Here are 3 looks at the trading ratio of the Consumer Discretionary Sector (XLY) / Consumer Staples Sector (XLP) ratio.

It looks to us that this pair is due to reverse course to a risk-off configuration.

Here are some takeaways from the charts:

The ratio is approaching a 161.8% Fibonacci extension and pressing up against pitchfork resistance. See chart above.

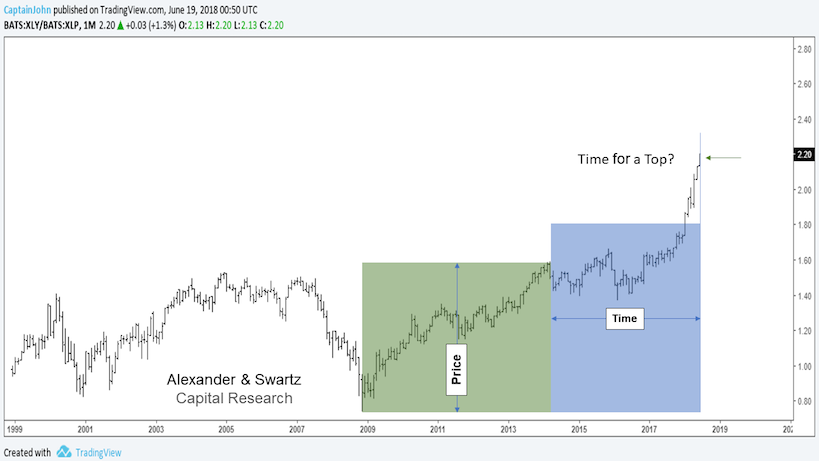

A price and time chart is lining right up for a turn exactly right here. Price = Time

$XLY / $XLP Ratio Chart – Price and Time Square Out?

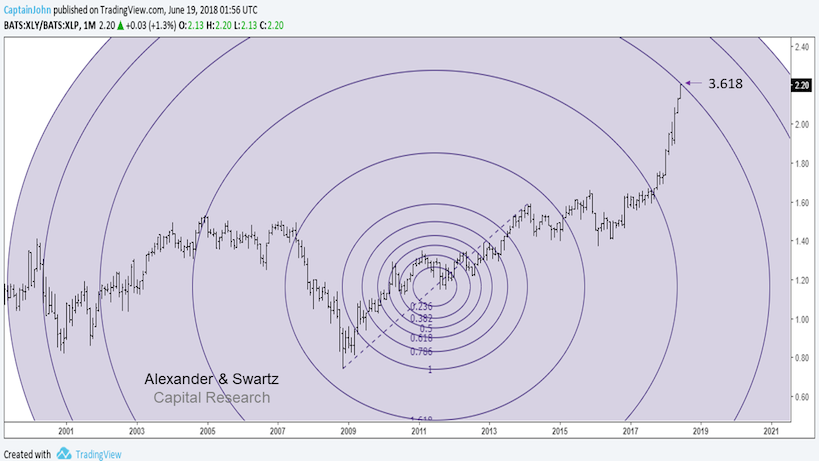

The Fibonacci ellipse reveals a potential turning point/ resistance at 3.618%

Looks like it may be time for a change of leadership in this pair… it’s overdue for some mean reversion.

$XLY / $XLP Ratio Performance Fibonacci Ellipse Chart

Twitter: @CptJohnCharts & @FortunaEquitis

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.