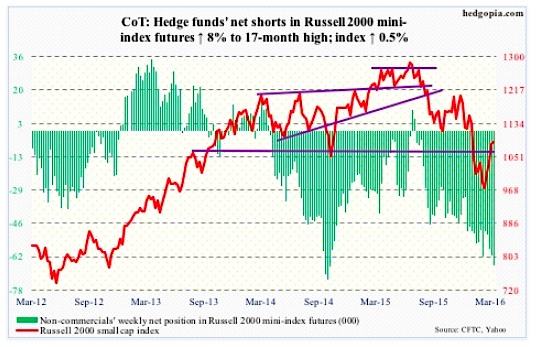

Russell 2000 mini-Index: As is the case with the Nasdaq 100, the Russell 2000 is past resistance – at 1080. But it is a feeble breakout.

Unlike the past couple of weeks, the small caps stock market index underperformed its major U.S. peers this week. This, despite the $460 million that moved into IWM, the iShares Russell 2000 ETF, in the week ended Thursday (courtesy of ETF.com).

Non-commercials raised net shorts to a 17-month high.

COT Futures Data: Currently net short 66.1k, up 4.9k.

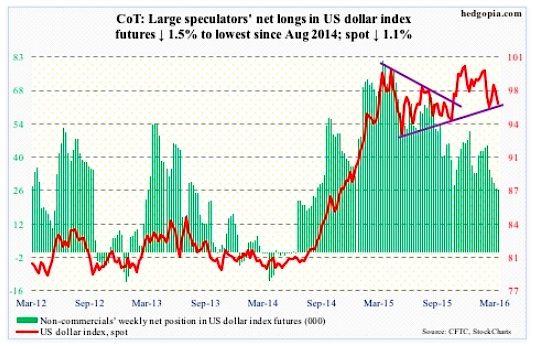

US Dollar Index: Not surprisingly in a whiplash session on Thursday, from intra-day high to low, the US Dollar Index lost 2.4 percent, ultimately finding support on a slightly rising trend line drawn from May 2015. It is trying to stabilize near the daily lower Bollinger Band.

The US Dollar Index has now lost both 50- and 200-day moving averages. The former incidentally is dropping, and the latter flattish. If there is no improvement in the next several sessions, for whatever it is worth, a death cross likely completes in the not too distant future.

Non-commercials show absolute no interest in adding to net longs.

COT Futures Data: Currently net long 26.4k, down 407.

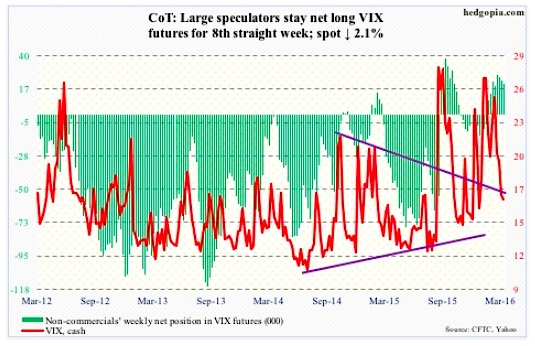

VIX: Spot VIX potentially is in the process of carving out a bottom on a daily chart. The only question is if the process needs more time or is already in motion. And that could signal an eventual return of volatility to the markets.

Encouragingly for volatility bulls, the August 2015 rising trend line is providing support. As long as this holds, the bottoming process continues.

COT Futures Data: Currently net long 21.1k, down 2.2k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.