This article was written by Will Nasgovitz – CEO and Portfolio Manager, Heartland Advisors.

For most of the past 10 years, corporate debt has been little more than an afterthought for many investors.

With interest rates low, the economy strong, and relatively easy lending standards, the thinking went that borrowing to buyback shares or finance acquisitions was a low-risk strategy.

But the next five years could severely test that Pollyanna view of corporate debt.

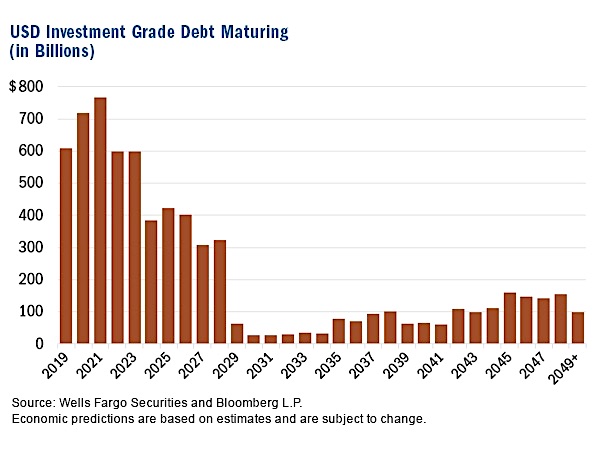

As shown in the chart show below, roughly $3.3 trillion—48% of all current outstanding commercial debt—will come due by 2023. The sheer volume would be challenging for the market to digest in the best of scenarios, let alone this late in an economic expansion.

Adding to our sense of caution are early signs that lending standards have begun to tighten for commercial and industrial borrowers. As banks become more stringent, borrowers could find themselves paying higher rates just to secure the capital they need to retire outstanding obligations.

While we don’t currently see signs of a full-blown financial crisis on the horizon, we do believe that excessive debt adds unnecessary challenges to companies in general and will likely be a headwind for heavy borrowers in the intermediate term going forward.

Not surprisingly, our long-held caution toward financial leverage plays out in our investment decisions: our portfolios are underweight debt-laden companies relative to their benchmarks.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Definitions:Buyback: the repurchase of outstanding shares (repurchase) by a company in order to reduce the number of shares on the market.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.