The following chart and data highlight non-commercial commodity futures trading positions as of March 6, 2017.

This data was released with the March 9 COT Report (Commitment of Traders). Note that these charts also appeared on my blog.

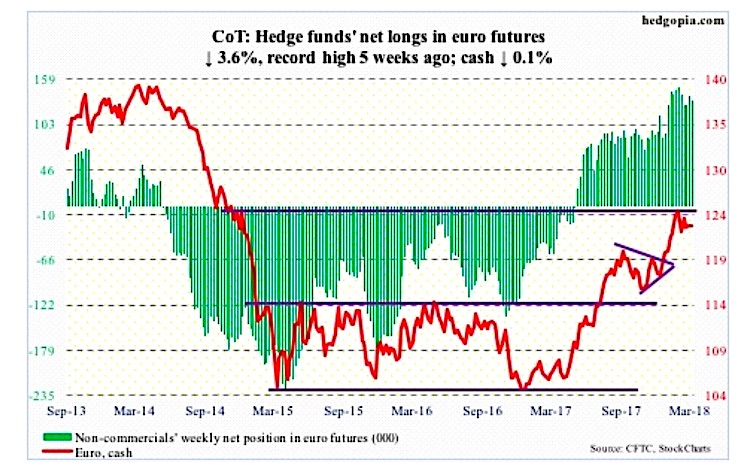

The chart below looks at non-commercial futures trading positions for the Euro currency. For the week, the Euro traded down -0.1%.

EURO Currency Futures

March 9 COT Report Spec positioning: Currently net long 133k, down 5k.

On Thursday, the ECB Thursday dropped its easing bias. In the post-meeting statement, the bank no longer explicitly committed to expanding its bond-buying program in case the Eurozone economic outlook worsened. The current program runs through September.

The Euro tried to rally on this development, but reversed hard to end the session down 0.8 percent.

Over three weeks in January and February, there were several unsuccessful attempts at $125. A falling trend line from the all-time high of $160.20 in April 2008 lies near that level, which also represents measured-move-target resistance of a 10-point range breakout last July.

A pattern of lower highs is now in place. The still-rising 50-day moving average ($122.57) lies underneath, and after that support at $121-122.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.