Small Cap Stock Research: Cryoport (CYRX)

Cryoport is a $390M provider of logistics solutions to the life sciences industry.

Shares of Cryoport (CYRX) are +72.85% YTD.

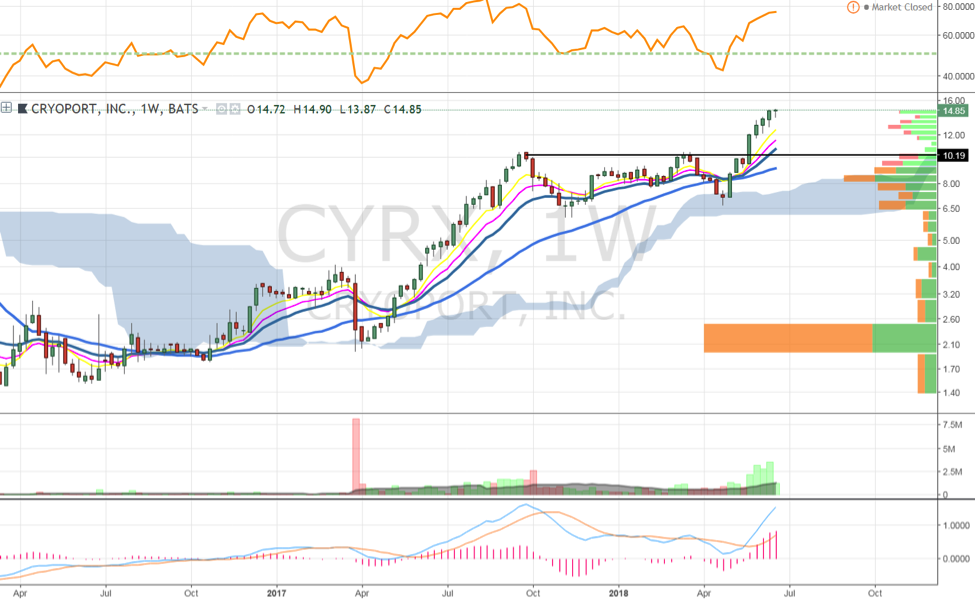

CYRX is expected to reach profitability next year and is seeing explosive growth with revenue growth of 95% last year, 64% expected this year, and 103% growth seen next year. CYRX shares broke a long term downtrend in June of 2017 and have seen strong momentum.

Cryoport (CYRX) Stock Chart

Statistics source: Sentieo; images from company presentation.

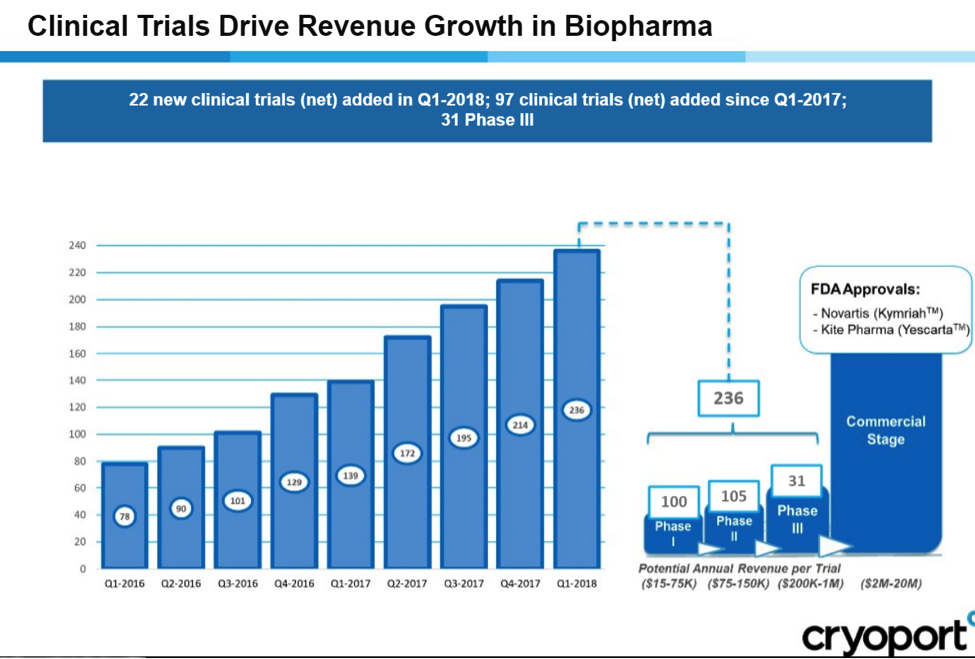

In Q1 CYRX reported 48.3% revenue growth with Biopharma revenues +62.3% as it added 24 new clients while gross margins also improved. It benefits from clinical trials driving revenue growth and its primary target market is regenerative therapy where an inflection point to commercialization has begun.

CYRX launched its Express C3 in August 2017 providing expertise in packaging, informatics and logistics to life science companies. CYRX is positioned well to continue to see meaningful growth acceleration before there is any need to be concerned with valuation, currently trading 10X FY19 EV/Sales.

In short, it’s a niche play with a sizable market opportunity.

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading and good luck out there!

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.