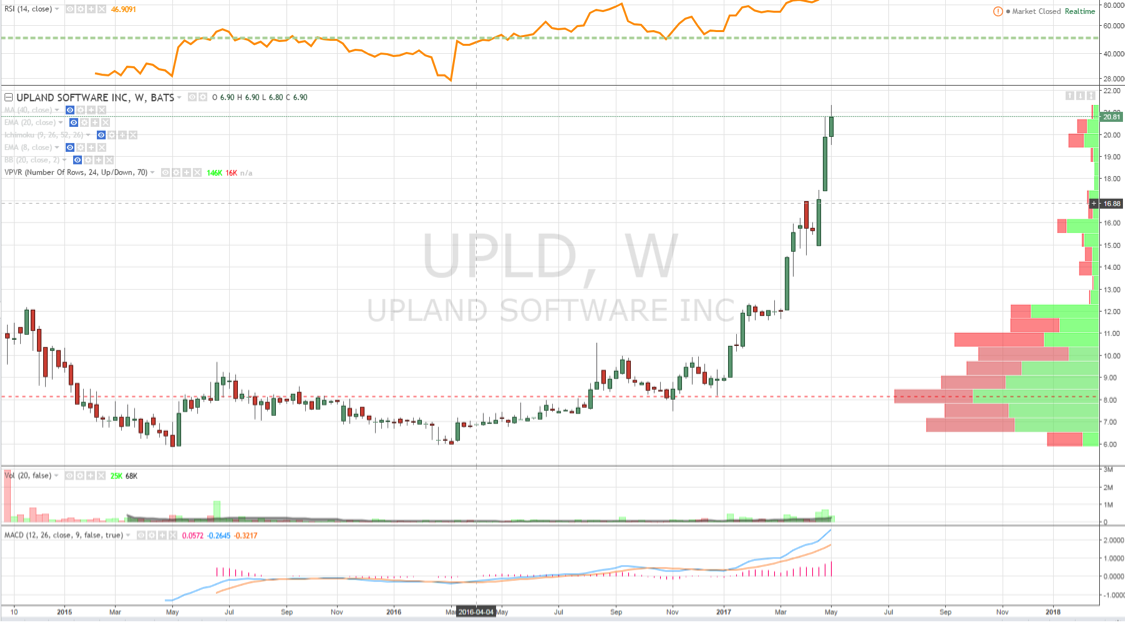

Upland Software (NASDAQ:UPLD) is a $375M cloud-based provider of work management software trading 5.2X EV/Sales for FY17. UPLD shares have been on a crazy run this year climbing 132.5% YTD. The company has posted 8.3% and 6.9% revenue growth the last two years but expects 18% growth this year, still a couple years away from profitability. UPLD has 87% recurring revenues, 70% gross margins, and 17% growth in recurring revenues with opportunities seen through M&A, installed base expansion, and cross-selling. Its product family includes Project/IT Mgmt., Workflow Automation, and Digital Engagement. It sees a total addressable market of $18.6B. In late April the company announces a $17.2M deal for Right-Answers and raised guidance. UPLD is very unique as it is in the business of making acquisitions in SaaS to unlock hidden value. UPLD shares have closed higher each of its last 5 earnings reports.

ICHOR Holding (NASDAQ:ICHR) is a $486M maker of fluid delivery subsystems for the semiconductor capital equipment industry trading 8.3X Earnings, 1.2X Sales and 9.55X Cash. ICHR grew revenues 39.6% last year and expecting 37% growth this year while EPSS growth of 51% this year. Next year growth does slow to 11% revenue and 16% EPS. ICHR already pre-announced on 4-24 and completed its secondary offering that was well received. ICHR is benefitting from strong trends in etch and deposition in the Semi industry. Lam Research (LRCX) accounts for 55% of its revenues and coming off another impressive quarter. The strong demand for 3D NAND is one of the primary catalysts for ICHR.

You can catch more of my research and options trading ideas over at OptionsHawk. Thanks for reading and have a great week!

Twitter: @OptionsHawk

The author has a position in INAP and FOGO at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.