The chart and data that follow highlight non-commercial commodity futures trading positions as of August 7, 2018.

This data was released with the August 10, 2018 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

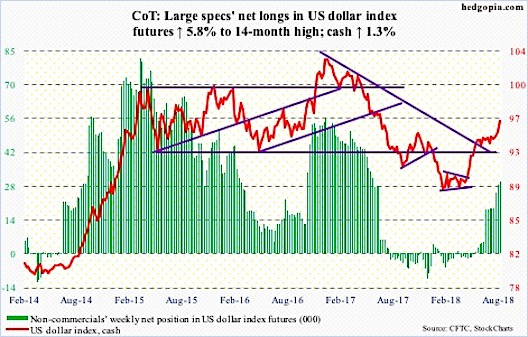

The chart below looks at non-commercial futures trading positions for US Dollar Index futures. For the week, the spot US Dollar Index spot finished up +1.3%, while the Bullish US Dollar ETF (NYSEARCA: UUP) closed up +1.2%.

Here’s a look at US Dollar Index futures speculative positioning. Scroll further down for commentary and analysis.

The Dollar has extended gains on news out of Turkey, coupled with a weaker Euro.

Let’s look at the COT data and technical to see what’s next…

US Dollar Index Futures: Currently net long 30.1k, up 1.6k.

The US Dollar struggled to break out above the 95 level for several weeks. That came to an end last week… specifically on Friday with news out of Turkey that hit the Euro.

Dollar bulls are in control again. They continue to add to their long positions, providing support for the Dollar’s ascent. Now they’ll need to turn prior resistance (95) into support.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.