China released it’s May official PMI data, and overall the results are fairly benign. On the surface there wasn’t much to change the current view.

The May Chinese manufacturing PMI was unchanged at 51.2 and the non-manufacturing PMI up +0.5 to 54.5 with services up +0.9 to 53.5. As well, the all-important construction sub-index was down -1.2pts to 60.4.

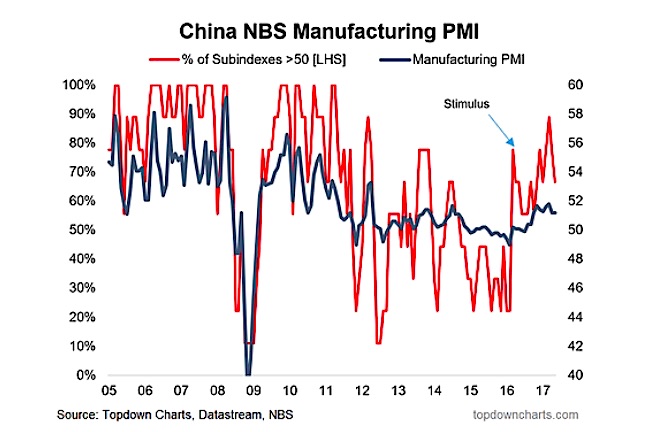

Looking closer at the breadth of the manufacturing PMI, there has been a further deterioration since the peak in March, and this is a slight concern in that it may be an early indicator of slowing underlying momentum in China’s economy.

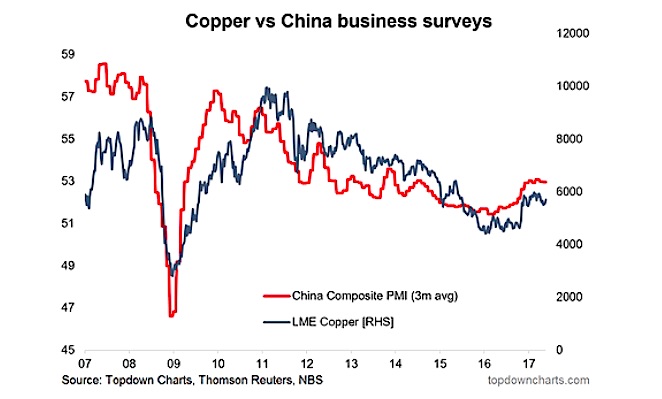

China’s economy has seen a big rebound as a result of fiscal and monetary stimulus, better export demand, and a booming property market. As we’ve previously discussed, property remains a risk area and will likely start to become a drag later this year and potentially a source of downside risk going into 2018 if our leading indicators prove correct.

The May Chinese manufacturing PMI has rolled over after the breadth of the subindexes peaked back in March.

The path of copper remains linked to the path of China’s economy, and at this stage both have settled into a tight range after a major (stimulus-driven) rebound late last year.

For more of my macro analysis, visit Top Down Charts. Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.