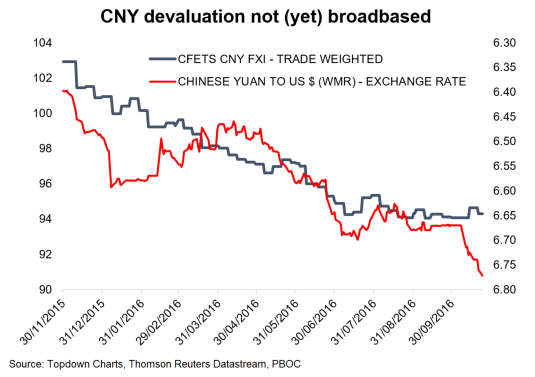

The Chinese Yuan (CURRENCY:CNY) or Renminbi is on the move again. But part of the reason why markets are shrugging it off is that it’s really more of a US dollar thing than a Renminbi thing as the chart below shows.

The chart shows the USDCNY exchange rate vs the official basket index, the “CFETS” TWI.

If it was a broad based move i.e. a China-driven devaluation you would expect them both to be moving in the same direction at around the same pace. But what we are seeing is a move that is clearly idiosyncratic to the USDCNY.

Thus the simplest explanation is that the Chinese Yuan is US dollar driven. And this should be expected as pricing of Fed rate hikes steps up given improving US data and the trends in inflation. It’s also worth noting, that China itself is going through a smooth patch after stimulating its economy earlier this year – which again goes to highlight that this time it’s not a China problem that’s driving the move in the currency.

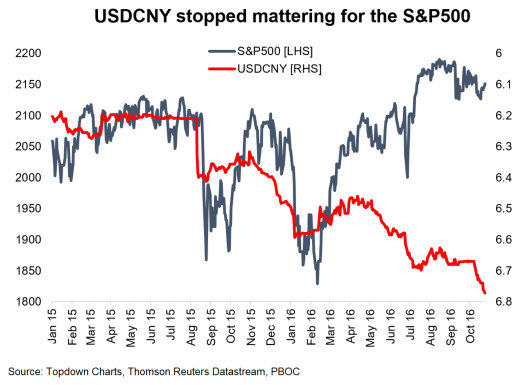

Having established that, the lack of reaction by the S&P 500 to the movement in the USDCNY is perhaps more understandable. It lacks the panic and shock “what’s happening in China??” effect that occurred in the August and January corrections.

But that’s not to say it doesn’t matter at all. China remains in a smooth patch and is unlikely to spook the S&P 500 in the near term, but that doesn’t mean a surge in the US dollar won’t cause issues. So while it’s definitely different than August and January, a move in the USDCNY that reflects a surging US dollar will ultimately be reflected in tighter financial conditions for the US economy, and could act as a headwind to earnings. So while it “doesn’t matter” now, if it keeps going at this pace it will almost certainly start to matter.

Bottom line: The move in the USDCNY is driven by the US Dollar (USD) not the Chinese Yuan (CNY) this time; this explains the shrug by markets, but the shrug will be short-lived if the USD continues to surge, so keep an eye on the USD.

Read more of my research and insights on my blog. Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.