The major market indexes ended Friday down between 2 and 3 percent, with the NASDAQ taking the brunt of the damage down almost 3 percent. Earlier in the day, the Russell 2000 was down almost 4 percent before rallying back to close down 1.75 percent.

For the week, the S&P 500 Index dropped 2.2 percent. Clearly, capital preservation is becoming critical for investors as global market risks rise.

And rightfully so. Fear is starting to rise in the global markets as it becomes clear that growth is slowing around the world. Clearly, global market risks are growing.

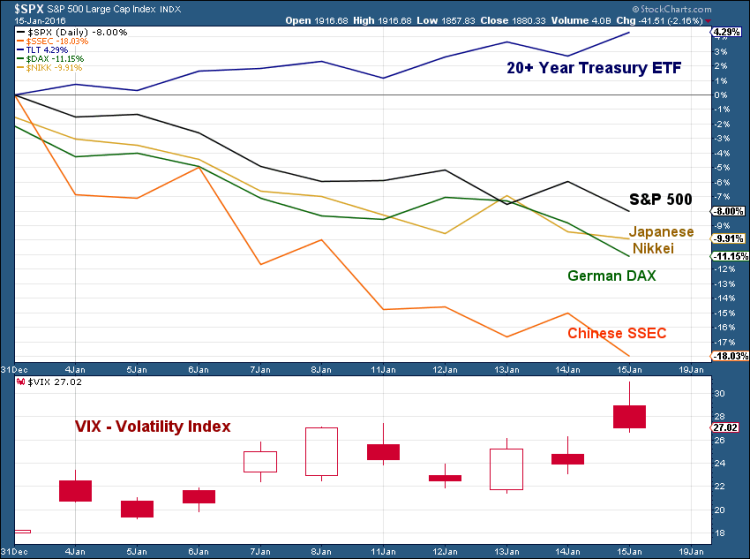

Year-to-date, the S&P 500 Index is down 8 percent… after just two weeks.

As many readers are aware, I have repeatedly written about slowing growth and warned against heavy exposure to stocks. I have stayed in cash and U.S. Treasuries and believe this formula for capital preservation will be important here in 2016 as global market risks remain elevated.

After weathering some market volatility late last year, the US Treasury bonds ETFs that I own have been doing well. This is in large part due to a flight to quality (bonds, cash, blue chips, etc.). The gains are mild, but they beat the losses associated with stocks right now. Capital preservation strategies keep your wealth safe during uncertain times like now.

Here’s a quick look around the world through the first two weeks of 2016: The German DAX, Chinese SSEC, Japanese NIKKEI, and the S&P 500 vs the popular treasury bond ETF (TLT) and the VIX Volatility Index:

This is a time to focus on capital preservation and that’s what I’ve been doing for several months now as grow slows and global market risks rise. We may not be seeing huge gains, but we are holding our ground while the world has been crashing around us.

Twitter: @JeffVoudrie

The author holds positions U.S. Treasuries securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.