The Dow Jones Industrial Average has survived several market scares over the past 5 decades, including the 1987 crash (Black Monday), Tech Bubble, Financial Crisis, and Coronavirus crash.

In a very noisy, news-driven world, sometimes it pays to simply zoom out on the charts and stop thinking about trading every headline.

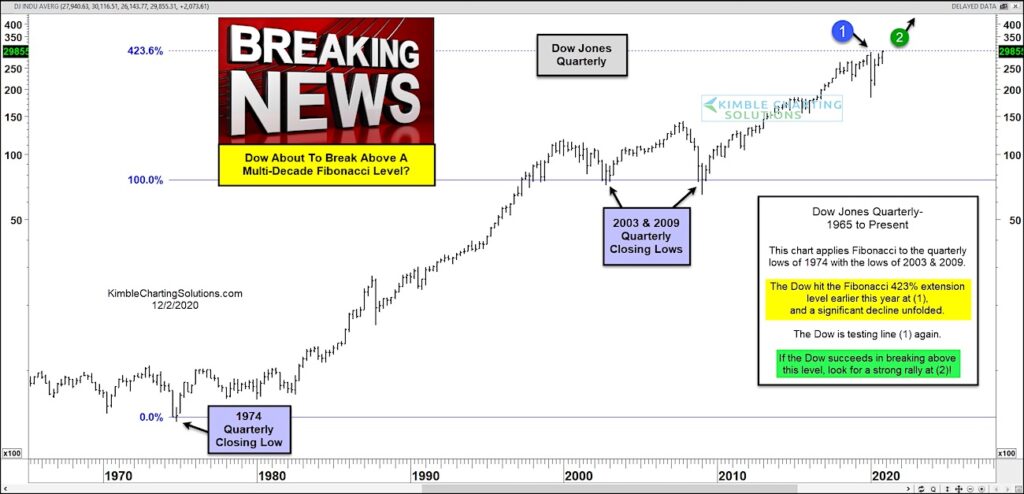

Today’s chart is a “quarterly” chart of the Dow Jones Industrial Average (spanning the past 50 years). It includes some relevant Fibonacci price levels for active investors to consider; we apply Fibonacci to the quarterly lows of 1974 and the lows of 2003 and 2009 (that being 100%).

Note that the Dow Industrials hit the 423% Fibonacci price extension earlier this year at (1) – roughly 30,000. Note as well that a significant decline followed. The Dow Industrials are testing this level again right now.

If the Dow Industrials succeeds in breaking above 30000 (on a quarterly closing basis) it could signal a super breakout and much higher prices as indicated by point (2). Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.