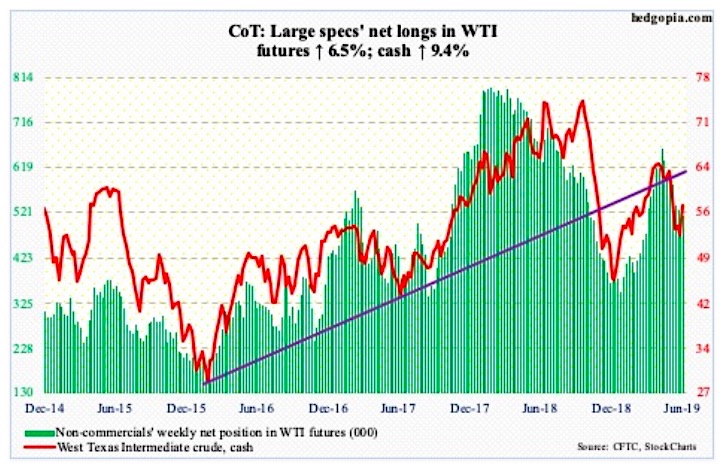

The chart below looks at non-commercial futures trading positions for Crude Oil. For the week Crude Oil closed higher by nearly 10 percent on US / Iran tensions. The US Oil ETF (NYSEARCA: USO) also closed higher by 9.4%.

Here’s a look at Crude Oil futures speculative positioning. Scroll further down for commentary and analysis.

Note that the chart and data that follow highlight non-commercial commodity futures trading positions as of June 18, 2019. This data was released with the June 21, 2019 COT Report (Commitment of Traders).

Note that this chart also appeared on my blog.

Crude Oil prices rocketed higher from oversold levels, fueled by US / Iran tensions. Can bulls keep it going in the week ahead? Or will bears stop the rally?

Let’s look at the COT data and technicals to see what’s next.

Crude Oil Futures: Currently Net Long 512.8k, up 31.3k

The cash ($57.43/barrel) fell from $66.60 on April 23 to $50.60 on June 5, before going sideways. Support at $50-51 was defended several times over two weeks. Tuesday’s 4.2-percent rally brought the crude to resistance at $54-55. Thursday’s 5.7-percent jump easily cleared that ceiling.

Crude Oil rallied on concerns over possible US retaliation against the downing of its drone by Iran… tensions rising. The 50- and 200-day moving averages lie right above – $59.56 and $59.21, respectively. There is also horizontal resistance just north of $60.

Bullish sentiment also got help from the EIA report for the week of June 14. US crude production dropped 100,000 barrels per day to 12.2 million bpd. Two weeks before that, a record 12.4 mbpd was pumped.

Crude oil imports fell 144,000 bpd to 7.5 mbpd. Stocks of crude, gasoline and distillates all declined – by 3.1 million barrels, 1.7 million barrels and 551,000 barrels to 482.4 million barrels, 233.2 million barrels and 127.8 million barrels, in that order. Refinery utilization rose seven-tenths of a percentage point to 93.9 percent – a 22-week high.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.