Any time I read about a market “stalling” or reaching “stall speed” my palms start to sweat. They are literally sweating right now. Let me share why I’m uncomfortable, then I’ll explain why stalls are often an ideal representation of the markets.

I’m a student pilot with about 75 hours in a Cessna 172R. Learning to fly has been one of the most exciting and challenging experiences of my life, even to the point that I designed my research firm using the language of aviation.

Stall training was a huge hurdle for me, to the point that I e-mailed a couple college buddies who are airline pilots to build up enough confidence to give them a try.

What is a stall? You may know that a plane is able to fly because of the lift produced by the wings. A stall is when you put the airplane into a configuration that prevents the wings from producing lift.

While this is not a big deal when you’re 5000 feet up in the air (which is where you practice stalls), a stall when you’re near the ground can be very dangerous. Stalls tend to happen during takeoffs and landings, which are two points when you definitely do not want a stall to happen.

How do you avoid stalls? You fly thousands of feet up in the air and you practice them. You recreate takeoff and landing phases then force the plane into a stall. (I had to stop typing there because my hands were sweating. I’m not kidding.)

You do this for two reasons. First, you experience the bodily sensations so you can recognize when a stall is imminent, and second, you learn how to quickly alleviate the conditions and return the plane to normal flight.

For a power-off stall, which you would likely experience when landing the airplane, you pull the throttle out and tip the nose up. This slows the plane down and pushes the “angle of attack” high enough to force a stall.

The correct procedure to recover from a power-off stall is to relieve pressure on the yoke, that is, stop pulling back so hard on the stick. When done correctly, the plane “buffets” or shudders briefly then recovers to normal flight.

My scariest moment in the air was when I did what you are absolutely not supposed to do. Instead of simply relieving pressure on the yoke, I pushed forward. This very quickly put the plane into a nose dive.

This, ladies and gentlemen, is why you have a flight instructor. Mine immediately took over the controls and got us back to flying straight and level.

What’s interesting is that after a stall, if you do absolutely nothing, the plane actually returns to straight and level flight. After plunging down, it will quickly come back higher. Then after correcting on the upside, it will go lower, then higher, and eventually return to level.

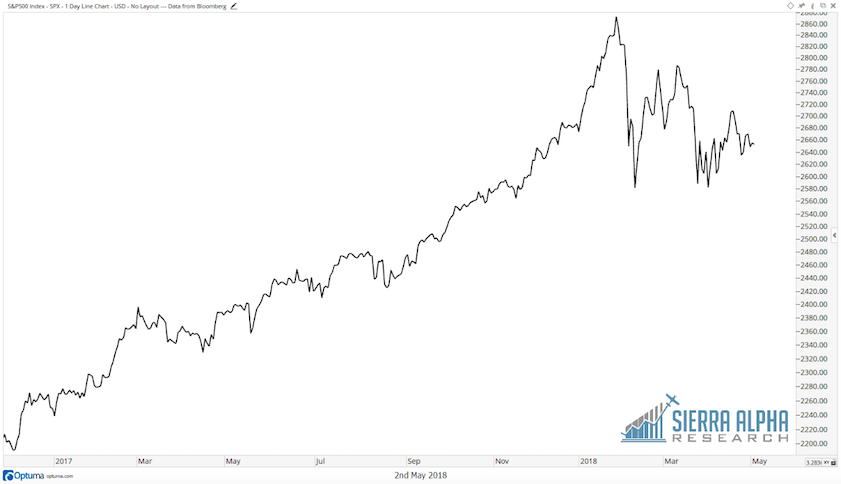

Why are stalls such a beautiful illustration for the markets? Look at the daily S&P chart and you’ll see exactly why.

My flight path during stall training. I mean, the S&P 500 since late 2017.

When markets have been going in a certain direction for a period of time, it feels as if it needs to correct. Much like a power-on stall (if you tip the nose up too high during takeoff), eventually the plane/market can’t go up any more.

I wrote about the S&P 500 and stall speed in early 2017, and I recently noticed Ed Yardeni applying the concept to the growth rate of economic indicators:

During 2010, pessimistically inclined economists observed that 2.0% growth had been the economy’s stall speed during all expansions since WWII. In other words, 2.0% growth meant a recession was likely to occur soon. It’s eight years later now, and real GDP still is growing around its purported stall speed without stalling.

Much like a plane slowly recovering from a stall with a series of up and down moves, markets often come down from a high with a series of impulse moves and corrective reactions. Eventually, a good pilot, much like a healthy market, can get things back to an equilibrium.

As is evident from the chart above, the S&P 500 has experienced a power-on stall. Luckily, this was accomplished thousands of feet in the air after a nine-year bull market.

As the market settles into an equilibrium of sorts during this correction, I’m looking for a catalyst to push us out of this trading range. Until then, I’ll be patient. As the saying goes, “There are old pilots and there are bold pilots, but there are no old bold pilots.”

RR#6,

Dave

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.