How is it possible the worst ten-day start in U.S. stock market history was followed by what Bloomberg termed the sharpest about face in nine decades? While markets never move based on any one factor, the primary answer is central banks.

In this article we will examine the following questions:

- Just how far have central banks gone in their recent attempt to keep asset prices elevated?

- Why are central banks so concerned about keeping things propped up?

- What are the shorter-term investment implications and the potential end game?

- How can we navigate this period of hyper central bank intervention?

Central Banks Are Buying Corporate Stocks And Bonds

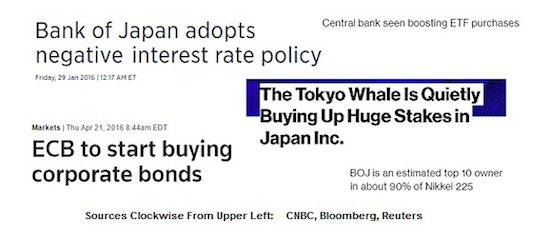

In an April 20 article, we chronicled the Federal Reserve’s 26-day interest guidance shift that occurred between January 6 and February 1, 2016. The Fed’s extreme shift on rates fell into the rare category. Central banks across the globe are starting to tread into much more radical policy waters.

Do you think it would be concerning if the Federal Reserve announced they were going to start buying S&P 500 ETFs in an effort to “stimulate” the economy? That is exactly what is happening in Japan. From Bloomberg:

They may not realize it yet, but Japan Inc.’s executives are increasingly working for a shareholder unlike any other: the nation’s money-printing central bank. While the Bank of Japan’s name is nowhere to be found in regulatory filings on major stock investors, the monetary authority’s exchange-traded fund purchases have made it a top 10 shareholder in about 90 percent of the Nikkei 225 Stock Average, according to estimates compiled by Bloomberg from public data. It’s now a major owner of more Japanese blue-chips than both BlackRock Inc., the world’s largest money manager, and Vanguard Group, which oversees more than $3 trillion.

Distorting The Sanity Of The Stock Market

While investors prefer to see their investment portfolios rise instead of fall, when government institutions start distorting markets there will eventually be negative consequences. From Bloomberg:

A majority of analysts surveyed by Bloomberg predict the Band of Japan will boost its ETF buying — a move that could come as soon as Thursday. “For those who want shares to go up at any cost, it’s absolutely fantastic that the BOJ is buying so much,” said Shingo Ide, chief equity strategist at NLI Research Institute in Tokyo. “But this is clearly distorting the sanity of the stock market.”

The ECB Will Start Buying Corporate Bonds In June

The “non-traditional” central bank policies have not been limited to Japan. The European Central Bank (ECB) is getting ready to launch a new form of quantitative easing (QE). QE typically involves central banks injecting electronic money into the financial system via the purchase of government debt. However, when central banks start buying corporate debt, they are helping pick winners and losers in the private sector. Some companies will be receiving assistance from the ECB, while others will get no assistance. From Reuters:

The European Central Bank will begin purchases of euro zone corporate bonds in June, ECB President Mario Draghi said on Thursday…The ECB said last month it would start buying corporate bonds issued by companies that are based in the euro zone, have an investment-grade rating and are not banks…The plan has raised questions about the risks the ECB will take onto its balance sheet by buying unsecured private debt.

Extraordinary Measures Of Central Banks

The Bank of Japan is not only buying publicly traded stocks via ETFs; they recently announced a negative interest rate policy. From CNBC:

The Bank of Japan blindsided global financial markets Friday by adopting negative interest rates for the first time ever, buckling under pressure to revive growth in the world’s third-largest economy…The bank also clearly communicated a dovish bias, with officials saying they would undertake additional easing if necessary using quantitative and qualitative tools, as well as interest rates.

The concept of negative interest rates was described by Bloomberg on March 18:

Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year. Now Japan is trying it, too. For some, it’s a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it’s an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire. If negative interest rates work, however, they may mark the start of a new era for the world’s central banks.

Extraordinary Measures Should Only Be Used In Extraordinary Times

Concerns about negative interest rates have been expressed from many corners of the economy and markets. From The Wall Street Journal:

The top two executives at Swiss banking giant UBS Group AG teamed up Tuesday to blast the negative interest rate environment brought on by the easy money policies of central banks, an indication that patience is wearing thin in some quarters over these emergency measures… “The introduction of negative interest rates—now not only in Switzerland, but also in large parts of Europe and in Japan—is an extraordinary measure and should only be used in extraordinary times,” said UBS Chairman Axel Weber in remarks to the bank’s annual shareholders meeting…“We can all only hope that the times of such drastic measures by the central bank pass as quickly as possible,” said Mr. Weber, a former Bundesbank president who has been critical in the past about negative interest rates. “Unfortunately, I have to say, unfortunately, there is little indication that negative interest rates will soon be a thing of the past.”

Why Central Banks Are So Concerned About Keeping Asset Prices Elevated

On December 29, 1989, a massive inflationary bubble began to pop in Japan. As prices dropped, investors with cash sat on their wallets waiting for lower asset prices. The desire to “get out” became much stronger than the desire to “get in” and prices continued to fall. In early 1990, Japan started a process that central bankers have nightmares about – a deflationary spiral. As the chart of the Japanese stock market below shows, a deflationary spiral is very hard to stop once it starts. In fact, over 26 years later the Nikkei is nowhere near its 1989 high.

Can you imagine if the S&P 500 peaked last spring and did not revisit that high for over 26 years? Japan has been desperately trying to reverse deflationary trends.

continue reading on the next page…