Commodities came into March like a lion and went out like a lamb.

Even so, the price of several commodities remains elevated and pressuring an already ugly inflationary environment.

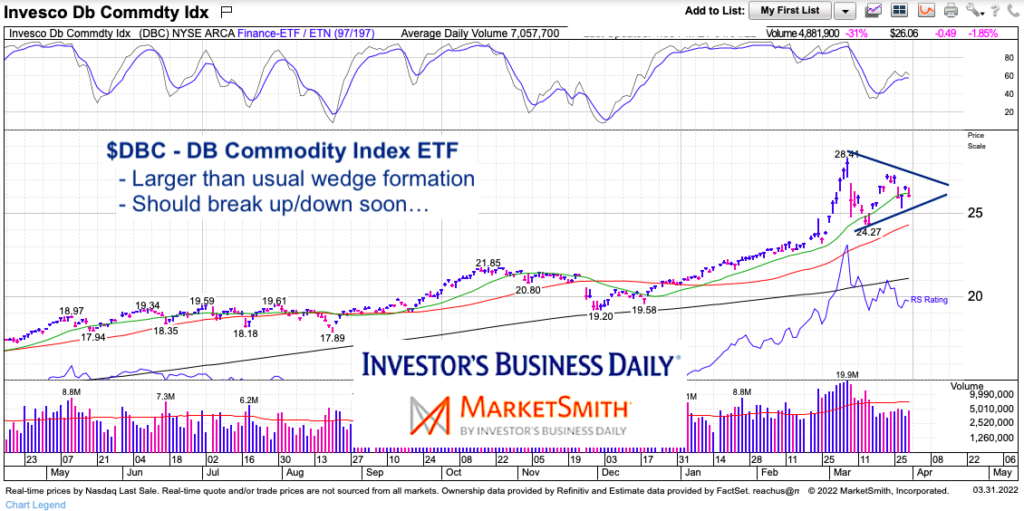

Today, we look at a chart of the Invesco DB Commodity Index ETF (DBC). The chart is simple (as usual) but important as its price is narrowing within a large wedge formation. The start of a larger move could be on the horizon.

Let’s take a look!

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$DBC DB Commodity Index ETF Chart

All things considered, this is a pretty large wedge formation. And since it is happening within the context of an up-trend, bulls are in charge… until they’re not. In short, price is narrowing and will get squeezed one way or another. A move higher will bring a retest of the March highs (and potentially new highs), while a move lower will bring a retest of the March lows.

Commodities are extremely important to the financial markets right now. Yes, they are a trading vehicle, but with inflation on the rise, supply issues all around, and a war in Ukraine… yeah, commodities are worth watching.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.