Last week the equity markets broke a two-week winning streak.

Gold rallied for the seventh straight week climbing above $1900/ounce, its highest level since August 2011. And Silver broke through a 52-week high.

This surge is due in part to the resurgence of the coronavirus and investors seeking safe-haven assets.

As well, the U.S. dollar fell to a two-year low and three-, five- and seven-year Treasury yields dropped to record lows.

Here are the primary themes impacting the stock market right now:

Most of the tracking data over the past few weeks shows the U.S. economy is trending down. The recent virus outbreak and the renewed partial lockdown of select businesses in some states will likely impact confidence and consumer spending.

The good news is that we have more knowledge, more tools and new antiviral drugs at our disposal. Pfizer and German biotechnology firm BioNTech agreed to supply the U.S. Government with 100 million doses of a coronavirus vaccine that could be available by the end of the year. Evidence from their clinical trials has been positive.

A covid-19 stimulus package will be negotiated by Congress beginning this week. Many benefits are running out and with millions of people still unemployed, continued federal money is a much-needed lifeline. The proposal calls for, among other things, additional unemployment benefits but less than the payments issued previously because some workers were collecting more than they earned on the job. As a result, some employees did not have an incentive to return to work. The emphasis will target those who need the assistance the most. Hopefully a bi- partisan relief package can be worked out as quickly as possible.

There is a significant shift taking place in the global attitude toward the Chinese Communist Party driven by its conscious neglect to report the onset of the covid-19 virus in their country which turned the virus into a world pandemic. The coronavirus has brought to the forefront our dependence on China for certain medical supplies and pharmaceuticals. We are working on decoupling from China in those specific areas.

Last week the U.S. closed a Chinese consulate in Houston based on spying and intellectual property theft. China reciprocated by closing one of the U.S. consulates in China. A rise in tensions may impact the trade agreement that we signed earlier this year. The U.S. does not have a problem with the good, hard-working people of China. Our problem is with the Chinese Communist Party.

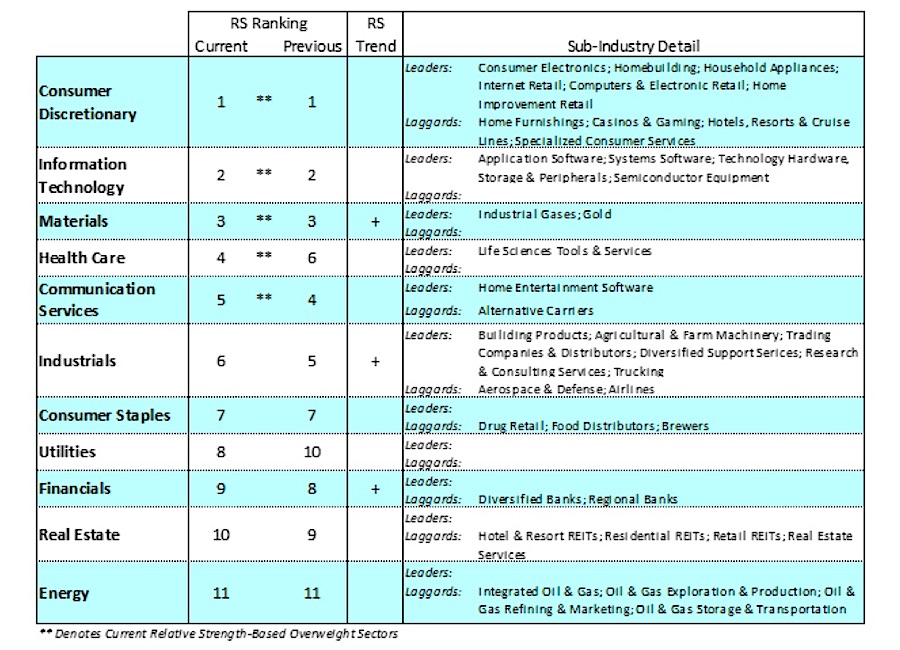

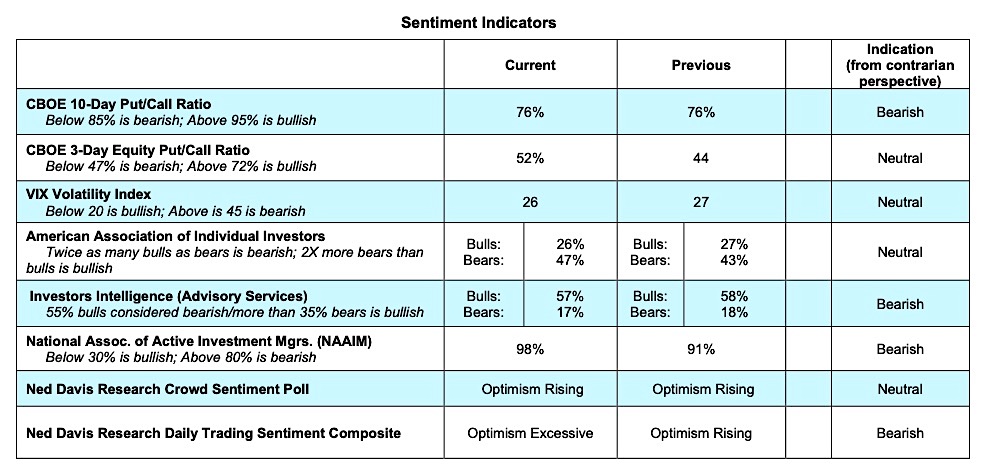

Stock market technicals suggest too much optimism has entered the market. The Chicago Board Options Exchange put/call ratio is in the extreme optimism zone as the demand for call options has exploded. The latest report from Investors Intelligence (II) shows only 17.1% bears, the fewest since January 2018, just before the market corrected. We now have companies offering commission-free stock trading, quickly accessible from your mobile device, enabling large numbers of inexperienced traders to trade the market.

The Bottom Line: We saw a notable improvement in employment, spending and manufacturing activity in May and June. However recent tracking data suggests the economy may be stalling as another outbreak in the virus has raised concerns about the extent of the rebound. The offset to this is another stimulus package from Congress in the works and the Federal Reserve is committed to keeping short-term interest rates low for several years. Stock market technicals point to too much optimism in the market suggesting a continuing consolidation phase.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.