Small caps continue to provide the most alpha for smaller investors. And if properly researched, we can uncover growth stories far before the masses catch on, and get in with earlier entries into holdings that may become longer term positions.

The market has rallied sharply over the last few years and a lot of stocks are hitting new highs, but there are still plenty of opportunities to be found in small caps. Let’s review my process and highlight some small cap stocks with potential.

Every week I screen the upcoming earnings and look for small cap growth stocks seeing modest price momentum and then dive into see if there is an opportunity. It is the exact process that allowed me to find a stock like Heska (HSKA) in 2014 at $12 that recently hit $110, and still a small cap with a $630.9M market cap. With the earnings schedule starting to slow I was able to look ahead this week to a number of names that likely will be new to many, and provide a brief overview.

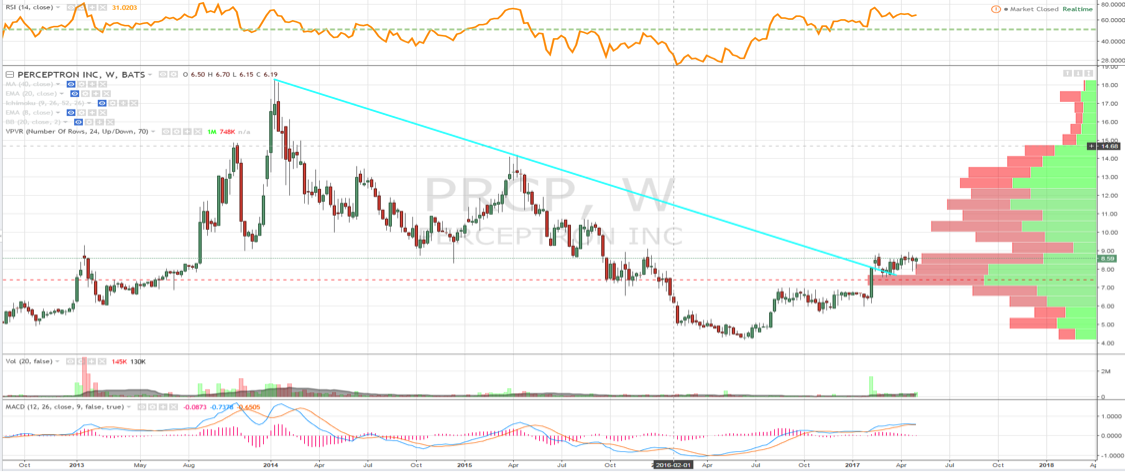

Perceptron (NASDAQ:PRCP)

Perceptron (PRCP) is a $79M maker of automated industrial metrology products for dimensional gauging, inspection, and 3D scanning. Shares trade 22.6X Earnings, 2.1X Book and 12.5X Cash with a clean balance sheet. Perceptron posted 24.8% revenue growth in 2015 and then saw sales slide 7% in 2016, expecting to hit 9% growth this year to a record higher and also return to profitability. Perceptron is under new management and focusing on profitability, and sees potential to expand its technology to the automotive industry and diversify into new industries. Total bookings have flattened out since 2014 with 2016 showing weakness in Americas and Asia, two markets that should rebound with recent Industrial data. Gross margins is a concern having fallen to 30.6% in 2016 from 42% in 2012, and expect management to focus on increasing margins. PRCP is also one of the more interesting stock charts; shares in a downtrend since hitting highs at $18 in early 2014 and recently flagging under the $9 level to clear this downtrend and also move out of a 5 point base. PRCP shares have closed more than 11% higher each of its last two reports as the restructuring is showing to be working, and another strong report this quarter can be the start of a new trend on the chart.

Internap (NASDAQ:INAP) is a $285M provider of data center, cloud and network services trading 7.6X EBITDA and 2.3X EV/Sales. INAP has seen sales slip since posting 18% growth in 2014 and is eyeing a return to modest growth in 2018, and has not been profitable since 2012. INAP is another restructuring story that has hired new senior management, recently completing phase 1 of 3 for cost reduction, and is rebuilding its sales and marketing. INAP’s recent results took a hit from a large customer being acquired. INAP also has an interesting chart with strong momentum since December accompanied by a big volume footprint, and also has an unusual amount of October $3 calls in open interest, more than 37,500. INAP has room to close a volume pocket on a move up to $4.60. Investors will be looking at bookings and ARPU in the coming report, and one of its main peers, Rackspace (RAX), was taken private last year at 6X EBITDA and 2X EV/Sales. Stifel raised INAP to Buy with a $5.50 target in March seeing new management driving improvements, expecting multiple expansion with the turnaround plan. INAP shares closed 17% higher last quarter on earnings after being lower the previous four reports.

Fogo de Chao (NASDAQ:FOGO) is a $478M operator of Brazilian steakhouses trading 17X Earnings, 1.66X Sales and 27X FCF. FOGO is expecting 10% revenue and 5% EPS growth this year after posting 6% revenue growth last year, and also expects around 10% revenue growth in both 2018 and 2019. FOGO’s AUV (average unit volume) at $8.50 compares favorably to peers in the casual dining space, only Cheesecake Factory (CAKE) higher at $10.60, with an average of $5.40 for established players and $2.10 for high growth newer names in the industry that came public. FOGO’s contribution margins of 31.4% are best in class, well above the 19.5% industry average. The company is focused on growth in the US with the potential for 100+ new restaurants after opening just 3 in 2016, and also sees potential in International capital cities. FOGO only has 33 existing locations in the US. FOGO is also a top performer in social media and digital with its eClub growth of 191% and social media growth of 91% impressive. On the chart FOGO saw shares trade as high as $27 the week of its IPO and then came crashing down to $10.50, but seeing strong momentum higher since November. FOGO should be able to drive accelerating US sales with expanding its Saturday hours and introducing Brunch. FOGO has closed higher its last two reports and average max moves greater than 10%.

You can catch more of Joe’s research and options trading ideas over at OptionsHawk.

Addus HomeCare (NASDAQ:ADUS) is a $416M provider of personal care services to older adults and younger disabled persons. Shares trade 19.9X Earnings, 1.05X Sales and 2.64X Book. ADUS is expecting 6% revenue and 7% EPS growth in 2017 and has seen sales climb to $400M in 2016 from $244M in 2012. ADUS operates in 111 locations in 24 states, and is a leading provider in a highly fragmented industry with strong demographic trends supporting its growth potential. Its continuum care business has an average duration of 26 months per customer with 58 billable hours at $17.47/hour, and feels this platform is scalable. ADUS provides a service that keeps people out of nursing homes, preferred by most consumers and families. ADUS has been fairly acquisitive and been able to maintain consistent margins. Shares have closed higher each of its last 3 reports with an average max move of 16%. The chart sets up strong into this report with a weekly bull flag nearing a breakout.

Tactile Systems Tech (NASDAQ:TCMD) is a $325.8M medical technology company providing medical devices for the treatment of chronic diseases. Shares trade 92.85X Earnings, 3.86X Sales and 52.55X FCF. TCMD posted more than 30% revenue growth in both 2015 and 2016, and targets 20% growth for both 2017 and 2018. TCMDI’s EPS was $0.27/share in 2016 but set to fall to $0.10/share in 2017 before moving back to $0.21/share in 2018. TCMD’s main targeted areas are therapeutics with vascular disease like Lymphedema and CVI. TCMD sees a $4B US addressable market opportunity. The company estimates 3-5 million US patients are living with lymphedema and only 820,000 diagnosed cases thus far. In March, a Director bought 20,000 shares in the $19.85-$20.01 range for $400,000. Shares have closed higher each of its first two reports, and last quarter jumped 17%. On the chart shares have formed a weekly cup and handle in the $15/$20 range, measuring to $25 upside on a breakout.

continue reading more on the next page…