“Experience” is the most valuable teacher of investing over time. Severe market drawdowns have permanent negative effects on an individual’s financial goals, their lives, and their families.

Dan would likely have a much different opinion if he had to sit across the table from someone who had just lost 50% of their retirement savings pleading with him about how they are ever going to get it back.

Thisis why all great money managers throughout history have all operated under one simple investment philosophy – “buy low, sell high.”

Even the great Warren Buffett once noted the two most important rules of investing.

- Don’t Lose Money

- Refer To Rule #1

Josh Brown also commented on Michael’s tweet and made a good suggestion.

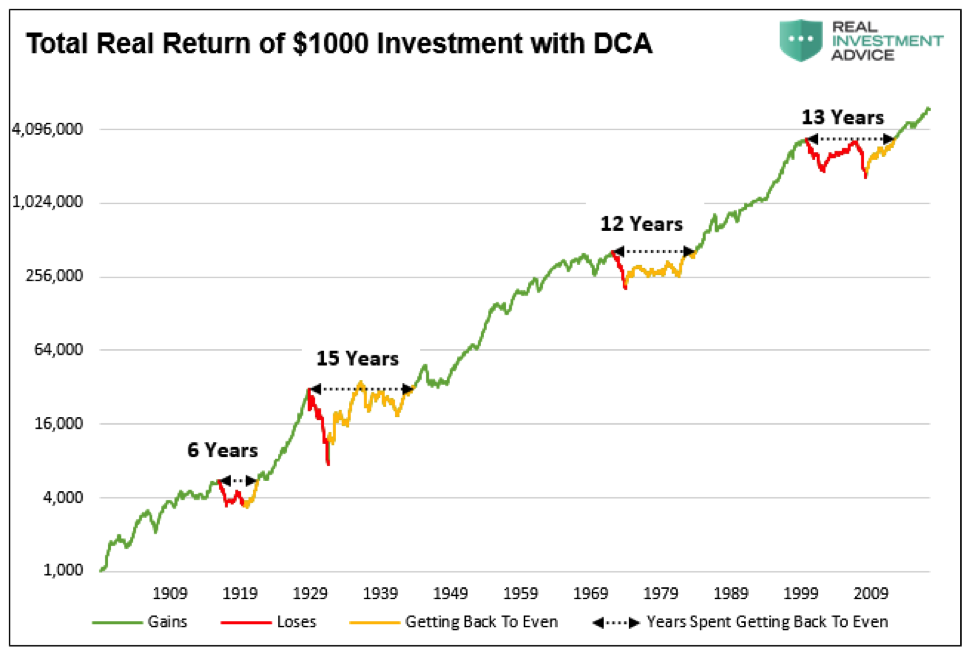

Per Josh’s request, the chart below shows the total real return (dividends included) of $1,000 invested in the S&P 500 with dollar cost averaging (DCA).

While the periods of losing and recovering are shorter than the original graph, the point remains the same and vitally crucial to comprehend: there are long periods of time investors spend getting back to even, making it significantly harder to fully achieve their financial goals. (Note the graph is in log format)

Data Courtesy Robert Shiller

The feedback from Josh, Dan and others exposeseveral very important fallacies about the way many professional money managers view investing.

The most obvious is that investors do NOT have 118 years to invest. Given that most investors do not start seriously saving for retirement until the age of 35, or older, most investors have just one market cycle to reach their goals. If that cycle happens to include a 10-15 year period in which total returns are flat, the odds of achieving their savings goals are massively diminished.

If an investor’s 30-year investment cycle happens to end with a major market crash, the results were devastating. Time, duration and ending dates are crucially important to expected investor outcomes.

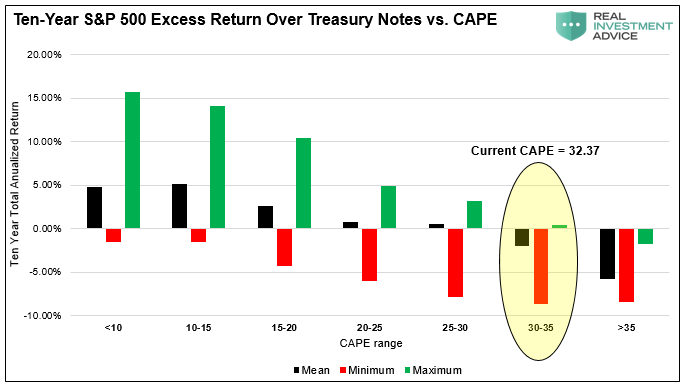

Second and more importantly, “buy and hold”investors fail to consider risks, expected returns and alternative strategies. Consider that from 2000 through 2013, the S&P 500 Index, including dividends and inflation, delivered a zero rate of return. And from 2000 through 2017, it returned a scant 0.30% more than risk-free Treasury bonds (5.4% annualized for stocks versus 5.1% annualized for bonds). Further, to reach that returnit required the expansion of valuation multiples to extreme and risky levels. Equityinvestors have endured two 50% drawdowns, and over a decade of no returns, to achieve an 18-year, 30 basis point annualized pickup over bonds. In recent years that entailed holding equities that were well above long-term averages and presented a poor risk/return framework.

Given current valuations, it is possible, perhaps even likely, that we will wake up on New Year’s Day 2025 to a stock market that has lagged or only barely matched the return of bonds for a full quarter century.The chart below shows the annualized performance of 10-year equity returns versus 10-year U.S. Treasury notes based on over 100 years of history. Clearly equity investors will need to defy history to outperform risk-free bonds. Stocks vs. Bonds: What to own over the next decade.

Summary

As shown and described, markets go through cycles. During these cycles,there are often incredible opportunities to own stocks. However, these cycles also include periods when risk should be minimized and greed should be constrained. Active management, unlike the static, one-size-fits-all mindset of the popular “buy and hold” strategy, seeks to measure risk and expected returns and invest in a manner in which one is aggressive when valuations are cheap and defensive when they are rich. The philosophy of this approach seeks first to avoid large losses which arethe key to compounding wealth.

The bottom line, and the topic for Part II, is that corrections and crashes matter a lot. Avoiding losses weighs far more heavily in compounding wealth than does chasing returns. In the next article we will walk through the math of compounding and explain why investing in markets that are expensive may provide short-term satisfaction but more than likely will severely harm your ability to meet your retirement goals.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.