Broad Stock Market Futures Trading Overview – July 18, 2018

The S&P 500 (INDEXCBOE:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are holding steady today but appear to be forming near-term topping formations. Pullbacks should produce buying regions for the longer-term.

I am staying focused on initial supports holding as a sign that buyers are still active.

S&P 500 Futures

Tests of resistance and higher lows hold across the board on larger time frames for yet another day.

We are a bit toppy again, but yesterday the shallow fades brought us to waiting buyers who advanced the price action north. Dips will continue to be buying zones and divergence shows mildly. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2813.5

- Selling pressure intraday will likely strengthen with a bearish retest of 2789.75

- Resistance sits near 2809.75 to 2816.5, with 2824.75 and 2834.75 above that.

- Support sits between 2802.25 and 2797.75, with 2784.75 and 2778.75

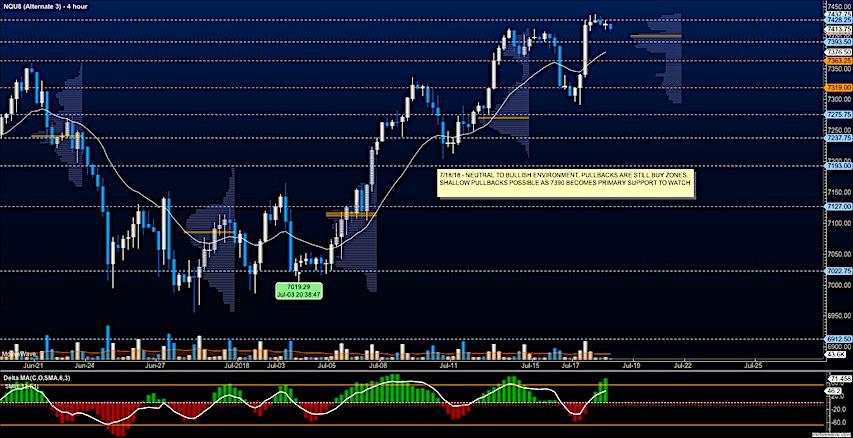

NASDAQ Futures

A complete recovery of the drift down into key support held for this chart. We now sit in a new resistance zone that holds buyers from advancing. Pullbacks remain value events and need to quickly recapture support else resistance will take hold and we will head into deeper congestion. The levels of interest to me today sit between 7376 and 7408. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7428.75

- Selling pressure intraday will likely strengthen with a bearish retest of 7380.5

- Resistance sits near 7426.5 to 7438.5 with 7471.5 and 7484.25 above that.

- Support sits between 7401.5 and 7394.5, with 7367.5 and 7319.75 below that.

WTI Crude Oil

For the fourth day, traders continue to sell off the WTI in profit-taking moves as the EIA report is released today. Buyers have failed to recapture key levels of support but we are holding 67 this morning into the price action that should slow into the release of inventories. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 67.78

- Selling pressure intraday will strengthen with a bearish retest of 67.04

- Resistance sits near 68.16 to 68.44, with 69.33 and 70.15 above that.

- Support holds near 67.37 to 67.04, with 66.54 and 65.89 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.