Crude Oil Demand

The supply-side of the market has deteriorated but the demand-side has not. Global oil demand is expected to rise by 1.3% in 2017. That is positive; however, we would note that 1.3% would be deceleration relative to the 1.7% and 2.1% seen in 2016 and 2015, respectively.

The OECD will account for ~48% of global oil demand in 2017. We are positive on Europe and Japan. Therefore, we would not be surprised if OECD growth figures come in better than expected. Even so, it is important to note that non-OECD is the major growth driver. Non-OECD Asia, which includes China and India, will account for 75% of global growth in 2017, according to the International Energy Agency (IEA). We are not overtly concerned that China which appears to be seeing some softening. Still, we acknowledge that there is the potential for a slowdown. China injected a massive amount of credit into its economy in 2015/early 2016. That helped to reinvigorate investment and to support commodity prices. Now, the credit impulse is starting to wane. Moreover, there are concerns about refinery cuts and fewer imports relative to the 1st half of 2017. Each of these developments has the potential to weigh on demand. India recently took its two largest bank notes out of circulation. The resulting cash shortage has negatively impacted oil demand. Despite that, we believe that strong GDP in 2017 will continue to boost demand growth, albeit at a slower pace than in 2016.

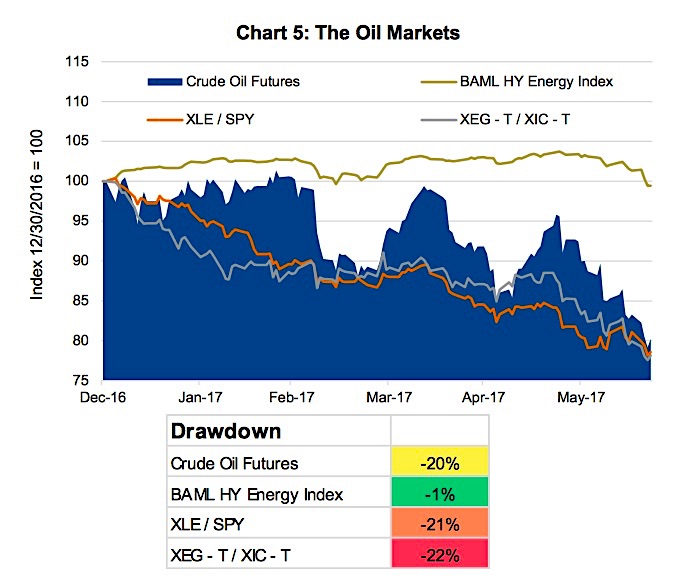

Oil Markets

The energy markets have been fading for some time. Year to date, crude is down ~20% while U.S. (XLE) and Canadian (XEG) energy stocks have underperformed their respective indices by ~21% and ~22%, respectively (Chart 5 below).

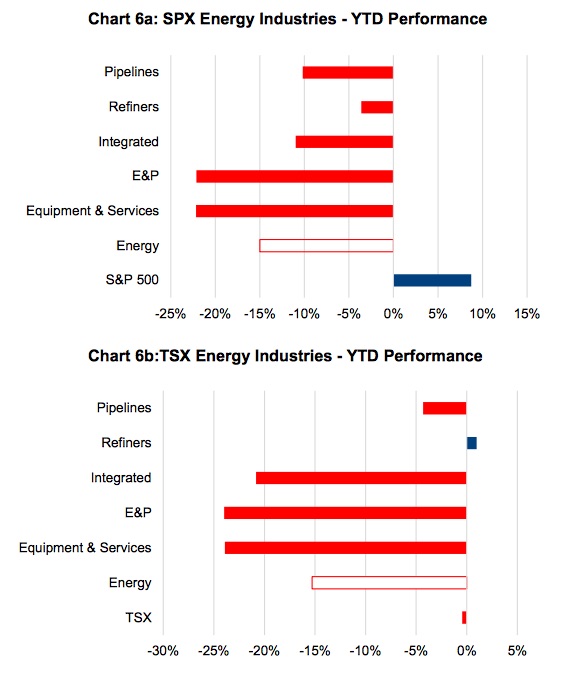

Despite weakness at the sector level, there has been some dispersion at the industry level. Refiners & Pipelines have outperformed while E&P & Equipment & Services have underperformed the sectors (Chart 6 below).

On the credit side, high yield energy is finally starting to show signs of weakness. M&A activity is also drying up. Activity among U.S. E&Ps fell to <$15 billion in Q2 of 2017 vs. $23 billion in Q1. Of the former amount, $6.7 billion is attributable to the deal between EQT Corp and Rice Energy. In terms of volume, the number of deals has fallen to the lowest level since early 2015. The same applies to Canada, where major players such as Royal Dutch Shell, Marathon and ConocoPhillips have been paring back investment.

Implications

The outlook for oil has worsened and rebalancing has been pushed further away. Reuters’ John Kemp recently stated that “oil traders have become increasingly doubtful that OPEC will manage to cut (inventories) stocks down to the 5-year average and keep them there.” That is a far cry from the optimism that we witnessed not long ago. While our macro view is tilted to the negative side, we are not in the business of buying and selling oil. Our focus is on defensive companies that will continue to perform even if the downside risks to come to fruition. The portfolios are underweight energy, with an emphasis on low-beta names such as TransCanada and Suncor. Our view is that it is impossible to time the bottom. As a result, we are adding to positions and will continue to do so if and when prices move lower.

“The petroleum industry has not of late years earned a return on its investment sufficient to enable it to continue to carry in the future the burden and responsibilities placed upon it in the public’s interest, and it would seem impossible to do so unless present conditions are changed.” – Anglo-Persian Oil Company (now BP) – 18 August 1928

Thanks for reading.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.