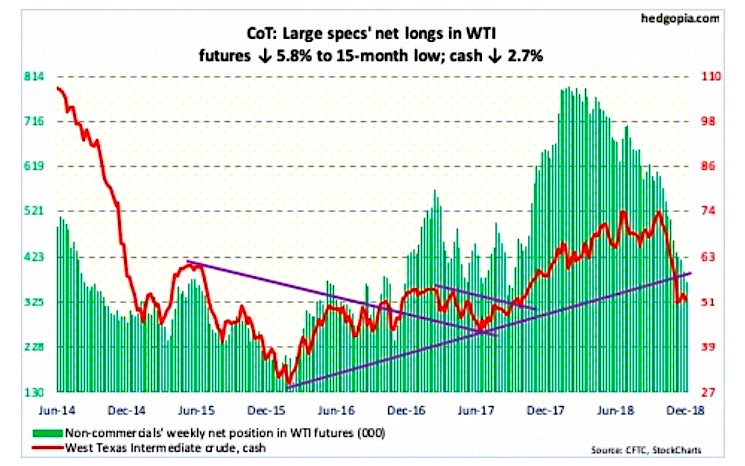

The chart below looks at non-commercial futures trading positions for Crude Oil. For the week Crude Oil closed lower by -2.6%. The US Oil ETF (NYSEARCA: USO) also closed down -2.6%.

Here’s a look at Crude Oil futures speculative positioning. Scroll further down for commentary and analysis.

Note that the chart and data that follow highlight non-commercial commodity futures trading positions as of December 11, 2018. This data was released with the December 14, 2018 COT Report (Commitment of Traders).

Note that this chart also appeared on my blog.

Crude Oil prices were really volatile this week, but managed to stay above the late November lows. Can bulls stop the selling and ignite a relief rally? Or will a bearish triangle bring new lows?

Let’s look at the COT data and technicals to see what’s next

Crude oil: Currently net long 369.3k, down 22.7k.

WTI crude oil is attempting to stabilize, trading mostly sideways over the last three weeks. Oil prices fell from $76.90 on Oct 3rd to $49.41 on Nov 29th. On intermediate term time frames (weekly chart), crude oil is oversold.

Any bounce will find initial price resistance at $54.50-$55. That level needs to be exceeded if any multi-day rally is to take hold.

US crude oil production fell 100,000 barrels per day to 11.6 million barrels per day during the week ending Nov 30th. Crude oil stocks were down 1.2 million barrels to 442 million barrels. Distillate inventory fell 1.5 million barrels to 124.1 million barrels. On the flip side, Gasoline stocks rose 2.1 million barrels to 228 million barrels and crude oil imports rose 174,000 barrels per day to 7.4 million barrels per day. It’s a big week ahead for oil bulls…

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.