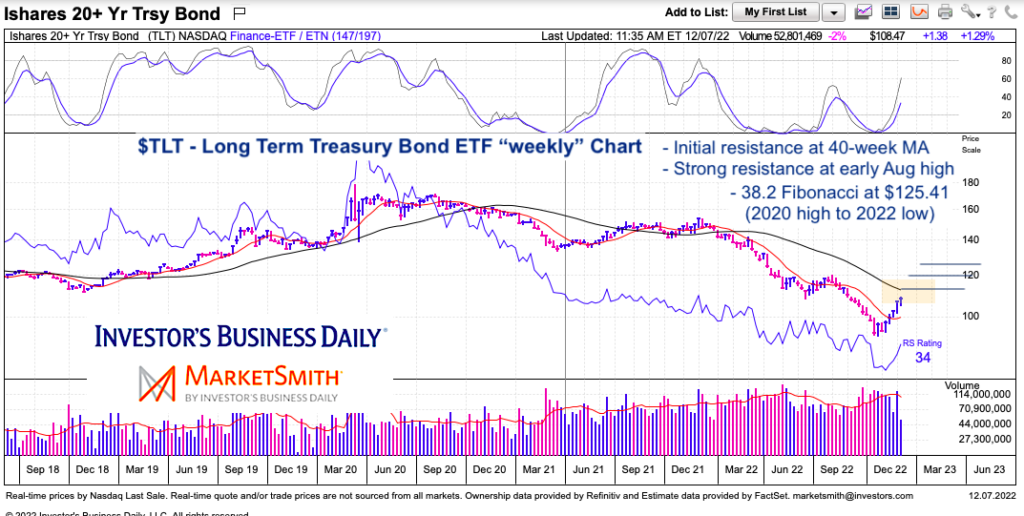

In early 2020, treasury bonds reached a spike high on news of coronavirus. Since then it’s been all downhill for the treasury bond market.

To be sure, the decline started slowly with bond prices trickling lower in 2020 and 2021. But as inflation became more pervasive, the markets took note. And so did the Federal Reserve. Several interest rate hikes rattled the bond markets and sent the long-dated Treasury Bonds ETF (TLT) tumbling.

And when I say tumbling, it’s a nice way of saying crashing. TLT dropped from $150 to $91 in a year!

Nothing goes down in a straight line. More recently, a relief rally has taken shape and treasury bonds are bouncing. Today we examine how far this rally might extend.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$TLT 20+ Year Treasury Bond ETF “weekly” Chart

Note that you can read my treasury bond trading insights and downside price target, as well as my initial thoughts on where the relief rally may be headed. Now for an update:

The long-dated treasury bond etf (TLT) is nearing its first price objective, the falling 40-week moving average around $112-$114. A move through this level could see TLT reach up to its early August high and topside of what would be a uniform base. Though a surge could reach the 38.2 Fibonacci retracement level, I think this rally will need a breather before one can assess if there is further upside.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.