When corporate bond buyers stepped up into the January/February 2017 issuance period, they were almost immediately rewarded with price markups thanks to what seemed like a never-ending compression of risk spreads, coupled with the drop in 10yr Treasury yields between January and September of last year.

The same cannot be said for corporate bond buyers in September/October of 2017 and in January/February of this year.

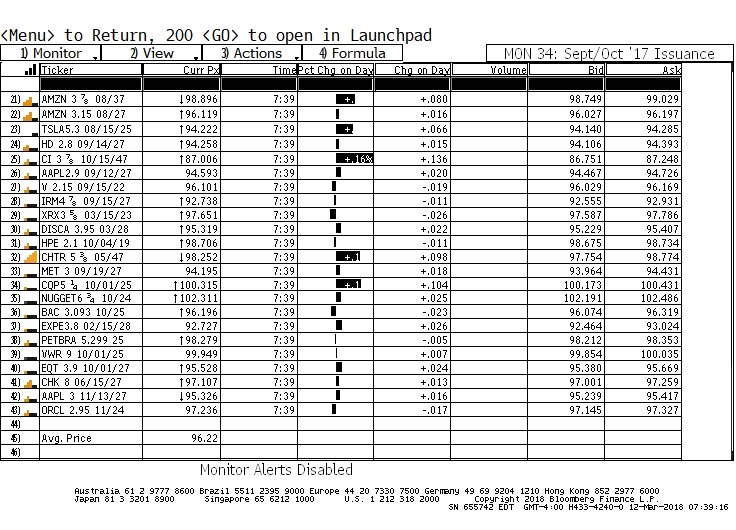

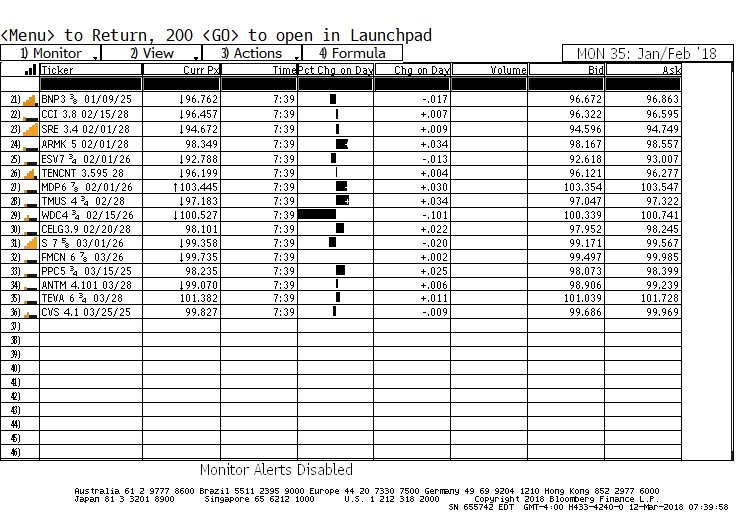

As you can see in my sampling of the largest corporate bond issues sold during those periods (images directly below), on average those bonds are already under par. Obviously, taking losses on fresh positions isn’t ideal in any scenario, but there are a couple of silver linings.

First, the drop in prices is almost entirely attributable to the increase in Treasury yields, not what would be a more ominous widening of risk spreads. In fact, both Investment Grade and High Yield risk spreads remain just about near multi-year tights. (see images further below).

Second, credit managers flush with cash to invest are far more interested in being able to chase higher overall yields than they are concerned with paper losses on their holdings.

And to add to this point, in January and February dozens of private/corporate pension plans joined the public ones in committing more than $54 billion dollars of fresh money to new investments, the bulk earmarked for fixed income, real estate and direct lending bets (these are just the allocations that I could track down – the real number is probably much higher; also, that figure does not take into account the leverage that most managers layer on their accounts). So credit managers can count on more fire-power to continue buying.

As Canaccord Genuity’s Brian Reynolds has been explaining for decades, the dynamic of “averaging down” on credit purchases in the midst of rising Treasury rates – yet calm risk spreads – has been the hallmark of the most intense periods of credit bull markets going back to the mid-‘90’s, and it has generally resulted in the most powerful legs of the coincident equity bull moves. That’s because a significant portion of the proceeds of bond sales by corporations end up in stock buybacks and cash-based M&A transactions.

Eventually – sometime after the 2-10 yield curve inverts and new cash commitments dry up – this virtuous cycle will end, and the next financial crisis will begin. But for now, rising yields will likely add fuel to the white-hot credit and equity markets, despite potentially violent air pockets like we saw in mid-February.

Twitter: @FZucchi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.