It is possible that gold gets some help toward the end of the month. Current funding for the U.S. government expires on September 30. The borrowing limit needs to go up… but maybe not before some DC drama. It is possible the government shuts down – no matter how fleeting.

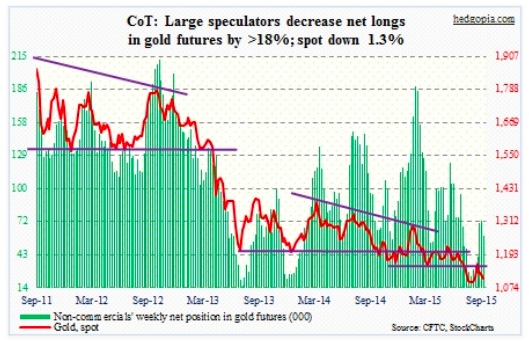

Having added to net longs for five weeks only to see gold head lower, non-commercials gave up this week. Net longs were cut by more than 18 percent.

The COT Report: Currently net long 59.3k, down 13.4k.

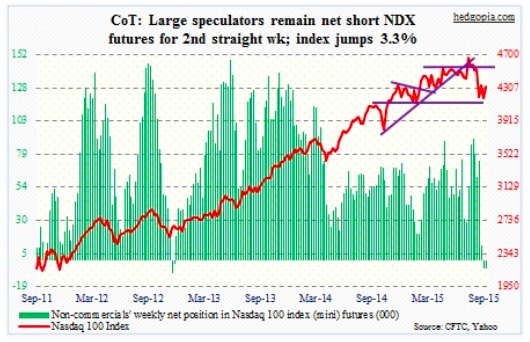

Nasdaq 100 Index (mini): Investors returned from the holiday all bulled up, and they wanted to own tech. Apple (AAPL), of course, helped – up 4.5 percent for the week. Going forward, clues will probably come from semis.

Non-commercials are not that impressed. Per the COT Report, they continue to remain net short for the second consecutive week. Directionally, they are positioned the same way as are non-commercials in S&P 500, Russell 2000, and VIX futures. This is rare. Traders are heavily net short S&P 500 futures at the same time as they are heavily net long VIX futures. If they are right, it’s bad news for equity bulls. If they are wrong, there is a massive squeeze coming for stocks. Probably time for long straddle/strangle?

The COT Report: Currently net short 5.8k, down 326.

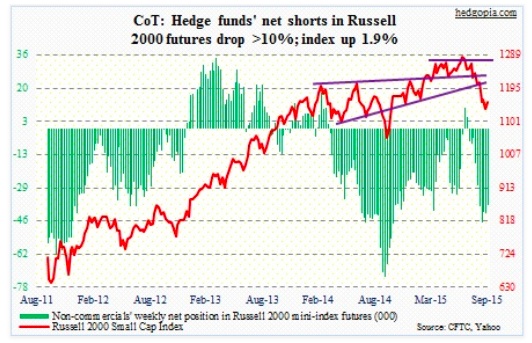

Russell 2000 mini-Index: Is risk-on making a comeback in the market? High-yield bond funds attracted $186 million of inflows in the August 9th week – first inflows in three weeks. This is too small an amount. Nonetheless, if risk-on is indeed making a comeback, it is not yet evident in small-caps. The Russell 2000 underperformed – up only 1.9 percent.

Non-commercials reduced net shorts by 10 percent, but still have sizable short exposure.

The COT Report: Currently net short 37.5k, down 4.3k.

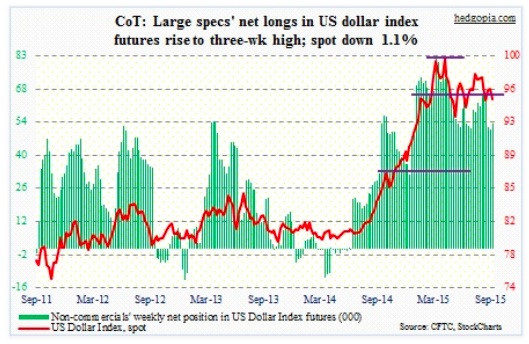

US Dollar Index: There were more signs of slowdown in China. Alibaba (BABA) expects 2Q gross merchandise volume to be lower than prior estimates due to weaker consumer spending. Torsten Mueller-Oetvoes, Rolls Royce chief, said on Bloomberg TV the Chinese market is currently seeing quite a contraction in the luxury goods business. General Motors (GM) said China sales in August fell 4.8 percent y/y to 249,000, and Ford’s (F) fell three percent y/y to 79,600. Last but not the least, on the heels of an 8.3-percent decline in July, China exports fell 5.5 percent in August. Potentially more yuan devaluation down the line?

The US Dollar Index, by the way, does not have yuan in its basket. But it does have euro – a hefty 57.6 percent weight. In the wake of Mr. Draghi’s comments last week about possible expansion in the ECB’s stimulus program, non-commercials were indifferent toward the US Dollar.

The COT Report: Currently net long 53.4k, up 2.2k.

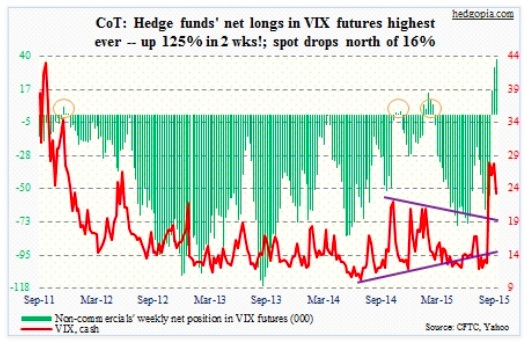

VIX: Yet another record! Per the COT Report data, non-commercials are piling on. In the week ended this Tuesday, spot VIX dropped nearly 21 percent, but this did not stop these traders from increasing net longs by another 18 percent. The spot VIX has stayed north of 20 for the fourth consecutive week, and this probably has emboldened them.

The COT Report: Currently net long 37.9k, up 5.7k.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.