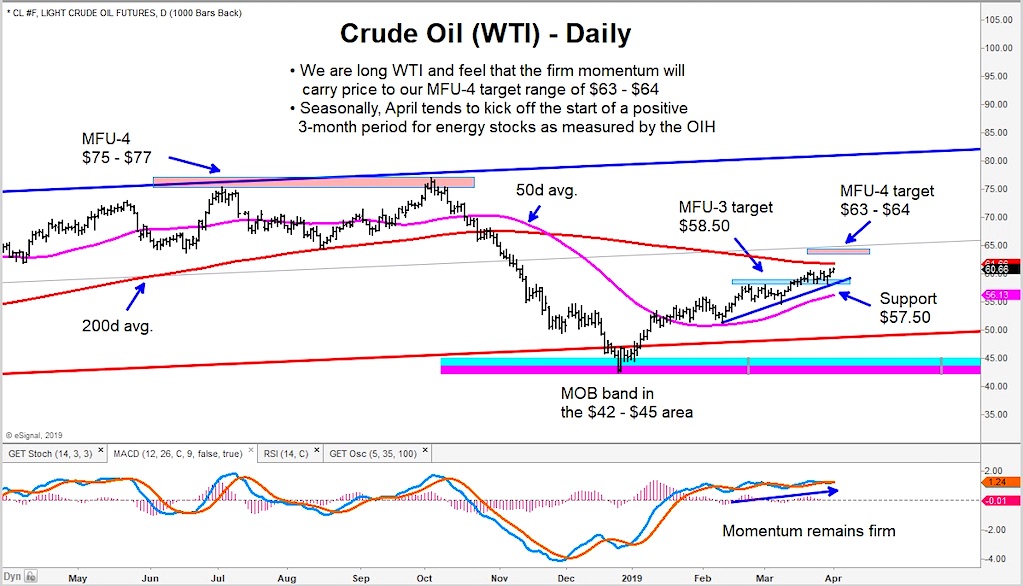

Crude Oil “daily” Chart

I wanted to share a few thoughts on WTI Crude Oil and where prices may be headed over the near-term.

Higher. But that is still very short-term as the rally has already taken WTI crude oil to $62.

WTI Crude Oil remains in a favorable uptrend. Momentum should carry Oil up toward $64 near-term.

On the equity side, price seasonality for core Energy ETFs OIH (NYSEARCA: OIH) and XLE (NYSEARCA: XLE) tends to be bullish April through June (source: Erlanger Research). This would be further supported should Oil remain firm/elevated around $60 during this time.

We suggest further analysis of these ETFs and components to find short-term ideas.

Author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.